Photographs: Pawan Kumar/Reuters

'Just keep investing a steady amount every month irrespective of what the media says about the direction of the market,' advises Jyotivardhan Jaipuria, Managing Director, DSP Merrill Lynch, India.

While 2011 turned out to be very bad for Indian investors -- the 30-stock bellwether recorded its worst performance after the meltdown in 2008 -- 2012 could help revive the mood, believes Jyotivardhan Jaipuria, managing director and head of research at DSP Merrill Lynch, India.

In an interview with Prasanna D Zore, Jaipuria discusses the issues that could affect the Indian equity market in the New Year.

As per your report, 2011 is the second worst year for the stock markets after 2008.

In 2008 there was no shadow of corporate scams looming over the Indian equity markets. In 2011 it was very much so.

How much have these corporate scams affected the performance of the Sensex in 2011?

Normally markets follow growth. In 2011 growth was bit of a concern. It was a series of interest rate (hikes) that were also a concern and which seems to have hurt the market. That has been the critical factors really (of the markets performing badly in 2011).

So would you say the markets were not concerned about skeletons tumbling out of corporate cupboards?

People (market participants) were bothered. See, the (equity) market is a combination of many, many stocks. If one stock goes down because there is some problem there, somehow market tends to take it in its stride.

But if it were to happen with many, many stocks, then one could (conclude) that it is systemic.

One needs to make a clear distinction between an individual problem and a systemic problem and there was no systemic problem that we saw and hence we should not be very bothered about it (corporate scams).

Please ...

'The biggest thing you should be worried about is to change the growth number'

Image: Foodgrain stocksDo you see the expenditure on account of the food security bill leading to the government's fiscal woes and hence having an impact on the stock markets?

I don't think the whole amount of the food security bill is modified yet. So it's not like we exactly know what the amount would be (in terms of the food subsidy).

Going by what the media says it could be in the range of Rs 10,000 crore to Rs 20,000 crore (Rs 100 billion to Rs 200 billion). If that were to be true, this amount is only 0.1 per cent of GDP. So to that extent it's not something we should be worried about.

So you don't see the expenditure on account of food subsidies putting additional pressure on fiscal deficit and interest rates?

The 0.1 per cent increase in expenditure may put some pressure on the fiscal deficit, but then again it is just 0.1 per cent.

The biggest thing you should be worried about is to change the growth number (GDP) by 0.3 per cent and that will be good enough.

The number (0.1 per cent increase in the fiscal deficit because of the food subsidies) will not be noticed if your growth number changes.

Please ...

'We have seen 9 per cent already a few years ago'

Image: Workers stand beside the stacked containers in RajasthanPhotographs: Vijay Mathur/Reuters

Many people are talking about India pegging a growth rate of 6.7 to 7 per cent. What kind of reforms could help us achieve a growth rate of 9 per cent?

We have seen 9 per cent already a few years ago. Investment flows were very strong then. That was the time when investments grew at 15 per cent per annum for five to six years at a stretch.

So once we see these kind of investments coming back the GDP will automatically go back to 9 per cent.

What will be the impact of the outcome of the assembly elections on the stock market, particularly if the main constituent of UPA2, the Congress party, fares poorly in Uttar Pradesh?

If you look at the history of last 20 years the impact of assembly elections on the stock markets is very miniscule. In the last 20 years I haven't seen any assembly election outcome to be a game-changer for stock markets.

People do talk about the impact, but in the end it comes out to nothing.

Please ...

'If the Euro zone crisis blows up then it will blow up in all the stock markets'

Photographs: Reuters

How will a slowing Euro zone and US economy affect us in India?

Obviously negatively. The issue is how negative will it be and the extent of this slowdown. Just now the markets are expecting there is a bit of problem in the Euro zone.

The question is will the problem get sorted to some extent over the next six months or will it blow up and get worse.

Is that discounted in the current valuations?

If it blows up (the Euro zone crisis) then it will blow up everywhere (in all the stock markets). Everything is discounted and nothing is discounted in some sense.

Please ...

'The Chinese economy is the other thing over which hangs a question mark'

Image: Employees at an assembly line in Anhui Jianghuai Automobile Coin Hefei, Anhui province, ChinaPhotographs: Jianan Yu/Reuters

Your report says 2012 is going to be a battle of nerves for the markets... what exactly are you suggesting?

There is the Euro zone crisis in the background which one cannot ignore. At the same time we can spend hours and hours speculating on how the crisis is going to play out (in the next six months).

That will never come to suggest anything where the market is going because there is lots of politics and personalities involved there (in solving the Euro zone crisis).

The good thing is that everybody knows there is a crisis and it needs to be solved.

And nobody's talking about the problems one could come across from an overheated Chinese economy?

People are talking about it. The Chinese economy is the other thing over which hangs a question mark.

What do you foresee happening in China? The Chinese government is making an all out effort for soft landing of their economy. Will it succeed? What is your assessment?

Basically, that's what one is looking at whether the Chinese government will manage a soft landing of their economy or not. One hope they are able to achieve a slowdown in an orderly and meaningful way.

Please ...

'The worse the news on GDP, the faster the rate cuts are going to be'

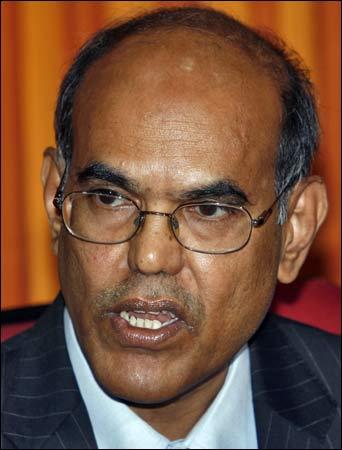

Image: RBI Governor Dr D SubbaraoBig bang reforms that could excite the Indian stock markets...

If you get investors spend money (to invest in India) it could help the longer-term market. Secondly, controlling the fiscal deficit will be critical. If that happens things would tend to move up on their own.

The third reform could be on the GST (Goods and Services Tax) front where the empowered committee is looking into the issue.

What one could hope is at some point in time the empowered committee manages to get some kind of consensus on its roll out. That will surely help the markets going ahead.

Everybody is talking about the interest rates moving down in the next two quarters. But how brisk will be the pace?

I think it will be faster than what the market is thinking. The worse the news on GDP, the faster the rate cuts are going to be.

One hopes that the cut in interest rates is faster than what one would think because when interest rates went up (in the previous six quarters) it went up faster than market expectations.

Please ...

'Overweight on pharma and auto'

Photographs: Reuters

Sectors and stocks to watch out for in 2012...

At some point you have to buy rate sensitives during the year. So lot of stocks that have done very badly over the last two years are places where you could make lot of money when rates start their downward journey in a fast and meaningful fashion and we get the investment cycle building up.

Currently, we are overweight on the pharma sector and with the rupee depreciation we think the earnings in this sector will be very strong.

We are also overweight on autos, the sector being (interest) rate sensitive.

Any advice for retail investors on the strategy they must follow while investing in the market?

I think retail investors should invest Rs 10,000 every month in the market. That is the best strategy one could follow.

One should avoid timing the market. Just keep investing a steady amount every month irrespective of what the media says about the direction of the market.

As long as one invests systematically it is the best way one could average out market movements.

article