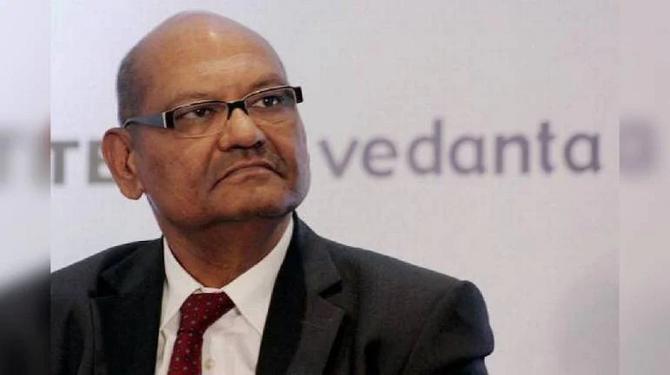

With a robust outlook for mineral-led growth in India, Anil Agarwal-led Vedanta Limited is looking to invest up to $20 billion across its businesses, which includes doubling of silver production and steel capacities.

In a virtual press conference had last month, Agarwal said the company planned a capex of $5 billion over a period of three years.

The company has not given a timeline for $20-billion investment.

“In aluminum, we are already India’s largest producer. For silver, we aim to double our production, as it is not only a precious metal but also used in high-tech industry and renewable energy. In steel, we intend to double our capacity,” Anil Agarwal, founder and chairman of Vedanta Resources Limited, said on Tuesday.

He was speaking at the 56th annual general meeting of Vedanta Limited. In the last ten years, the company contributed Rs 2.7 trillion to the exchequer, Agarwal said.

“Alongside, our acquisition of FACOR and its niche ferro-alloys business is yet another example of our diversification and future readiness,” he added.

With regard to oil demand, Vedanta is looking to increase domestic production in oil and gas by up to 50 per cent to meet this demand.

The company reported highest-ever earnings before interest, taxes, depreciation and ammortisation (EBITDA) of Rs 27,341 crore, up 30 percent year-on-year.

Revenue of the company for FY2021 was at Rs 86,863 crore, up 4 per cent year on year.

According to a International Finance Corporation (IFC) report, Vedanta’s operations contribute 1 per cent to India’s gross domestic product (GDP).

Overall from the sector perspective, mining contributes 1.5 per cent to GDP while metals contribute an additional 2 per cent.

“The GDP contribution of mining and metals must double, possibly even treble. It is the only way to avoid import dependence of the kind we have seen in crude oil,” said Agarwal.

Vedanta is also of the view that both technology and digitization are becoming the heart of each of its businesses.

The company has implemented industry first digital smelters at one of its plants in Jharsuguda, Odisha. Also, Hindustan Zinc has developed technologies to efficiently manage operations remotely.

Of this, about $2 billion has been earmarked for oil and gas business and the balance for aluminium, copper, steel and zinc where about $500 million each (at least) would be used as capex.

© 2025

© 2025