| « Back to article | Print this article |

Why this is the best time to buy gold

The third (Tritiya) day of the Hindu calendar's Vaishaka month which falls in late April or early May every year is called Akshaya Tritiya. The Word Akshaya means eternal and Tritiya means 3rd in Sanskrit and Hindi too.

Quite a lot of legend is associated with this day:

i) It is considered that Akshaya Tritiya was the day in which the so-called Golden Age-Satya Yuga of the four periods in Hinduism started. It is also said that Lord Krishna gave the exiled pandavas an Akshaya Patram (never diminishing vessel) which literally means that the vessel would never become empty and hence ensure an eternal availability of food.

Click NEXT to read more...

Why this is the best time to buy gold

ii) Jain mythology has it that this was the day on which Tirthankara Rishabhdev, the erstwhile king of Ayodya, broke his one year old fast and hence it is considered a very auspicious day to indulge in religious gifting. Any gift given on this day becomes inexhaustible, it is believed.

iii) The story of Lord Krishna bestowing material gains on his poor friend sudama for the gesture shown by Sudama is also strongly associated with this day.

How Gold got associated?

Since the day is strongly associated with the word "never diminishing" people started buying Gold (which is supposed to never diminish) as they believed that buying gold on this day would ensure that they keep getting gold though out their lives or at least till the next year.

Click NEXT to read more...

Why this is the best time to buy gold

Till a few years ago the concept of Akshaya Tritiya was a predominantly Western India affair. However, more recently jewellers and marketers of gold turned it into an opportunity to encash on people's beliefs and have gone gung ho in promoting the day across the country. Every shop selling gold does a great deal of business on this day.

From a customer's perspective this is a golden day to buy gold as every shop/seller seems to be giving out great discounts and offers for buying gold. And going by the crowds thronging the streets like Lakshmi Road in Pune, North Usman Road in Chennai, Oppanakara Veedi in Coimbatore it is really a golden treat for buyers and sellers alike.

Click NEXT to read more...

Why this is the best time to buy gold

The banks too are celebrating. Almost all banks have been offering rewards and offers for customers to buy gold from them. Here's a look at some of the major bank's offering on this day.

Following are the details of Akshaya Tritiya offers from banks:

i) ICICI bank is offering a discount of eight per cent on gold purchased online.

ii) PNB is selling gold of two grams to 10 grams weight with discount on purchase.

iii) Indian Overseas Bank is offering a discount of Rs 5 to Rs 15 per gram for a purchase of 100 grams up to 1,000 grams as per predefined slab rates.

Click NEXT to read more...

Why this is the best time to buy gold

iv) Bank of Baroda offers sale of gold coins in the denomination of two, three, five & eight grams in round shape and 10, 20 & 50 grams bar. It is offering two per cent discount to customers and bulk purchasers (ie 10 or more coins).

v) Bank of India is offering a discount of Rs 7 for purchase of up to 250 grams gold, Rs 10 for purchase of 251 to 1 kg gold and Rs 15 discount on purchase of gold over 1 kg quantity.

Also, one of the leading jewellers has come up with an offer of a free silver coin equal to half the weight of gold purchased ie if someone buys 100 grams gold, then he will get 50 grams gold free.

Click NEXT to read more...

Why this is the best time to buy gold

Another renowned jeweller is offering up to 50 per cent discount on the making charge of jewelry. Similarly, banks are also offering attractive discounts on the gold coins if booked on or before Akshaya Tritiya.

With the many options available in the market, and it's natural for the buyers to get confused. The buyers have a wide range of options to buy gold on this Akshaya Tritiya.

Before buying, it is necessary to understand whether one is purchasing for investment or as jewellery.

Click NEXT to read more...

Why this is the best time to buy gold

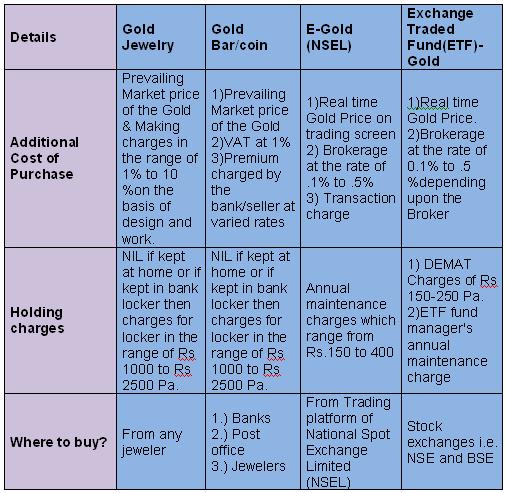

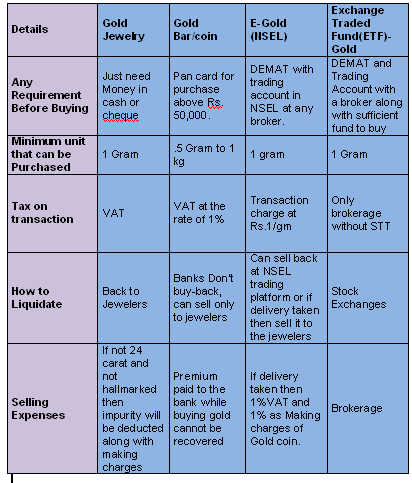

Following are some of the most attractive gold investment options available in the Indian market:

a. Gold jewellery

b. Gold bar/coins

c. E-gold investment

d. Exchange traded fund (ETF)

The details of all the options are:

Purity offered in gold jewellrey: 9 carat to 24 carat

Purity offered in gold bar/coin: 999.9 per cent (24 carat)

Purity offered in E-gold (NSEL): 995.0 per cent (24 carat)

Purity offered in Exchange Traded Fund (ETF)-Gold: 995.0 per cent (24 carat).

Chances of impurity in gold jewellrey: Yes

Chances of impurity in gold bar/coin: Not Possible

Chances of impurity in E-gold (NSEL): Not Possible

Chances of impurity in Exchange Traded Fund (ETF)-Gold: Not Possible

Click NEXT to read more...

Why this is the best time to buy gold

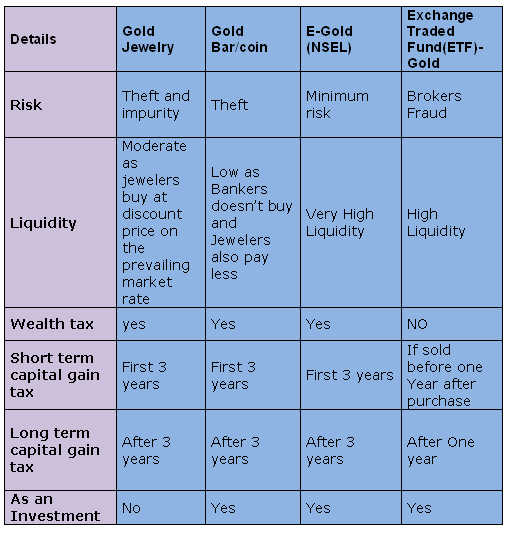

Now, after analysing all the data under the four options to invest in gold, it would be a better choice for a buyer to first analyse his/her need.

If the buyer wants to invest for long term with less carrying cost and doesn't want many tax obligations, then Gold ETF is the best choice.

Click NEXT to read more...

Why this is the best time to buy gold

Even when the buyer wants to make jewellery in the future with the invested gold, it is best to invest in the electronic form of gold because later on when needed, it can be easily liquidated, and proceedings can be used to make gold jewelry at the prevailing market price.

Click NEXT to read more...

Why this is the best time to buy gold

If, however, the buyer immediately wants to use gold as jewelry, then obviously there is no point in buying gold in an electronic form.

Usually during Akshay Tritiya people try to invest in gold as a long term asset, so perhaps the best way to do this is to invest in the electronic form of gold.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2025 www.BankBazaar.com. All rights reserved.