Photographs: Reuters

Ten Indian companies, including Mukesh Ambani-led Reliance Industries and telecom major Bharti Airtel, are among the 500 top global companies for 2009 in terms of market capitalisation, according to the Financial Times.

The league of 500 companies is topped by American energy giant ExxonMobil followed by oil major PetroChina and US retailer Wal-Mart Stores at the second and third positions, respectively.

Reliance Industries is the lone Indian entity featuring in the top 100 and is ranked at the 75th place with a market capitalisation of $47.25 billion. The entity was placed at the 80th spot last year.

10 Indian firms among world's best

Image: An ONGC oil rig.Photographs: Courtesy, ONGC

Other Indian firms featuring in the list are Oil & Natural Gas Corporation (120th), National Thermal Power Corporation (138th), Bharti Airtel (188th), Infosys Technologies (330th), Bharat Heavy Electricals Ltd (345th), ITC (362nd), State Bank of India (372nd), Tata Consultancy Services (483rd) and Hindustan Unilever (495th).

"The companies are ranked by market capitalisation -- the greater the stock market value of a company, the higher its ranking. Market capitalisation is the share price on March 31, 2009 multiplied by the number of shares issued. . .," the Financial Times said in an accompanying report.

10 Indian firms among world's best

Image: The four-screen multiplex at the Infosys Mysore Development Centre. Shaped like a massive golf ball, it is perhaps the most photographed structure on the sprawling Infosys campus.Photographs: Rediff archives

Seven Indian firms have improved their positions from last year, while SBI and TCS have slipped in their rankings. Hindustan Unilever was not in previous year's list.

ONGC has a market capitalisation of $32.87 billion, NTPC ($29.29 billion), Bharti Airtel ($23.41 billion), Infosys Technologies ($14.95 billion), BHEL ($14.51billion), ITC ($13.75 billion), SBI ($13.35 billion), TCS ($10.42 billion) and Hindustan Unilever ($10.23 billion).

10 Indian firms among world's best

Image: Indra Nooyi, CEO, Pepsico.Photographs: Paresh Gandhi

As many as three American companies led by India-origin chief executives -- PepsiCo (42nd), Citigroup (358th) and Adobe Systems (448th) -- also feature in the list.

Indra Nooyi-led PepsiCo has a market capitalisation of $80.12 billion, Vikram Pandit-led Citi ($13.85 billion) and Shantanu Narayen-led Adobe Systems ($11.21 billion).

Both PepsiCo and Adobe Systems have improved their positions from last year's 46th and 469th ranks, respectively. However, Citi's rankings has tumbled from previous year's 53rd place.

10 Indian firms among world's best

Image: S Ramadorai, CEO, Tata Consultancy Services speaks to N Chandrasekaran, CEO-designate.Photographs: : Arko Datta/Reuters

"The total market capitalisation of the Global 500 companies has fallen by 42 per cent from $26,831 billion to $15,617 billion. The 500th company is worth $10.1 billion, compared with $19.3 billion last year," the report said.

The daily noted that oil companies overtake banks as the most valuable sector, with 15 banks leaving the list and the number of oil companies increasing by one.

"The market value of the banks has more than halved from $4,116 billion in 2008 to $1,937 billion in 2009," it added.

10 Indian firms among world's best

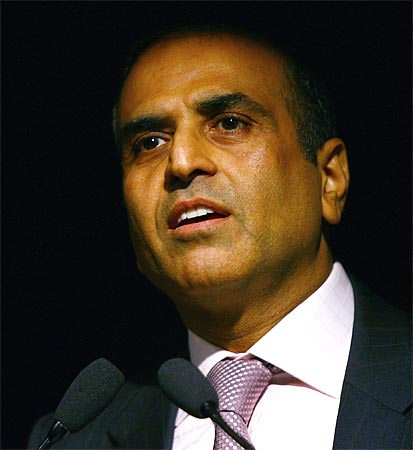

Image: Bharti Airtel Chairman Sunil Mittal.Photographs: Vijay Mathur/Reuters

Last year, NTPC was ranked at the 206th place, while Bharti Airtel had cornered the 218th spot. Infosys Technologies was at the 465th position, BHEL (367th), ITC (497th), SBI (365th) and TCS (481st).

"We have included all companies where the free float -- the proportion of shares in market circulation -- is at least 15 per cent. Companies are then valued on the lines of shares that are quoted on the stock market. The full value of a listed stock is included even if part of it is tightly held. Unlisted lines of stock are excluded. Investment companies are not included," the report noted.

article