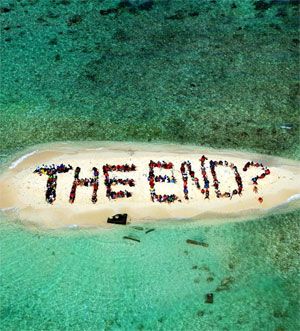

While India is still growing, though at a slow pace, many countries have not yet been able to come off the last decade’s financial crisis. Recently Argentina defaulted on payments to its lenders.

Post the default, credit rating agencies have classified the investment grade of the country as ‘poor quality and very high risk’ (technically called as Caa1 rating).

Argentina is not alone. 24/7 Wall St., an online news portal, has come up with a list of 11 more economies that have a risk of defaulting in future based on Moody’s rating of each country.

Let’s take a look at countries that have a high chance of defaulting and even going bankrupt.

Here's a guide to Moody's credit ratings from Wikipedia.

| Moody's credit ratings | ||

|---|---|---|

| Investment grade | ||

| Rating | Long-term ratings | Short-term ratings |

| Aaa | Rated as the highest quality and lowest credit risk. | Prime-1 Best ability to repay short-term debt |

| Aa1 | Rated as high quality and very low credit risk. | |

| Aa2 | ||

| Aa3 | ||

| A1 | Rated as upper-medium grade and low credit risk. | |

| A2 | Prime-1/Prime-2 Best ability or high ability to repay short term debt |

|

| A3 | ||

| Baa1 | Rated as medium grade, with some speculative elements and moderate credit risk. | Prime-2 High ability to repay short term debt |

| Baa2 | Prime-2/Prime-3 High ability or acceptable ability to repay short term debt |

|

| Baa3 | Prime-3 Acceptable ability to repay short term debt |

|

| Speculative grade | ||

| Rating | Long-term ratings | Short-term ratings |

| Ba1 | Judged to have speculative elements and a significant credit risk. | Not Prime Do not fall within any of the prime categories |

| Ba2 | ||

| Ba3 | ||

| B1 | Judged as being speculative and a high credit risk. | |

| B2 | ||

| B3 | ||

| Caa1 | Rated as poor quality and very high credit risk. | |

| Caa2 | ||

| Caa3 | ||

| Ca | Judged to be highly speculative and with likelihood of being near or in default, but some possibility of recovering principal and interest. | |

| C | Rated as the lowest quality, usually in default and low likelihood of recovering principal or interest. | |

Ecuador

Moody’s credit rating: Caa1

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): 24.8 per cent

2014 GDP per capita (PPP): $10,492

Egypt

Moody’s credit rating: Caa1

Moody’s outlook: Negative

2014 Gov’t debt (pct. of GDP): 91.3 per cent

2014 GDP per capita (PPP): $6,696

Pakistan

Moody’s credit rating: Caa1

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): 63.7 per cent

2014 GDP per capita (PPP): $3,231

Venezuela

Moody’s credit rating: Caa1

Moody’s outlook: Negative

2014 Gov’t debt (pct. of GDP): 51.6 per cent

2014 GDP per capita (PPP): $13,531

Argentina

Moody’s credit rating: Caa1

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): 52.9 per cent

2014 GDP per capita (PPP): $18,917

Belize

Moody’s credit rating: Caa2

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): 80.4 per cent

2014 GDP per capita (PPP): $8,915

Cuba

Moody’s credit rating: Caa2

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): N/A

2014 GDP per capita (PPP): N/A

Cyprus

Moody’s credit rating: Caa3

Moody’s outlook: Positive

2014 Gov’t debt (pct. of GDP): 121.5 per cent

2014 GDP per capita (PPP): $24,171

Greece

Moody’s credit rating: Caa3

Moody’s outlook: Stable

2014 Gov’t debt (pct. of GDP): 174.7 per cent

2014 GDP per capita (PPP): $24,574

Jamaica

Moody’s credit rating: Caa3

Moody’s outlook: Positive

2014 Gov’t debt (pct. of GDP): 133.7 per cent

2014 GDP per capita (PPP): $9,256

Ukraine

Moody’s credit rating: Caa3

Moody’s outlook: Negative

2014 Gov’t debt (pct. of GDP): N/A

2014 GDP per capita (PPP): N/A

© 2025

© 2025