MPC members unanimously decided to keep the benchmark rates unchanged and said they would continue with their accommodative stance as long as necessary.

With inflation under control, the Monetary Policy Committee’s (MPC’s) job is to support growth because the economy had recovered well from the lows in the initial months of the pandemic, according to the panel’s members, who met in the first week of this month.

The minutes of the meeting show the Reserve Bank of India (RBI) governor in his statement said: “Given the sharp moderation in inflation along with a stable near-term outlook, monetary policy needs to continue with the accommodative stance to ensure that the recovery gains greater traction and becomes broad-based.”

Ashima Goyal, external member of the MPC, said: “The current macroeconomic configuration and its expected future evolution imply there is space for the MPC to continue to support the revival of the economy with inflation remaining in the target band.”

Since June last year, inflation was breaching the upper tolerance threshold of the committee but in December it cooled to 4.6 per cent because of a fall in food prices and favourable base effects.

However, core inflation remained at elevated levels owing to the inflationary impact of rising crude oil prices and high indirect tax rates on petrol and diesel, and a pickup in prices of key goods and services, particularly in transport and health.

According to the governor, proactive supply-side measures, particularly in enabling a calibrated unwinding of high indirect taxes on petrol and diesel -- in a coordinated manner by the Centre and states — are critical to contain a further build-up of cost pressure in the economy.

In the meeting, the members unanimously decided to keep the benchmark rates unchanged and said they would continue with their accommodative stance as long as necessary -- at least during the current financial year and in the next one -- to revive growth on a durable basis and mitigate the impact of the pandemic, while ensuring that inflation remained within the target.

Michael Debabrata Patra, RBI deputy governor, said: “Overall, the near-term outlook for inflation appears less risky than the near-term challenges for growth, which warrant continuing policy support, at least until the elusive engine of investment fires and consumption, the mainstay of aggregate demand in India, stabilizes.”

Shashanka Bhide, external member, MPC, said: “An accommodative monetary policy stance is needed to strengthen recovery enabling expansion of both output and demand.”

“Monetary policy will need to lean against the wind to keep interest rates low to the extent possible.

"If central bank open market operation purchases are moderate, it entails the risk of crowding out of private investment; if they are large, it carries risk of reengineering inflation,” said Mridul K Sagar, executive director, RBI.

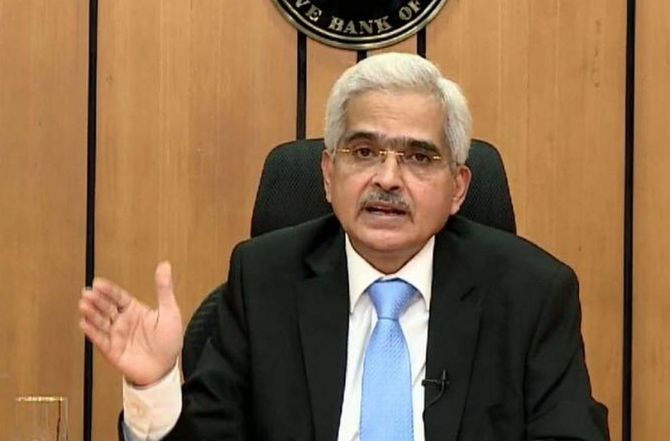

Photograph: PTI Photo

© 2025

© 2025