Unattractive valuations could limit the downside at these firms, believe analysts

Leading information technology stocks -- Tata Consultancy Services, Infosys Technologies, Wipro and HCL Technologies -- have lagged the benchmark S&P BSE Sensex in the December quarter.

As against a 0.4 per cent fall in the latter, these IT biggies witnessed a 0.3 per cent to 7.6 per cent fall in their stock prices.

In a seasonally weak quarter, given the higher number of furloughs and holidays, the sudden floods in Chennai and unfavourable cross-currency movement are expected to add to their problems.

The floods’ impact will depend on the exposure a company has to Chennai.

HCL, with about a third of its workforce there, estimate analysts at Edelweiss Securities, could see a higher impact.

This metric is lower at 13-15 percentage points lower for the other three companies.

Consequently, analysts expect these companies’ dollar revenues to grow only 0.1-1.5 per cent on a sequential basis in this quarter.

Lower utilisation and higher expenses to relocate employees are expected to cancel the positives from a weaker rupee.

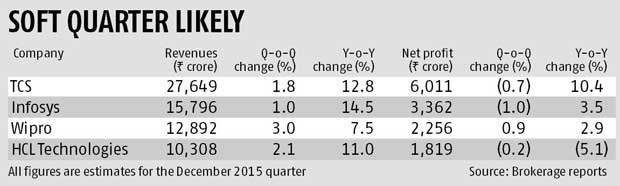

And, lead to a contraction in operating earnings for most. HCL, though, is relatively better placed, given the low base effect of the September quarter. Not surprisingly, these companies’ net profit growth will be flattish, sequentially, with a downward bias in the quarter (see table).

The average of analysts’ estimates suggest Wipro could lead its peers this quarter on both revenue and earnings growth on a sequential basis.

However, part of this would be driven by inorganic initiatives. Wipro is likely to meet the lower end of its constant currency sequential revenue growth forecast, of 0.5-2.5 per cent in the quarter.

Analysts at Emkay Global expect the company to say it expects one to three per cent sequential constant currency revenue growth for the March 2016 quarter.

The Street will also watch for the new chief executive’s stated growth plans, digital strategy and revenue growth in top clients/energy vertical, as well as overall demand trends.

Pressure in TCS' insurance subsidiary, Diligenta, is likely to continue this quarter as well and add to the overall revenue pressure. Management commentary on deal wins, digital growth and overall demand will be noted.

The Street expects Infosys to maintain its full-year constant currency revenue growth expectation of 10-12 per cent. A higher revenue base in the September quarter due to one-offs will be an additional factor.

Analysts believe the company will see improvement in revenue from top clients.

Commentary on deal wins and integration of recent acquisitions will be key.

HCL’s revenue will be fuelled by healthy traction in its engineering services and infrastructure management services businesses.

HCL’s revenue will be fuelled by healthy traction in its engineering services and infrastructure management services businesses.

Impact of pay rises will be negated due to low margins in the base quarter. Management commentary on the re-bids market and digital business will be key.

At Monday’s closing prices, these stocks are trading at reasonable valuations of 14-17 times the FY17 estimated earnings.

While most analysts remain positive on TCS and Infosys, they are cautious on Wipro.

The latter has to post sustained improvement in its financial performance (which has lagged that of the sector in recent times) for an uptick in sentiment. Analysts remain mixed on HCL, with some estimating that the company has fallen short of peers on the digital front.

The image is used for representational purpose only

© 2025

© 2025