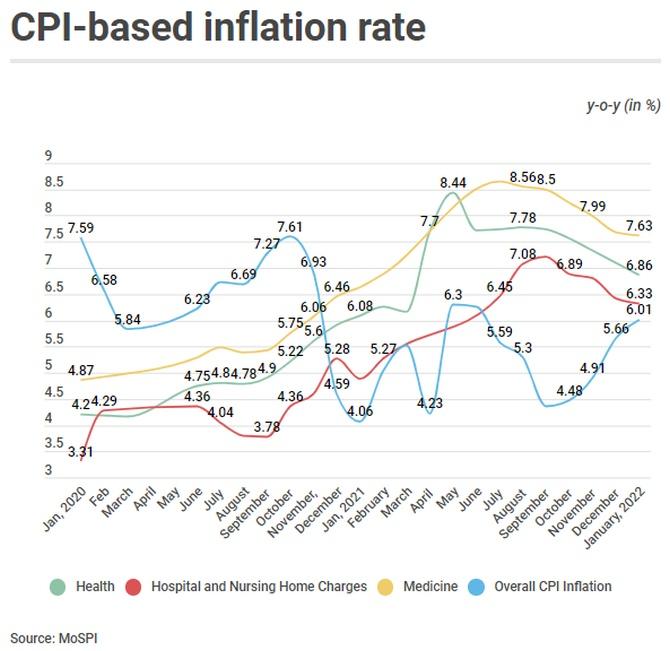

Since January 2021, the inflation rate in health has stood in the range of 6.08-8.44 per cent.

At a time when health has become a priority post-Covid, the price that the consumer pays for hospitalisation or admission to a nursing home, along with expenses on medication, has remained above six per cent for over the past one year, making it a structural issue.

The spike was despite the fact that the health inflation rate was not high in the immediate aftermath of the first wave of Covid in 2020.

The details of inflation are not available for the Covid period of April-May of that year.

Even as the consumer price index (CPI)-based inflation rate stood in the range of 6.23-7.27 per cent during June-September 2020, that in health was sub-five per cent.

It was only in October that the health inflation crossed five per cent, which along with other items, pushed the overall inflation rate to 7.61 per cent.

After that the health inflation never came below five per cent, rising to as much as 8.44 per cent in May 2021 which was the month of the second Covid wave.

In April 2021, it stood at 7.7 per cent, which was also the month of the second wave of Covid.

Since January 2021, the inflation rate in health has stood in the range of 6.08-8.44 per cent.

In between, the overall inflation rate came down to below five per cent in April, September, October, November of 2021.

Former chief statistician Pronab Sen said the whole issue really is that when costs are going up, anybody who has pricing power will increase prices.

"Healthcare is a sector where everything is in short supply -- whether you talk about personnel or facilities or medicines. There is excess demand in everything. Passing on costs is easy for companies," he said.

Bank of Baroda chief economist Madan Sabnavis also said high health inflation is due to cost of raw materials going up and passthrough seen in final medical costs.

Besides, with demand going ahead of supply for healthcare, hospitals have increased charges.

"Also, staff has been paid more due to exits during lockdowns leading to shortages and overtime. To this, we can add that hospitals have also leveraged the sellers market to hike all costs," Sabnavis said.

Sunil Sinha, principal economist at India Ratings, also said pricing power is at the core of health inflation since medicine and a large part of the health services is provided by the private sector.

Inflation in hospitalisation and nursing remained over six per cent since July, 2021, while that in medicines were higher much before.

The rate of price rise remained above six per cent since November, 2020.

In fact, inflation in medicines remained over eight per cent for the four consecutive months of July, August, September and October, 2021. It peaked at 8.66 per cent in July.

Icra chief economist Aditi Nayar said the pandemic has led to a change in various protocols which is likely to have resulted in a non-transient increase in certain costs.

"Additionally, footfalls have varied in different periods, introducing volatility to revenues. Moreover, the share of healthcare in consumer budgets would have surged in some periods, particularly during the second wave, exacerbating the impact of the higher health inflation," she said.

Sen said that high inflation in health forced consumers to cut back on something else.

Overall private final consumption expenditure (PFCE), representing demand in the economy, declined six per cent in 2020-21 for the first time since at least 2012-13.

It is officially projected to rise 6.9 per cent in the current financial year by the first advance estimates.

However, this growth is coming from a very low base of the previous year. Compared to pre-covid period of 2019-20, PFCE is pegged at -2.9 per cent in FY22.

In fact, PFCE also shrank by 2.1 per cent even in the health sector.

This seems to be surprising in the context of health inflation.

This may be because of the fact that for estimating growth we take figures at constant prices.

If taken at current prices, PFCE for health purposes grew by 5.1 per cent during 2020-21, the highest since at least 2011-12.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025