The Securities Appellate Tribunal on Tuesday bundled the petitions from DLF promoter-chairman K P Singh and four others with the main petition that the realty major has filed with the quasi judicial body on October 22 and put off the hearing on the matter to December 10.

The Securities Appellate Tribunal on Tuesday bundled the petitions from DLF promoter-chairman K P Singh and four others with the main petition that the realty major has filed with the quasi judicial body on October 22 and put off the hearing on the matter to December 10.

DLF chairman K P Singh, his son and vice-chairman Rajiv Singh, younger daughter and whole-time director at DLF Pia Singh, company directors T C Goyal and Ramesh Sanka had earlier moved the tribunal challenging the October 10 Sebi ban on them.

Market regulator Securities and Exchange Board of India had banned the company and six of its senior officials including the Chairman from accessing the capital markets for three years for alleged non-disclosure of three of its hundreds of subsidiaries in the 2007 Initial Public Offer filing.

Admitting their petitions, the quasi-judicial body SAT directed Sebi to submit respond to these new bunch of petitions on December 6 and directed the petitioners to file their rejoinders on the 8th, and fixed December 10 for hearing on their petitions along with the main case.

On November 5, the tribunal had allowed DLF to redeem Rs 1,806 crore (Rs 18.06 billion) from its mutual fund investments to meets its working capital requirement and to service its debt, till December 31.

DLF had sought permission to redeem money locked in mutual funds after being slapped with the three-year ban by Sebi.

The final hearing in DLF's main appeal against the order would commence on December 10, prior to which Sebi and the company will have to file their replies with the SAT.

As an interim measure, SAT has allowed the company to redeem mutual funds worth Rs 767 crore (Rs 7.67 billion) in November and further funds worth Rs 1,039 crore (Rs 10.39 billion) in December.

"Sebi order did not ban DLF from continuing its business, but only barred it from accessing the capital markets for three years," a three-member SAT bench said explaining the rationale for the interim relief.

"It can be reasonably concluded that the appellant should be allowed to use its own funds to meet its every day needs and other working capital requirements, including meeting its obligations to the creditors.

"Accordingly, this tribunal justifies the appellant's demand to redeem Rs 1,806 crore (Rs 18.06 billion) from MFs and also allow its lenders to de-freeze/invoke pledged shares of its subsidiaries as and when required," Presiding Officer JP Devadhar had said.

The tribunal had also noted that Sebi counsel Rafique Dada did not object to the interim relief.

"We are not opposing the plea for interim relief presuming that the tribunal is satisfied with the case made out by the appellant and not that we agree with all the points made," Dada said.

Sebi took action against DLF for 'active and deliberate suppression' of material information at the time of 2007 IPO, which fetched it Rs 9,187 crore (Rs 91.87 billion), the biggest IPO at that time.

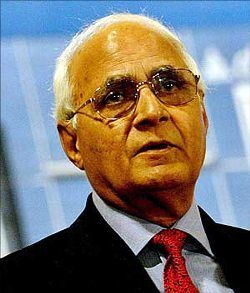

Image: K P Singh

© 2025

© 2025