The continuing stress faced by corporate India has weakened its debt-servicing capability and this is reflected in the banks' books, as yet-burgeoning bad loans, says Sheetal Agarwal.

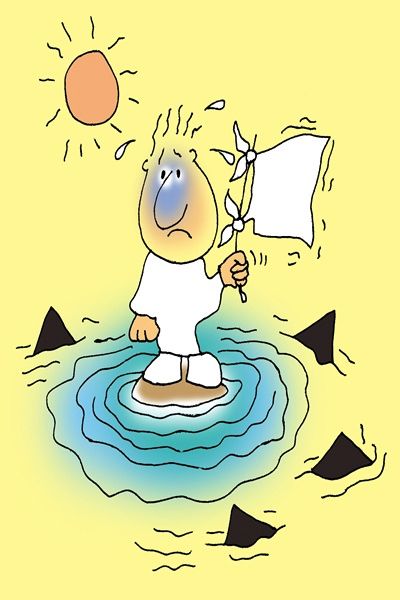

Illustration: Uttam Ghosh/Rediff.com

If one goes by the initial March quarter (fourth or Q4 of 2016-17) results of the relatively stronger pack of individual loan-focused private banks, investors should brace for a weak show from the others.

This applies particularly to the corporate-heavy private ones, ICICI and Axis, as well as most public sector banks (PSBs). Notably, the continuing stress faced by corporate India has weakened their debt-servicing capability; this is reflected in the banks' books, as yet-burgeoning bad loans.

This applies particularly to the corporate-heavy private ones, ICICI and Axis, as well as most public sector banks (PSBs). Notably, the continuing stress faced by corporate India has weakened their debt-servicing capability; this is reflected in the banks' books, as yet-burgeoning bad loans.

In graphs: The grim story of India's bad loans

Retail (sector jargon for individual)-focused private lenders such as HDFC Bank and IndusInd Bank, among others, have been relatively better off on the asset quality front.

However, recent developments also indicate that stress on most banks' earnings could rise, for multiple reasons.

First, in a recent directive, the Reserve Bank of India (RBI) asked all banks to step up standard provisioning for loans to stressed sectors. For instance, the central bank asked all lenders to review their standard provisioning for the telecom sector, facing weakening profit on the back of a rising price war.

'NPAs are part of the business'

Second, banks will have to provide for a host of loan accounts classified under the Standard Debt Restructuring (SDR) scheme but where they've failed to find suitable buyers. The 18-month forbearance window provided by RBI on this began expiring from the March quarter; some will end in the coming ones.

As a result of these pressures, banks’ provisions for bad and doubtful loans are slated to grow meaningfully, leading to a further squeeze of earnings.

“Banks’ provisions could increase if a restructured SDR account slips into (the) non-performing assets (category), as it might directly enter into higher categories of NPAs. Credit costs will, thus, remain very high for the sector even in FY18. That will keep return on equity depressed,” says Suresh Ganapathy, banking analyst at Macquarie Capital.

News reports also suggest RBI has asked banks to make further provisions towards loans extended to cement company Jaiprakash Associates.

While IndusInd and YES Bank have already provided for such loans, State Bank of India and ICICI also have meaningful exposure to this company and could see higher provisioning on this count.

Notably, as RBI’s suggestions came recently, their impact is not baked in adequately in brokerages’ earnings estimates for Q4.

Regarding higher provisioning on telecom loans, PSBs could be worst hit, estimate analysts.

“Retail private banks have higher telecom exposure to the top three players. The majority of exposure to stressed accounts - Aircel (standard asset) and GTL (NPA) - is with PSBs, and exposure to Reliance Communications is with foreign banks,” says Adarsh Parasrampuria, banking analyst at brokerage Nomura.

With credit growth slowing in the retail segment as well and rising provisioning, the pre-provisioning operating profit of most banks will come under pressure. This, in turn, will have a bearing on the return ratios and valuations of banking stocks.

Against this backdrop, most analysts are cautious on the sector and recommend only a few picks. Most believe the recent rally in PSB stocks is unjustified and could fizzle soon.

“Earnings since January 2016 have been cut 50-plus per cent for PSBs but stock prices are up 40-50 per cent. Q4 will be terrible and earnings will be cut further. The transition to IFRS (accounting rules) will further impact their earnings,” adds Ganapathy.

© 2025

© 2025