Photographs: Reuters Kumar Gautam, Outlook Money

The Indian stock market, spooked for more than a year, got a shot in its arm when the Congress and its allies won the general elections.

Then came the Union Budget that belied hopes and the bellwether indices started falling, registering the biggest Budget day loss ever.

However, over the following period, as investors and market players figured out finance minister Pranab Mukherjee's plan, the broad market recovered to its pre-Budget levels.

But, even in this market, which has gained 13 per cent in the last 10 days, there is value to be found in individual stocks.

Given here are seven of them, selected on the basis of their fundamentals. Over the medium-to-long term, they should bring good growth to your portfolio.

The selection criteria

A common theme runs through these picks. Their earnings quality is good, although they may not have the very high growth rates often seen because of the cyclical nature of businesses. But cycles can catch an investor on the wrong side too.

The focus is also on a company's performance in the last four quarters -- this indicated its earning ability in challenging times. They have strong balance sheets. For example, most of their assets are self-financed and not bought with borrowings.

Also, they have ample cash to help them ride out difficult times. We have tried to pick stocks that have valuations lower than others in their industry. This gives a margin of safety: even if a company's earnings falls and its price-to-earnings ratio rises, it would still not be too expensive.

7 steady-rise stocks to buy

Image: Aventis PharmaPhotographs: Courtesy, Outlook Money

Aventis Pharma

Aventis Pharma -- whose majority stake is held by international pharmaceutical major Sanofi-Aventis -- specialises in drugs related to areas such as cardiovascular diseases, metabolic disorders, oncology, internal medicines, vaccines and disorders of the central nervous system.

It has a portfolio of strong brands and some of them, such as Combiflam, Allegra and Cardace, feature among the Top 100 brands in the retail market.

It doesn't run the risk that Indian players do in the generics market. For example, Dr Reddy's Laboratories, Ranbaxy and Sun Pharmaceutical are mired in regulatory and market-related troubles. Aventis Pharma's India focus and strong brands give it a higher predictability in earnings.

In the year ended December 2008, it has reported healthy figures in spite of challenging domestic and international environments. Net sales increased year-on-year (y-o-y) by 12.6 per cent.

Growth in domestic sales was 10 per cent as compared to the industry average of 9.8 per cent. Export sales, too, grew by a robust 23.4 per cent. The cost was kept under control in spite of high commodity prices in first half of the year. That resulted in its bottomline growing faster, at 19.23 per cent.

Aventis' core strengths are its drugs for chronic ailments, such as diabetes and respiratory diseases. The company already has a strong presence in urban areas.

The stressful lifestyle there is expected to increase chronic ailments and this would provide an even larger market for Aventis Pharma.

Further, the company plans to target tier-II cities with new products. This would provide it with stable income in the long term. Considering this and a PE of 15.57, which is less the PE of the industry (31) as well as those of major players such as Biocon and Cipla, Aventis Pharma's stock is attractively priced.

7 steady-rise stocks to buy

Image: Axix BankPhotographs: Courtesy, Outlook Money

Axis Bank

On 6 July 2009, the day the Budget was presented, BSE Bankex Index lost 10 per cent, the highest fall witnessed among all sectoral indices. The concerns were related to rising government borrowings, which could push up the overall interest rate in the economy.

When that happens, yield on government securities and bonds rises and their value falls. As a result, banks that are invested in these securities will see a drop in their portfolio value and will be forced to register losses to the extent of the drop in the portfolio's value, which is also called marking-to-market (MTM).

The MTM loss, however, will depend on how dynamically a bank manages its investment portfolio. In case of Axis Bank, around 57 per cent of the investment portfolio is government securities, which is not marked-to-market. Therefore, the MTM loss will be restricted, as it will be applicable only on the remaining portion of the portfolio.

Also, income from investments is not used alone to judge a bank's earning potential. A bank's performance should be judged by growth in its core income.

By this measure, Axis Bank qualifies as a strong candidate for a BUY. It has performed consistently with low volatility in quarterly earnings and profit growth, ranking just below HDFC Bank.

In FY09, its net profit grew sharply at 69.50 per cent y-o-y due to high growth in core incomes -- net interest income (NII) and fee income. Increase in NII was due to expansion of its asset size or loan portfolio. Despite a growth in its asset size, the quality was maintained: the percentage of gross non-performing asset (NPA) at the end of FY09 was 0.35 per cent as compared to 0.36 per cent in FY08.

One of the bank's strengths is mobilising low-cost deposits (current account and saving bank account, or CASA). This helped the bank keep cost of funds low even as it had to pay a higher interest rate on term deposits in the second half of FY09.

Axis Bank repeated the performance of FY09 in the first quarter (Q1) of FY10: y-o-y net profit growth is up again by 70 per cent. The dynamics that worked in Q1FY10 are the same as the ones in FY09. With this kind of growth rate, Axis Bank is an attractive buy at a trailing 12 month (TTM) PE of 15.69.

7 steady-rise stocks to buy

Image: Corporation BankPhotographs: Courtesy, Outlook Money

Corporation Bank

Corporation Bank, a public sector unit, is yet another bank that derives its growth from basic banking services: lending and deposit services.

A closer look at its sources of income says it all. In FY09, Corporation Bank's profit before tax from treasury operations, this is a major source of a bank's income, declined y-o-y by 8 per cent. In spite of this, it recorded a 21.46 per cent growth in net profit.

Retail banking and wholesale banking, which are other sources of its revenue, grew at 53.66 per cent and 67 per cent, respectively, which boosted its bottom line.

There are certainly some concerns that the overall banking sector's credit growth would go down amid slow economic growth, which would affect the bank's interest income.

However, to minimise the impact of slow economic growth, it is stepping up lending to small and medium enterprises and the agricultural sector. Corporation Bank pushed its loan products to both retail and corporate segments through intense marketing activities.

Growth in its credit portfolio during FY09 was 23.8 per cent, which is substantially higher than the overall banking sector's credit growth of 17.3 per cent.

Along with high credit growth, it was successful in improving the quality of its loan portfolio: the percentage of net NPA declined from 0.32 per cent in FY08 to 0.29 per cent FY09, which is among the lowest in the industry. The bank also achieved a high deposit growth of 33.49 per cent against the industry average of 19.80 per cent.

The focus was mainly on CASA growth, by targeting different sections, to keep the cost of the overall deposit base in control. The bank's effort to accelerate its deposit and lending activities should keep intact the growth in its bottomline.

Healthy and stable growth, along with low valuation (TTM PE of 5.57), makes Corporation Bank's shares worth buying.

7 steady-rise stocks to buy

Image: Cummins IndiaPhotographs: Courtesy, Outlook Money

Cummins India

Cummins India -- a leading manufacturer of diesel and gas engines -- has reported healthy figures in FY09 in spite of an overall slowdown in the industry it operates. The company's net sales, on y-o-y basis, went up by 22.75 per cent and the net profit grew at an even higher pace of 36.45 per cent.

Going ahead, in a globally challenging economic environment, the company does face certain risks. A major one would be a drop in export revenue, which forms around half of the company's total revenue.

On the other hand, Cummins has traction in the domestic market, which, to a large extent, will make up for fall in export revenues. All segments of its domestic business -- power, industrial, automobile and spares -- should see a higher growth in sales in the months to come.

Revenues from the automobile industry are slated for high growth. Under the Jawaharlal Nehru National Urban Renewal Mission, the Union government has incentivised state transport corporations to upgrade their buses to fuel-efficient ones.

This will turn out to be large potential market for Cummins' diesel engines. Recently, it has won the tender in Delhi for upgradation of buses in the period leading up to the Commonwealth Games around October 2010.

Also, the government is now looking forward to investments in infrastructure. Construction and mining are seeing signs of revival. The power sector, which contributes 30-35 per cent to its revenues, will always be the focus of any infrastructure development initiative.

And Cummins' products, being very closely related to infrastructure development, will see a rise in demand.

So, these factors bode well for long-term growth of Cummins, even if its growth falls in the coming quarters. Furthermore, at a PE of 12, the company's shares seem to have already discounted the near-term risk. At the current market price, Cummins is a good stock to add to your portfolio.

7 steady-rise stocks to buy

Image: Honeywell Automation India (HAI)Photographs: Courtesy, Outlook Money

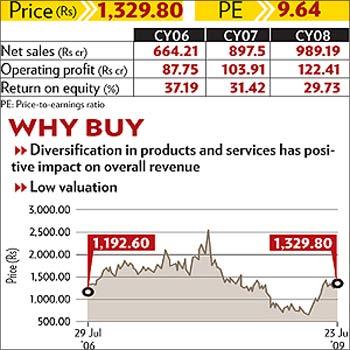

Honeywell Automation India (HAI)

HAI provides integrated automation, control and software solutions to key sectors of the economy, such as infrastructure, petrochemicals, refining, chemicals, and mining and materials.

So, one can assume the company's performance to be a function of economy's momentum. During 2008, the economy did witness some kind of a slowdown, but the severity was not uniform across all sectors.

For example, volatility in oil prices delayed capital investment in the sector, affecting HAI's business. But investment continued in sectors such as power and gas, and it had a positive impact on HAI's activities.

Overall, the year was challenging, but because of a diversified products and services portfolio, the company managed good numbers. In the year ended December 2008, net sales and net profit of the company rose by 10.85 per cent and 25.75 per cent y-o-y, respectively.

The upward trend was maintained in the March 2009 quarter. Sales and profits were both up, by 24.62 per cent and 174 per cent, respectively. During 2008, HAI also added many large companies, such as Larsen & Toubro, Tata Power and ONGC to its list of clients in different business segments.

In the coming quarters, HAI's earnings should continue to grow because of a diversified product and services portfolio and improving economy. Even if it went the other way, the company's PE, which is currently around 10, would rise.

But the rise in PE would be from a very low level and even at the new level, the stock would be attractively priced compared to its industry peers.

7 steady-rise stocks to buy

Image: Opto Circuits (India)Photographs: Courtesy, Outlook Money

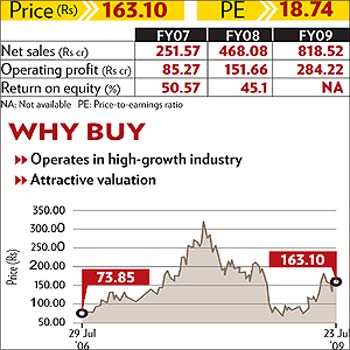

OCI designs, develops, manufactures and markets medical electronic devices such as pulse oximeters, cholesterol monitors, fluid warmers and stents. It enjoys the fruits of the growth of the industry it is in.

The opto electronics market is currently growing at around 15 per cent a year and, for the next 10 years, it is expected to grow at 10-20 per cent per year. The stents market, another industry that OCI operates in, is expected to grow in India at more than 15 per cent annually over the next 2-3 years.

These growth figures are also reflected in the company's statement of income. In FY09, the y-o-y growth of net sales and profit was 74.84 per cent and 60.31 per cent, respectively.

OCI's clients are mainly hospitals and large companies. This helps the company maintain high quality of earnings as almost all the sales made on credit to its clients are recoverable.

OCI plans to continue growing both through organic and inorganic means. Recently, it acquired a leading US healthcare company, which will give OCI greater visibility in global markets.

Backed by revenue visibility in the coming quarters, OCI's stock looks attractive at a PE of 18.74. Also, the stock's dividend yield of 2.15 assures some kind of fixed return to investors.

7 steady-rise stocks to buy

Image: Rolta IndiaPhotographs: Courtesy, Outlook Money

Rolta India

Rolta India is an information technology (IT)-service provider with three lines of business -- geospatial information system (GIS) services, engineering design (ED) services, and enterprise information and communication technology (EICT) services.

Its shares have been constantly under pressure since September 2008. The fear is related to dollar funds raised by the company through foreign currency convertible bonds (FCCB).

The loan burden in terms of rupees increased as the rupee depreciated against the dollar. As an accounting norm, the company marked incremental burden as loss in its income statement.

But the loss was notional in nature as there was no cash outflow. Market participants ignored this fact and the company's shares have fallen 85 per cent since September 2008. But its fundamentals did not support this kind of a drop. Sales during the quarters ended September 2008 and December 2008 grew 56.60 per cent and 49.7 per cent, respectively. Net profit suffered, but only because of notional losses.

Now, as the accounting norms have been relaxed, the company can reverse these notional losses suffered earlier as profit in the March 2009 quarter. The result is that the company has posted a sales growth of 15 per cent and profit growth at a higher rate of 102.6 per cent.

Moving ahead, Rolta has strong earnings visibility. It has an order book of Rs 1,552 crore to be executed in 12-18 months. Also, it caters to governments and utility sectors, which are stable sources for its revenue. Therefore, the current drop in Rolta's share price provides a great opportunity for stock pickers.

article