After a sharp rally in the equities market this year, investors could be better off rotating some funds towards the debt market.

Experts believe several tailwinds could spur bond market returns over the next 12–18 months.

These include India’s robust macroeconomics, declining inflation, and the imminent passive flows of close to Rs 2.5 trillion on account of domestic sovereign bonds getting included in the JP Morgan global indices.

Additionally, a study by Axis Mutual Fund shows that debt outperforms most other asset classes following a period of longer interest rate hikes.

The 10-year government security last closed at 7.27 per cent.

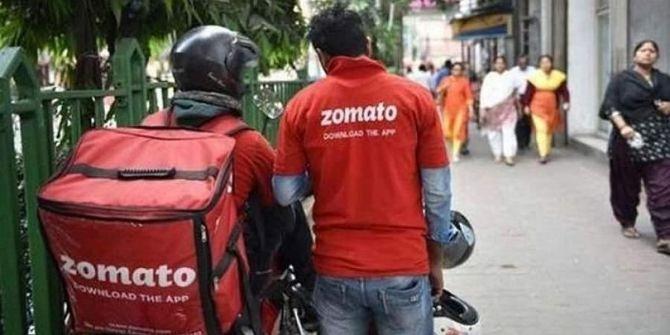

Zomato’s share snapback: Stirring the market pot

The stock performance of restaurant aggregator and food delivery platform Zomato could improve following the removal of the share sale overhang.

Japan’s SoftBank completed the sale of all the shares it received after Zomato’s 91 per cent acquisition of Blinkit.

Furthermore, Chinese payment major Alipay offloaded its entire 3.44 per cent stake in Zomato on November 28.

Although shares of Zomato have doubled this year, they have underperformed the market recently.

Over the past month, the National Stock Exchange Nifty has risen by 8 per cent, while Zomato has declined by 1.5 per cent.

Analysts say that while the stock trades at rich valuations, the strong demand during recent selldowns indicates it can maintain momentum.

Grey brilliance: DOMS soars at 60%, IndiaShelter at 40%

Shares of DOMS Industries, a company known for its scholastic stationery and art/office supplies, command a grey market premium of more than 60 per cent, while that of home finance company (HFC) India Shelter Finance Corporation (IndiaShelter) is around 40 per cent.

Both DOMS’ and IndiaShelter’s initial public offerings — looking to raise Rs 1,200 crore each — open for subscription on Wednesday.

At the upper end of its price band of Rs 750–790 per share, DOMS is valued at Rs 4,794 crore.

IndiaShelter is valued at Rs 5,292 crore at Rs 493, the upper end of its price band. DOMS is India’s second-largest player in branded stationery and art products.

Meanwhile, IndiaShelter is a fast-growing HFC with a high-yield, retail-focused portfolio.

© 2025

© 2025