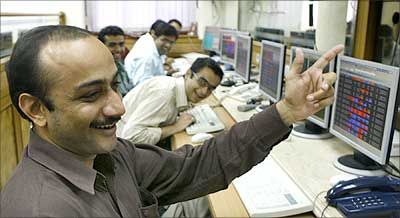

The BSE Sensex on Tuesday rose for the second straight session to close over 132 points higher and NSE Nifty reclaimed the crucial 8,500-level, enthused by revived global sentiments following improved prospects of Hillary Clinton's win in the US election.

The BSE Sensex on Tuesday rose for the second straight session to close over 132 points higher and NSE Nifty reclaimed the crucial 8,500-level, enthused by revived global sentiments following improved prospects of Hillary Clinton's win in the US election.

The sentiment-driven rally also got support from stock specific earning results and Finance Minister Arun Jaitley's statement that the Centre will step up reforms to attract more investment and fill up infrastructure deficit.

However, the momentum turned range-bound with investors being cautiously optimistic about the US poll outcome, while a fag-end buying saw key indices recovering from the day's low.

Anand James, Chief Market Strategist, Geojit BNP Paribas Financial Services Ltd, said, "Despite benchmark indices surging in the closing hours, markets wore a jaded look, with market breadth also declining after a firm opening. While improved chances of Hillary in the US elections, has upped the risk appetite, sectoral moves await key changes and IT, pharma sectors which have seen a lot of turbulence lately, remain cautious."

The 30-share Sensex after shuttling between 27,646.84 and 27,406.76, settled at 132.15 points, or 0.48 per cent higher, at 27,591.14. The gauge had gained 184.84 points on Monday.

The NSE Nifty ended 46.50 points, or 0.55 per cent, higher at 8,543.55 after moving between 8,559.40 and 8,480.10.

In the broader markets, the mid-cap index also rose by 0.36 per cent while small-cap index gained 0.16 per cent.

Buying was led by auto, industrials, oil and gas, banks, financials and utilities -- supported by second-line shares of mid-cap and small-cap industries. While selling was seen in healthcare, FMCG and realty counters.

Globally, most Asian markets extended gains on hopes that Hillary Clinton will beat Donald Trump in Tuesday's presidential election but traders are cautious, with many opinion polls saying the race is too close to call.

Hong Kong's Hang Seng gained 0.47 per cent, while the Shanghai Composite Index rose 0.46 per cent. Japan's Nikkei, however, ended almost flat.

European markets were cautious in their opening deals, with London's FTSE edging higher by 0.10 per cent, while Frankfurt's DAX 30 up 0.05 per cent. Paris CAC 40 up 0.15 per cent.

In the domestic market, 18 scrips out of 30 ended higher while 12 closed lower.

Tata Motors emerged as the top gainer among Sensex constituents by rising 6.49 per cent to Rs 540.20 after reports that Credit Suisse has upgraded its shares to "outperform" from "neutral".

Shares of ICICI Bank rose nearly 2 per cent after the company reported a net profit of Rs 3,102 crore for the quarter ended September as against Rs 3,030 crore in the corresponding period a year ago.

State-run power equipment maker BHEL's shares advanced by 2.87 per cent to Rs 143.15 after the company reported a net profit of Rs 109 crore in the second quarter.

Other big gainers that supported the key indices included GAIL, Asian Paint, Power Grid, Bajaj Auto, Axis Bank, ONGC, HDFC Ltd, M&M, Dr Reddy's, Wipro and Infosys, rising by up to 2.94 per cent.

However, Sun Pharma fell by 3.35 per cent, followed by Cipla 1.74 per cent, Maruti 1.03 per cent, Adani Ports 0.94 per cent, NTPC 0.71 per cent and Tata Steel 0.70 per cent.

The market breadth turned negative as 1,528 stocks ended lower, 1,354 finished in green while 128 ruled steady.

The total turnover on BSE amounted to Rs 3,142.77 crore, lower than turnover of Rs 3,203.53 crore registered during the previous trading session.

Foreign portfolio investors bought shares worth a net Rs 311.18 crore on Monday, as per provisional data.

© 2025

© 2025