After a spike in crude oil and gas prices in October following the Hamas terror attack, prices eased down 9 per cent month-on-month in November.

The Organization of the Petroleum Exporting Countries (Opec) and Opec+ agreed to a further voluntary production cut in January-March 2024 to try and support global crude prices.

The best guess here is that crude prices (currently at $75/barrel, or bbl) will not likely cross significantly above $80, and gas prices are also likely to remain subdued unless there’s a further escalation in the Israel-Hamas conflict.

Demand growth could be moderate in calendar year 2024 due to the rise in penetration of electric vehicles, efficiency gains, and continued global macro weakness.

This is likely to limit the sharp rise in oil prices unless Opec+ institutes another deeper round of production cuts.

Singapore’s gross refining margins (GRMs) recovered to $5.3/bbl in November 2023 after dipping to $3.9/bbl in October.

Refining margins may remain strong over the next two quarters due to strong seasonal demand coupled with scheduled refinery maintenance across multiple refineries.

India appears to have a competitive advantage in diesel exports since it has access to Russian crude at a significant discount to Brent.

This implies that oil-marketing companies (OMCs), which were under pressure as crude and gas prices spiked, could get unexpected good news with moderating feedstock prices and decent GRMs.

The recent Assembly election results should also mean some degree of confidence that OMCs will not be asked to reduce retail prices and may be allowed to pass on any feedstock price increases that occur.

Petrochemical (petchem) spreads may also improve. However, the potential for some price cuts in retail prices does remain at least until April-May.

There was a positive rerating of OMCs over the past six weeks as crude prices normalised.

Diesel marketing margins improved to a negative 70 paise/litre in November from a negative Rs 7.5/litre in October, while petrol margins increased to Rs 8.5/litre from Rs 7.1/litre.

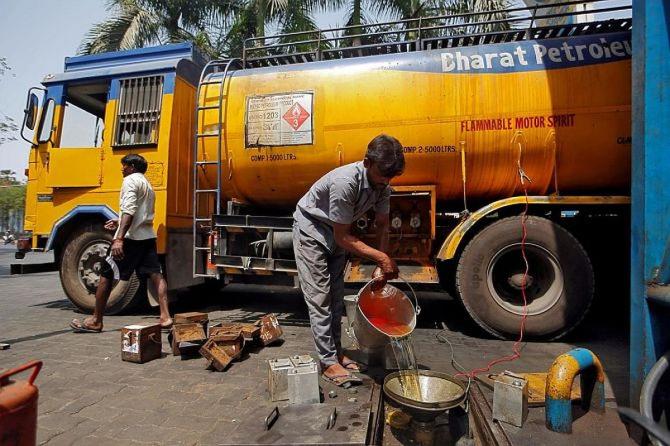

Bharat Petroleum Corporation is up over 15 per cent since mid-November, and IndianOil and Hindustan Petroleum Corporation are up 12-13 per cent. Chennai Petroleum Corporation and Mangalore Refinery and Petrochemicals are also up considerably in the same time frame.

Reliance Industries (RIL) should also ideally feature in this analysis since it is a big player across the whole energy and petchem space, and it will be a beneficiary.

However, RIL’s exposures in telecommunications and retail make it hard to assess how much of the valuation should be assigned to which vertical.

The strong price uptrend in OMCs over the past six weeks does, however, place a question as to the remaining upside.

The market is optimistic and expects this benign cycle to continue through the next two quarters at the least.

In that case, better-than-expected 2023-24 operating profit would help OMCs to pay down debt. But any breakdown in the assumptions listed above — crude prices within a narrow range, strong GRM and strong petchem margins, and pricing freedom at the retail stage — would make the valuations look stretched.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025