Jimmy Patel, MD & CEO, Quantum Mutual Fund, suggests some valuable financial gifts for your children.

A well thought out financial gift will enable parents to have a positive impact on their children's future.

Here are four financial gifts parents should consider:

Make prudent investments in mutual funds

At a time when inflation is eroding the purchasing power of our hard-earned money, making productive investments that potentially clock better inflation-adjusted returns (also known as the real rate of return) and are tax-efficient is necessary.

Mutual funds are a potent avenue for wealth creation.

Investments can be done in the name of minor children with one parent standing in as the guardian.

Parents need to select mutual fund schemes prudently across various categories to secure their child's financial future.

Specific children's funds exist, but they are not the only solution.

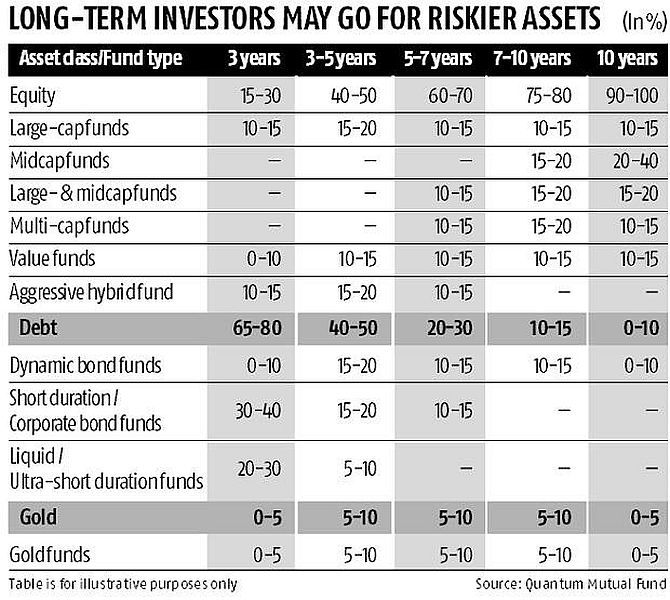

Depending on risk appetite, investment objective, financial goal (like a child's higher education, wedding expenses, etc), and the time horizon available, mutual funds should be selected across categories and sub-categories by assigning weights to each of them sensibly (please see table).

To plan for long-term goals, parents should adopt the Systematic Investment Plan (SIP) route.

SIP is an efficient mode of investing in mutual funds that instils the good habit of investing regularly, is lighter on the wallet, helps mitigate market volatility (through rupee-cost averaging), facilitates the power of compounding, and is an effective medium for goal planning.

Parents should enlist the services of a competent financial advisor.

She will be able to assess the financial health of the parents, their risk profile, the current age of the child, and the number of years to go before the goal is realised.

Based on her assessment, she will build the right portfolio of mutual funds.

Gift the yellow metal

Gold is an excellent store of value.

It serves as a safe haven in times of economic uncertainty and also serves as an effective portfolio diversifier.

In India -- the world's second-largest consumer of gold -- gifting the yellow metal is an intrinsic part of culture and rituals.

Moreover, gold can be passed on from one generation to another, strengthening family bonds.

Instead of gifting physical gold (bars, coins or jewellery) to their children, parents can consider gifting gold the smart way -- in the form of a gold exchange-traded fund (ETF) or a gold saving fund.

Gold ETFs offered by mutual funds track the price of gold.

Each unit of gold ETF is equal to one gram of gold (some mutual fund houses also offer units equivalent to 0.5 gram of gold).

Gold is held on investors' behalf by an appointed custodian.

These ETFs can be purchased on the stock exchanges (demat and share trading account is a must).

And when the investor buys gold ETF, it points to a contract indicating her ownership in gold equivalent in rupee terms.

A gold saving fund (also known as a gold fund) is a fund-of-fund that invests its corpus in an underlying gold ETF.

It attempts to provide returns that correspond closely to the returns of the underlying gold ETF.

Buying either of these two forms of paper gold offers several advantages.

They provide a convenient route to invest in gold at the prevailing market price.

No premium has to be paid, as happens when you buy physical gold.

The investor does not have to worry about storage and security, or about the quality of gold.

The cost of holding gold in paper form is lower than what is incurred on physical gold.

These forms are also highly liquid.

They can be sold easily in times of need at the prevailing market price.

About 10 to 15 per cent of a long-term portfolio can be allocated to gold.

Buy financial board games

Parents need to impart money management lessons to children from an early age.

Introduce children to a few board games associated with money, such as Monopoly, Game of Life (similar to Monopoly), Cashflow (inspired by Robert Kiyosaki's Rich Dad, Poor Dad, it teaches how to control your finances better), Payday (teaches how to manage monthly budgets), etc.

When parents engage children intelligently through these games, financial learning becomes interesting and children become better equipped to manage their personal finances deftly when they grow up.

As Robert Kiyosaki, the celebrated investor and author, says: 'The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.'

Parents consciously need to impart the right financial education to their children at the right age, and in addition, serve as a role model.

To prepare children for financial independence in the real world, these games are among the best gifts parents can give.

Purchase optimal insurance

Besides giving gifts to children, parents, especially the breadwinner, should also use this holiday (presuming they have taken one) to ensure that they are optimally insured.

Not having optimal insurance can jeopardise their children's financial future.

Insurance is for indemnification of risk and it protects dependants from a financial loss in the case of an unfortunate event.

One should hold optimal insurance covers for both life and health.

A life insurance policy should be bought with the core objective of indemnifying the risk to life -- in a way that dependants are financially secured.

Ideally, life insurance and investment needs should be dealt with separately.

To address the former, a term insurance plan is by far the best.

Term plans have the lowest premium structure.

They are cheaper compared to insurance-cum-investment policies and provide better cost-to-benefit advantage.

In other words, against the premium you pay, the sum assured is much greater than you would get in an endowment, money-back or unit-linked policy.

In insurance-cum-investment plans - primarily endowment and money-back policies - the insurance coverage is usually sub-optimal and the return on the investment component is also nothing to write home about.

Finally, parents should not overlook health insurance coverage.

Healthcare costs are rising and the lifestyle we are exposed to invites higher risk.

Not having optimal health insurance coverage for every family member can jeopardise the financial well-being of the family.

So, be the positive change in the life of your loved ones with these financial gifts.

© 2025

© 2025