Photographs: Christian Hartmann/Reuters Abhineet Kumar in Mumbai

They seemed like promising partners at one time. When homegrown automotive major Mahindra & Mahindra announced two joint ventures with US-based Navistar International Corp to mark its entry into the heavy commercial vehicle (HCV) segment, it was considered a formidable deal.

It gave Mahindra & Mahindra the much-needed technological know-how in its quest to become a full-fledged automobile company: from tractors to SUVs, cars, two-wheelers and commercial vehicles.

Navistar, in theory, was well suited to help the Indian automobile maker achieve that goal.

The manufacturer of commercial and military trucks and diesel engines brought with it not just manufacturing expertise, but also its technologically superior MaxxForce 7.2 diesel engine to power the trucks. Hopes, therefore, were obviously high.

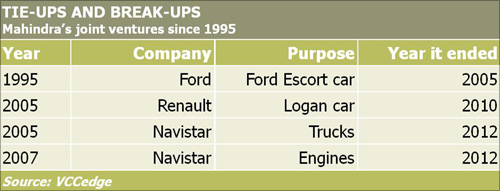

But in what has become a familiar experience for Mahindra & Mahindra, this partnership, too, like its earlier partnerships with Renault and Ford, came to an end abruptly.

Last month, Mahindra & Mahindra decided to buy out its US-based joint venture partner in two companies, one for making engines and the other for making trucks.

The stock markets cheered the exit; Mahindra & Mahindra shares scaled a one-year high of Rs 973.35 in intraday trading after the announcement. But analysts were quick to flag cash-flow concerns for Mahindra & Mahindra, especially as the joint ventures did not yield the desired results. What went wrong?

"There are challenges in a joint venture; when there are two decision makers, there are different approaches to do business," said Pawan Goenka, president, automotive and farm equipment sector, Mahindra & Mahindra, in a telephonic interview with Business Standard.

...

Why Mahindra lost all its joint venture partners

Image: Mahindra Navistar TruckPhotographs: Courtesy, Mahindra Navistar

Bumpy road

The partnership, to be sure, had got off well. After an investment of Rs 1,080 crore (Rs 10.8 billion), of which Rs 520 crore (Rs 5.2 billion) was contributed by Mahindra & Mahindra and the rest by Navistar, the joint venture company went into production in 2010.

It started with 25-tonne trucks from its brand new plant in Chakan, in Pune, and later widened its offering to products between 16 and 40 tonnes in the medium and heavy commercial vehicle segments.

Its HCV segment products included rigid trucks, multi-axle trucks, tippers and tractor-trailers, starting from Rs 18.36 lakh (Rs 1.83 million) and going till Rs 25.33 lakh (Rs 2.53 million).

While the joint venture provided Mahindra & Mahindra a strong new product line positioned outside its traditional domain, for Navistar, things were not so smooth.

The stress of the slowdown, coupled with the slow growth in sales in the Indian market dominated by Tata Motors and Ashok Leyland, was taking its toll on the company.

At the end of November 2012, the joint venture accounted for only 2 per cent of the market in segments where the company's products were available. Truck sales dropped to 1,730 in the April-November period this financial year from 3,490 in the corresponding period last financial year.

The company reported a cumulative loss of Rs 690 crore (Rs 6.9 billion) on net revenue of Rs 1,350 crore (Rs 13.5 billion) in 2011-12. What made things worse was the heavy price discounts to deal with increased competition and falling demand.

In this scenario, Navistar was forced to rethink its strategy. The company, Mahindra Navistar Automotive, had accumulated an outstanding loan of Rs 450 crore (Rs 4.5 billion), and Navistar was running out of appetite to pump in more money into the nascent Indian business.

...

Why Mahindra lost all its joint venture partners

Photographs: Business Standard

"While the Indian market has not expanded as we had originally expected and industry challenges there continue in the near term, we still see promise in India going forward. But given Navistar's 2013 priorities, our capital and focus needs to be allocated to other business opportunities in the near term," Troy Clarke, president and chief operating officer, Navistar, had said in a statement earlier.

Souring deals

This is the third time that a global partnership has gone bust for Mahindra & Mahindra. The company had earlier struck deals with Ford Motor and Renault, which, too, folded up prematurely.

In 1995, Mahindra & Mahindra had formed a 50:50 joint venture with Ford to diversify into the passenger car segment. The venture made Ford Escort cars in India, which later needed more investment.

Ford took its ownership to 72 per cent in March 1998 and later increased its holding further, even as Mahindra & Mahindra restrained additional investment.

Although Ford Escort sales did not achieve targets, it helped the Indian auto company learn the best global practices in manufacturing, which it later used in developing its most successful product, the Scorpio.

Mahindra & Mahindra sold its stake in Ford in 2005 to end its partnership. It then formed a new joint venture with French auto maker Renault to make and sell its sedan, the Logan, in India.

However, Mahindra & Mahindra's partnership with Renault didn't last long either. The 51:49 joint venture started selling the Logan in July 2007.

In April 2010, Mahindra bought out Renault's stake in the venture for an undisclosed amount and the partners parted ways as the venture didn't bring the desired results.

...

Why Mahindra lost all its joint venture partners

Image: Mahindra continued with the Logan name and logo till the end of 2010.Photographs: Punit Paranjpe/Reuters

The venture sold over 44,000 units of Logan in the three years after it was commercially launched. Mahindra continued with the Logan name and logo till the end of 2010, in accordance with the licence agreement and, later, re-launched the car under the brand name 'Verito', in April 2011.

The new product from Mahindra's stable was priced competitively for the diesel version at Rs 562,000 (ex-showroom) against Rs 647,000 for the outgoing Logan.

"Joint ventures are often terminated when the alignment of the objective does not remain intact and there are divergent views among partners," says Manish Mathur, partner, auto and industrial goods practice, at management consultancy firm A T Kearney. "This can happen when strategic objectives and market realities change," he says.

Ford has grown its business substantially since then, establishing itself as the fourth-largest player in the domestic passenger car segment after Maruti Suzuki, Hyundai Motor and Tata Motors.

The company sold 58,620 cars in the April-November period this year, which is an 8.8 per cent rise from the year-ago period.

However, both Mahindra & Mahindra and Renault continue to struggle in the Indian passenger car market. Sales for Renault dropped to 698 cars in the first eight months of 2012, a 90 per cent decline from 7,152 cars sold in the corresponding period previous year.

While Mahindra & Mahindra has registered a 10 per cent annual increase in sales in the April-November period to 11,652 cars, it is yet to make its presence felt in a market crowded by 19 original equipment manufacturers (OEMs), which together sold 1.24 million cars in the period.

Though Mahindra & Mahindra's partnerships may have folded up without the desired outcomes, Goenka says, "All the partnerships have given us something."

...

Why Mahindra lost all its joint venture partners

Image: Pawan Goenka, president of automotive and farm equipment sectors at Mahindra & Mahindra.Photographs: Vivek Prakash/Reuters

While the company primarily looks for engineering capabilities for making superior engines and world-class manufacturing practices to bring efficiency through these joint ventures, its foreign partners hope to learn the lay of the domestic market and ways of doing business in India.

Goenka says some of the foreign players also look at joint ventures as "stepping stones". But the company says that was certainly not the case with Navistar.

"If the partnership with Navistar had broken up three years ago, we would have been handicapped," says Goenka.

However, the exit may put the company's finances under strain. "We believe Mahindra & Mahindra's immediate task is to reduce the cash losses and focus on turning around operations," said Sahil Kedia, analyst with Barclays Equity Research in a recent note.

"We currently do not ascribe any value to the (Mahindra-Navistar) companies due to the large erosion in equity to date," he said.

Mahindra Navistar Automotive currently has 55 dealerships and 20 branches, along with about 1,000 service touch points. But it faces an uphill task, given the tough market conditions.

The company has already postponed its entry into the 9-16 tonne light commercial vehicle segment. However, it intends to invest Rs 250 crore (Rs 2.5 billion) over three years in both the companies to improve the product portfolios.

Under a new licence agreement, Navistar would continue extending necessary support to Mahindra Navistar Automotive and Mahindra Navistar Engines for the purpose of business continuity, and will receive a royalty for engine technology.

Mahindra & Mahindra, meanwhile, is working on rebranding its trucks. They will now be sold under the Mahindra brand instead of Mahindra Navistar.

article