| « Back to article | Print this article |

95 companies using stock market to fund terror

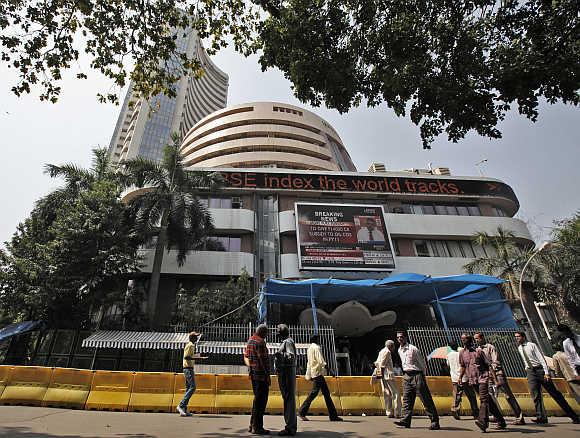

Home Minister Sushil Kumar Shinde's statement regarding the investment of terrorist funds in the stock market is yet another wake up call. This issue was first addressed by India in the year 2001 when it found traces of such investments in the stock market.

Sources in the financial intelligence bureau tell Rediff.com that this is a menacing network being used to legalise funds and gradually it appears to be growing. There are around 95 companies which deal with such funds and these are known as dummy firms. India is a victim of financial terrorism since long and investments into the share markets is just another form of the same, the source also pointed out.

Funds being pumped into the share market have been found since the year 2001 itself by India. These companies are not on the high end of the spectrum. They are infact low on the end of the spectrum and not in the main Sensex category which is very often watched by many.

Hence by remaining low on the category they avoid the heat and they can go about their operations without being noticed. Sources say that these firms are not registered in the bigger cities of India. They are often registered in smaller cities as the approval process is easier and they remain lower on the watch list.

Click NEXT to read more...

95 companies using stock market to fund terror

They work in various ways. The first intention is to convert black money into white and this they are able to do so since they have a registered firm in their name.

They would often start off with share prices at Rs 5 of Rs 10 and then artificially boost the prices up to Rs 18 to Rs 20. This creates a bit of a buzz and if there are people interested in picking the shares up they end up making a profit. In case no one picks up these shares, they are not too bothered since the initial investment remains with them.

The main idea is to park the funds and use it for subversive activities while avoiding the eye of the Intelligence Bureau or the security agencies. The other method that they have been using is to float a company with an interesting name.

In this manner they block the name and look for other companies to pick it up and thus they end up making a profit. However the main intention is to park black money and later use it for terrorist activities, sources point out.

Click NEXT to read more...

95 companies using stock market to fund terror

In all there are eight lakh companies in India and this figure of 95 dummy firms may appear to be a small number. However security agencies want to take no chances and want to step up the vigil in order to ensure that it does not become a full fledged racket.

IB sources say that the number could get bigger in the years to come and if these groups manage to take control of the stock market they could cause a crash which is a big bolt to the Indian economy.

Financial terrorism has always started off on a very small scale. Fake currency which is the biggest head ache for India started off with the circulation of notes of the Rs 50 denomination. It hardly even mattered to the Indian economy at that time.

However terror groups only improvised on their machinery and today they deal with only Rs 1,000 notes and over a period of time terror groups managed to pump in Rs 12,000 crore (Rs 120 billion) worth of fake currency in the market.

The other headache which India is dealing with on the financial terrorism front is the parking of terror funds in banks. In the past five years India has found at least 17,000 such transactions.

Click NEXT to read more...

95 companies using stock market to fund terror

Terror groups in this case too floated dummy companies and with the help of insiders of a bank they managed to park their funds. Such transactions were found to be the highest in Maharashtra which was followed by Delhi and then West Bengal.

Maharashtra alone accounted for 30 per cent of such transactions while Delhi was at 12 per cent and West Bengal seven per cent as per the report of the Financial Intelligence Unit.

During their investigations they also found that such transactions were gradually rising in smaller cities of Andhra Pradesh, Gujarat and Karnataka and this is what they needed to keep a watch on.

In addition to this, India has also found that such transactions go up during the elections. There is a sudden surge in investments into dummy firms and also in the banks during the elections.

Some politicians back such operations in order to get money for their campaigns. Terror groups on the other hand make hay while using few persons in the Indian political system to further their transactions.

India would watch these developments closely and would not want to experience what took place in the United States of America.

Click NEXT to read more...

95 companies using stock market to fund terror

As per a report, Economic Warfare: Risks and Responses by financial analyst Kevin D Freeman, a three phased attack was planned in the United States of America.

It was found that some persons from the Middle East and hostile members of the Chinese military had planned economic warfare against the US.

India too faces problems from the above mentioned nations. The main enemy is Pakistan who use their sources in Saudi Arabia and also persons in the underworld to float such firms and invest both in banks and the stock market.

It is pretty much the same network which is handling the hawala groups and also the fake currency network, sources pointed out. It is a multi-pronged approach to park funds and destabilise the economy, an official pointed out and we need to pursue this aggressively before it blows out of hand.

The Home Minister of India had said that there was credible intelligence to suggest that terrorist outfits were investing in the stock market with the help of dummy firms.

However India does have its task cut out since 90 per cent of these funds have been traced to persons who do not reside in India. There is a great deal of international cooperation required to bust these modules and the Interpol will have to play a crucial role.

India has been handing out names of suspects involved in this racket and with the Interpol, India plans on curbing such activities.