While mobile wallets are still busy exploring the multiple facets of interoperability, experts believe that bringing in new customers would be costly affair and the numbers of new wallet users might not see a major hike anytime soon.

For the $1.5-billion digital payments ecosystem in the country, the last few days have been quite a roller-coaster. While the Reserve Bank of India's move to remove a key roadblock for interoperability has opened new doors for fintech players, the Unique Identification Authority of India disallowing digital payments companies from offering any Aadhaar-based service on their platforms has come as a major setback.

The prohibitive costs of user verification, at times about Rs 700 per customer, are set to affect smaller players who will now have to spend anywhere between Rs 5 million to Rs 2 billion to bring in the next million or so customers.

Mobile wallets get fluidity of cash

A Paytm wallet user can now send money to a person using a MobiKwik wallet. The central bank has finally removed the roadblock that had earlier limited transactions only between wallets of the same company.

"Interoperability has turned wallets into anonymous banks. If I can send money from one bank to another, it will help me to reduce the cost of my loading. I do not need a credit card to load my wallet anymore; it can happen real time. Not only from one wallet to another, but from a wallet to a bank and vice versa. Interoperability is in the whole ecosystem of unified payments interface," said Vinay Kalantri, founder and managing director, The Mobile Wallet.

According to industry experts, users would not have to download multiple mobile wallets to use at different places and just have one for all online as well as offline digital transactions.

The nodal agency has not only allowed consumers to pay via any other wallet over UPI, but also given fintech firms the nod to issue UPI handles as well as issue physical cards similar to debit and credit cards without the requirement of a bank.

"If I want to issue a Mastercard or a Visa card, one would have to go through a bank. Now as UPI holder, I can do it myself. I do not need a bank in between," added Kalantri.

Higher costs on cards

While mobile wallets are still busy exploring the multiple facets of interoperability, experts believe that bringing in new customers would be costly affair and the numbers of new wallet users might not see a major hike anytime soon.

With UIDAI prohibiting the use of Aadhaar for the Know-Your-Customer process, companies would now have to send correspondents to personally take documents such as PAN card, passport details, driving licence or MGNREGA card from prospective wallet users.

The process, according to industry insiders costs between Rs 500 to Rs 700 per authentication, which would skyrocket the cost of bringing in new users.

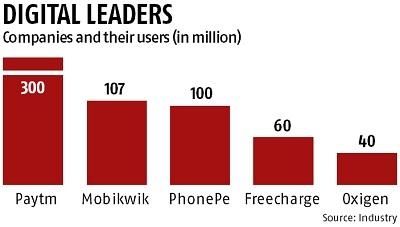

"Clearly, it is an expensive way to on-board users. While we have a retail base, where the documents can be collected, it is quite an expense proposition. Biometric KYC was much faster, easier and, of course, cost-effective. It is obviously going to affect the number of new wallet users being brought to the platform. Till a new mechanism for digital KYC is defined, the on-boarding would be a challenge," said Sunil Kulkarni, joint managing director of digital payments company Oxigen Services.

© 2025

© 2025