| « Back to article | Print this article |

How the Budget impacts industry sectors

The market had high expectations from the Union Budget 2009-10, especially with the Economic Survey suggesting radical changes -- including review, phase out surcharges, cesses and transaction taxes and annual target of Rs 25,000 crore per annum from disinvestment of stake in PSUs for the next five years.

While Union Budget did remove Fringe Benefit Tax, markets found the hike in Minimum Alternate Tax from 10% to 15% a bigger irritant.

Also, contrary to market expectations, fiscal deficit is set to zoom to 6.8% in the fiscal year 2009-10, up from 6.2% as per provisional accounts of FY 2008-09.

The markets were expecting inflows from auction of 3G spectrum auctions and the inflow from divestment of stake in PSUs to ensure that fiscal deficit does not shoot over 6.0%. However, the budget documents indicate that the deficit will touch 6.8% for FY 2009-10.

Similarly, revenue deficit is set to increase to 4.8% in FY 2009-10 from 4.6% in FY 2008-09 (as per provisional accounts).

Direct Taxes: Budget robs corporates to pay for individuals

The hike in Minimum Alternate Tax (MAT) from 10% to 15% is an irritant for the corporate sector. On the positive side, this hike has come with a benefit of extending the period allowed to carry forward the tax credit under MAT from 7 years to 10 years.

Also, the hike in MAT will not be 'earnings dilutive', but will only be 'cash flow dilutive'. The increase in liability towards MAT will be matched by an incremental deferred tax credit.

Hence, the net profit or EPS of a company will not change due to hike in MAT from 10% to 15%. However, it will lead to an increase in cash outflow and if the company is not returning to profits as per the Income tax Act within ten years, then it may have to forego these.

So, from the current year's point of view, the increase in MAT from 10% to 15% is not earnings dilutive but cash flow dilutive.

On the other hand, the removal of Fringe Benefit Tax (FBT) is a major positive for corporate India.

The finance minister has said that surcharge on income tax for individuals will be waived.

The finance minister has said that the budget proposals are revenue neutral as far as direct tax is concerned. This is so despite the fact that the exemption limit on personal income tax has been hiked by Rs 15,000 to Rs 2.40 lakh for senior citizens.

Similarly, the exemption limit was hiked by Rs 10,000 each to Rs 1.90 lakh for women taxpayers and to Rs 1.60 lakh for all other categories of individual taxpayers.

As the minimum tax bracket is 10%, this means the benefit for senior citizens will be Rs 1,500 per annum and for others (including women tax payers) will be Rs 1,000 per annum. The benefit could be more, including the surcharge waived.

The Union Budget has increased the deduction under section 80 DD in respect of maintenance, including medical treatment, of a dependent with severe disability has been raised from Rs 75,000 to Rs 1 lakh (Rs 100,000).

In a way, the biggest (maximum) and the largest (covering more people) beneficiary of the Union Budget 2009-10 is the salaried class. Their disposable income has been increased through hike in IT exemption limit and removal of surcharge.

The Union Budget has robbed corporates to increase disposable income of individuals. As a result, while corporate taxes are expected to rise by 15.6% to Rs 256,725 crore, personal income tax is expected to fall by nearly 8% to Rs 112,850 crore in FY 2009-10.

Good for the auto sector

Auto sector has to contend with the reduction in excise duty on vehicles that were left out in the three-stimulus package announced in 2008-09.

The Union Budget 2009-10 has cut the excise duty for petrol trucks to 8% from 20%. In addition, the ad valorem (duty by value) duty on cars and sports utility vehicles of engine capacity equal and above 2,000cc has been reduced by Rs 5,000/unit to Rs 15,000, auguring well for vehicle manufacturers.

In addition, the budget has further provided for a more level playing field between road freight and other modes of transport (including coastal shipping and railways) by applying a uniform service tax rate.

This will reduce the incremental disadvantage in pricing faced by road freight operators. Overall the Union Budget 2009-10 is marginally positive for the sector.

Software cherishes FBT withdrawal and extension of STPI scheme

The Indian software industry has something to cheer from the Budget 2009. The budget proposes to abolish FBT, which would mean lower cash outgo and lower administration hassles. Also, the budget proposes extension of STPI scheme (sun-set clause) for one more year, i.e. for FY2010-11.

This would mean one more year of relief on the taxation front for the IT companies. The budget proposes to exempt the value attributable to the transfer of the right to use packaged software from excise duty and CVD.

Finally, the budget proposes to increase the MAT limit from 10% to 15% and extend the period allowed to carry forward the tax credit under MAT from 7 years to 10 years.

Though this would mean higher cash outgo due to taxes to be paid on higher tax rate, on an overall basis the impact on earnings would be neutral.

On the administrative side, the budget proposes set up of alternative dispute resolution mechanism to be created within the Income Tax department for the resolution of transfer pricing disputes empowering the Central Board of Direct Taxes (CBDT) to formulate 'safe harbour' rules to reduce the impact of judgmental errors in determining transfer price in international transactions.

Print media benefits from extension of stimulus package

The budget proposes to continue with the stimulus package extended in February, 2009 up to December 31, 2009 to the print media, comprising waiver of 15% agency commission on DAVP advertisements and a 10% increase in the DAVP rates to be paid as a 'special relief' subject to documentary proof of loss of revenue in non-governmental advertisements.

This will spell relief for the print media sector, which is reeling due to slowing advertising revenues. With the election season over, DAVP advertising would begin and is likely to fill up some of the revenue shortfall created by the slowing economy.

However, the benefit would not be major as the share of DAVP of the total advertising revenues is 10-20%.

FMCG to benefit from increased focus on rural sector

Looking at the opportunity and growth in rural sector, FMCG companies are now focussing on the rural region for their volume growth.

The focus on rural sector in the budget -- like increase in agriculture credit flow to Rs 325,000 crore, allocation of loan to farmer up to 3 lakh at the rate of 7%, and144% increase in allocation for National Rural Employment Guarantee Scheme to Rs 39,100 crore -- will give the required boosts to the FMCG industry.

Along with it, an increase in teh exemption limit in personal income tax by Rs 15,000 to Rs 2.40 lakh for senior citizens; by Rs 10,000 to Rs 1.90 lakh for women tax payers; and by Rs 10,000 to Rs.1.60 lakh for all other categories of individual taxpayers, eliminating the surcharge of 10% on personal income-tax, abolition of Fringe Benefit Tax (FBT) and introduction of the Goods and Services Tax with effect from April 1, 2010 will the help the FMCG sector to continue it moment for the FY09.

Paper: Nothing on table

The paper sector didn't receive any much attention from the finance minster in the budget. However, the paper industry is thankful to the finance minister for not increasing the excise duty, which was cut by 600 basis points in the first two-stimulus packages to the current level of 4%.

The paper industry, which is suffering from low cost export, was expecting a rise in basic custom duty (BCD) from 10% to 15% on paper/paperboards along with re-introduce component of special additional duty to save the domestic manufacturer.

The finance minister has not heard their request. The scrips to be watch will be Ballarpur Industries (BILT), JK Paper, Tamil Nadu Newsprint & Papers (TNPL).

Entertainment: Customs duty imposed on STB at 5%

The budget proposes to levy basic customs duty of 5% on Set-Top Boxes. This would be a negative for the cable and DTH operators who are already reeling under losses on the back of higher customer acquisition cost as compared to revenue per customer.

Fertilizers: Major issues unaddressed

In order to ensure balanced application of fertilizers to increase agricultural productivity, the government intends to move towards a nutrient-based subsidy regime so as to cover larger basket of fertilizers with innovative fertilizer products available in the market at reasonable prices.

Besides, the government also intends to move to a system of direct transfer of subsidy to the farmers. The system of direct transfer of subsidy to farmers is laudable, but only if competition is allowed amongst fertilizer companies to price their products.

Here the problem arises due to substantial difference in cost of production depending on the feedstock used, like natural gas, regassified LNG, naphtha, other alternate fuels etc. So, while it was the government which encouraged fertilizer capacity additions through feedstock other than gas, it cannot shy away from its responsibility.

Also, if Indian fertilizer production comes down and domestic consumption continues to rise, the country may have to pay heavy price of sharp spike in global prices and import in larger quantities at such high prices.

We have seen this in wheat, sugar, etc, and hope we shall not see it in fertilizers. How the government achieves this remains to be seen.

Customs duty on rock phosphate was reduced to 2% from 5% earlier. Excise duty on naphtha was also reduced to 14%. Although the lower customs duty and excise duty on rock phosphate and naphtha respectively will enable the fertilizer manufacturers to reduce their production cost, important issues like the timely subsidy payment, measure to attract new investment went unaddressed.

There was also no time slab announced within which the nutrient-based subsidy regime and the direct payment of subsidy to the farmers are implemented. Thus the budget was really a dull affair for the fertilizer sector.

Pesticides feels uncared for

Although Fringe Benefit Tax (FBT) was abolished, there was no clarity on the other demand of the industry body. The pesticides industry had requested for reduction in excise duty on pesticides from 8% to 4%, besides lowering excise duty to 4% from the current level of 16% for furnace oil.

The industry had also requested for zero import duty for major fuels like fuel oil, LSHS, coal, etc. None of these, however, materialised in the budget.

Request for lower import duty on inputs and fuels for captive power plants and reduction of service tax was also denied. Thus, the budget for the pesticides industry is negative as far as immediate impact is concerned.

Telecom gains on removal of 4% CVD on mobile phone parts

In the Budget 2009-10, full exemption from 4% special CVD on parts for manufacture of mobile phones and accessories has been proposed to be reintroduced for one year.

The proposal is positive for the telecom services industry as it will help in achieving the key objective of the government to ensure fast spread of affordable connectivity to the rural areas.

But whether the cost of mobile phones will come down is a moot point.

Oil & Gas: Tax holiday extended to natural gas

The finance minister made few announcements for the oil and gas sector and one of the major ones was the extension of tax holiday under Section 80 IB (9) for production of natural gas too.

The demand for deregulation of the oil sector, however, was not fulfilled. But the government set up an expert group to advise on a viable and sustainable system of pricing petroleum products.

The announcements made in the budget are marginally positive for the sector in spite of major expectations remaining unfulfilled.

Slew of initiatives for the oil and gas sector have been proposed in the budget. These include:

- The government shall set up an expert group to advise on a viable and sustainable system of pricing petroleum products.

- Tax holiday under section 80-IB(9) of the Income Tax Act, which was hitherto available in respect of profits arising from the commercial production or refining of mineral oil, to be extended to natural gas. This tax benefit to be available to undertakings in respect of profits derived from the commercial production of mineral oil and natural gas from oil and gas blocks which are awarded under the NELP-VIII round of bidding. The section to be retrospectively amended to provide that "undertaking" for the purposes of section 80-IB(9) will mean all blocks awarded in any single contract.

- The government shall prepare a blueprint to be developed for long distance gas pipelines leading to a National Gas Grid to facilitate transportation of gas across the length and breadth of the country.

- The outlay for Assam Gas Cracker Project stepped up suitably in B.E. 2009-10.

- Excise duty on naphtha to be reduced to 14%.

- Duty paid High Speed Diesel blended with upto 20% bio-diesel to be fully exempted from excise duties.

- The ad valorem component of excise duty of 6% on petrol intended for sale with a brand name to be converted into a specific rate. Consequently, such petrol would now attract total excise duty of Rs.14.50 per litre instead of '6% + Rs.13 per litre'.

- The ad valorem component of excise duty of 6% on diesel intended for sale with a brand name to be converted into a specific rate. Consequently, such diesel would now attract total excise duty of Rs.4.75 per litre instead of '6% + Rs.3.25 per litre'.

- Customs duty on bio-diesel to be reduced from 7.5% to 2.5%

Steel loses sheen

The steel industry was expecting an increase in import duty on certain steel and steel products and was also hopeful of a hike in export tax on iron ore.

None of these two demands of the industry was met. However, focus on infrastructure is expected to provide indirect demand push.

From a medium-term perspective, the government plans to increase the investment in infrastructure to more than 9 per cent of GDP by 2014. Overall, with industry demands not met the Budget is neutral for the steel sector with a negative bias.

Cement: Thumbs down for the sector

Besides some boost for rural development and empowerment, the budget 2009-2010 was virtually silent for the cement industry.

The differential excise duty structure for the cement industry was kept unchanged. Besides, there was no change in the import duty of basic inputs like coal, PET coke, gypsum, etc.

The cement industry is one of the most heavily taxed sectors with a complex 3-tier excise structure. Apart from excise duty, other taxes on the commodity comprise duties on power tariff, sales tax, royalty and cess on limestone, coal and gypsum. Lower excise duty and abatement on it would enable the industry to pass on the benefit to the final consumer.

The industry had requested rationalisation of the excise duty, besides abatement of 35-55% on the MRP of the cement bags. In order to establish a level playing field for the domestic cement manufacturers with the importers the industry body had requested to re-impose import duty and CVD on imported cement.

Exemption in import duty on Pet coke and coal and reduction of VAT in line with similar important construction material like steel was desired by the industry.

Although the current demand is strong, going ahead there is a likelihood of margins of the cement industry being squeezed due to pricing pressure. High excise duty and customs duty on raw materials imported will render the sector uncompetitive.

Also, the budget has introduced service tax on transportation of goods by rail, which will negatively affect the transportation cost for the cement industry.

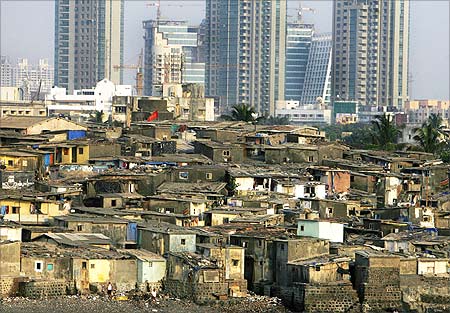

Real estate: Really not beneficial

The real estate sector looked up to to the budget with great hope for measures to resurrect the housing demand. It had asked for increase in 80C benefit to Rs 3 lakh and of which 2 lakh exclusively for principal repayment, extension of 100% deduction of interest on payment for owner occupied house as well like rented house, extension of sunset clause u/s 10A and 10B, etc.

While the extension of 10A and 10B benefits were granted for one more year, auguring well for commercial real estate -- especially, STPI space -- with no major change in tax benefits for investment in real estate sector, the budget has not done any thing concrete to resurrect the demand for the realty sector.

However, removal of surcharge for income up to Rs 10 lakh (Rs 1 million), increase in tax exemption by Rs 15,000 for senior citizens and by Rs 10,000 for women and other assesses will improve disposable income.

But this will largely be inadequate considering the current property prices in urban centers and interest rates and will hardly be any incentive for pushing up demand for real estate sector.

Capital Goods: No clear measures to encourage investments

The increased allocation for central funded schemes such as APDRP, Rajiv Gandhi Grameen Vidyutikaran Yojana has been good for the electrical equipment industry.

On the flipside, the budget has not clearly spelt out any measures to encourage private investment in infrastructure or the manufacturing sector.

Power: Fiscal benefit u/s 80IA extended

Moreover, the budget has also reduced the excise duty on naphtha to 14%. It has also increased the allocation under central power sector schemes such as APDRP, rural electrification, etc.

Though the tax benefit under section 80IA was extended beyond the terminal year, the other core expectations of the industry such as exemption of interest payable by Indian power/ infra companies U/s 10 (15) or withholding liability; refinancing of existing rupee loans through ECB, etc were ignored.

Yet, overall, the Union Budget 2009-10 is a positive for the power sector.

Wind turbine generators: Customs duty cut

The Budget has cut customs duty on permanent magnets for PM synchronous generators above 500 KW used in WTG to 5% from current 7.5%. According to the industry since the technology is not widely used that will not benefit much for the industry.

However, the increase in MAT to 15% from current 10% is a dampener for the industry affecting the renewable energy investments.

Outlook

The Indian equity markets were one of the best performing markets in the past few months. There was a need for correction, as we are slightly over valued compared to many other emerging markets.

The market used the high expectations on the Union Budget and their subsequent disappointment to herald a healthy correction.

As a result, BSE Sensex tanked 869.65 points to 140453.40 or by whopping 5.83% on a single Budget day of July 6, 2009. While there is lot of measures to be taken, Union Budget 2009-10 has bypassed most of them.