In the past two decades China grew at a breakneck speed keeping its debt low and the quality of its infrastructure high. In India, not only has economy and infrastructure deteriorated but also its public institutions.

Wars, internal strife and malaria keep nations poor until most of them eventually graduate to middle-income status. What starts then is the race to get rich, an arduous marathon that only few countries have managed to finish.

While demographic forces determine the intensity of the initial growth spurt, the winners tend to be those that build stamina along the way by paying attention to institutions, infrastructure and fiscal policies.

India and China, the two most populous nations to have ever attempted the middle-income marathon, offer striking contrasts - not in the tempo of growth, but in their endurance.

The two nations were equally poor in 1978 when China ended its economic isolation - a decade before India chose to open up its economy.

In 1993, average Chinese incomes, measured in 2005 prices and adjusted for purchasing power differences of currencies, rose above $2,000.

Click NEXT to read more…

That's the minimum threshold for a middle-income country, according to a March 2013 study by International Monetary Fund economists.

Yet after a two-decade-long slog, China is only two-thirds of the way towards reaching the $15,000 income threshold at which a country can declare itself rich.

That finish line will be in sight for China by the early 2020s - provided the huge build up of debt by the country's local governments doesn't lead to a collapse before then.

In an ageing society, an accident like that could cause growth muscles to cramp up. That's what happened in Japan in the early 1990s - though by then the Japanese were already rich.

India's case is more curious. The relative newcomer to the race showed great promise.

Starting in 2002, India's first eight years as a middle-income nation saw an even bigger jump in average prosperity than in a comparable period in China in the 1990s.

Click NEXT to read more…

All that has changed in the last few years. India is looking tired at the same point in the race where China, after receiving a boost from its 2001 entry into the World Trade Organisation, had begun to speed up.

Real per capita income this year might grow just 3.7 per cent, Oxford Economics estimates.

That's less than half the annual rate between 2005 and 2007, and indeed the slowest expansion in average income since India became a middle-income nation.

India's slowdown, which began in the second half of 2011, has worsened this year.

Manufacturing output has hardly grown in recent months, and rising long-term US interest rates have raised concerns about how the country is going to pay for its large current account deficit.

A sharp slide in the currency has spooked investors, leading to capital outflows. Unless New Delhi rebuilds the atrophied muscles of the economy, getting back into the contest with China will be tough.

Click NEXT to read more…

At under $4,000, the average Indian's real income is about the same as what the average Chinese earned 10 years ago.

If India can quickly return to its previous growth trajectory, the average citizen would command real purchasing power of $6,000 by the start of the next decade - still $2,000 less than what the average Chinese made in equivalent terms in 2010.

But if the slowdown persists, average Indian incomes will be even lower, at about $5,000.

The difference between "strong" and "tired" growth in India over the next few years will determine the pace of poverty reduction in the country.

It will also be of crucial significance to a demand-starved world. But policymakers' inertia could lead to some or most of this income failing to materialise.

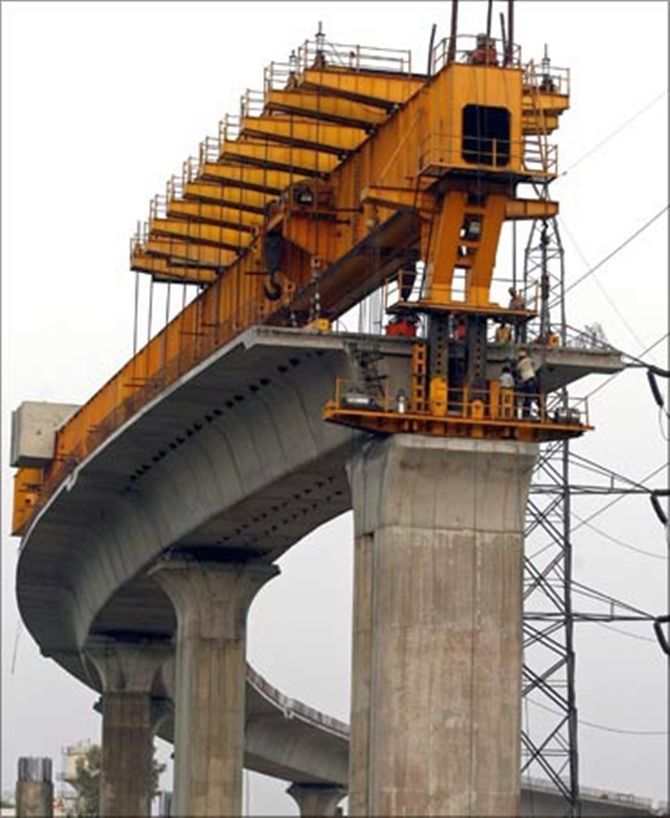

The nation's infrastructure deficit is one part of the reason. India was generating about 550 kilowatt-hours of electricity per capita in 2002.

At the same point in its growth journey in 1993, China was producing 28 per cent more power.

The gap has widened since: eight years after they each became middle-income countries, China's per capita power availability was 62 per cent higher than in India.

Click NEXT to read more…

Some of China's growth may be both economically and ecologically unsustainable. But it's undisputed that India has built too little infrastructure. Stretched government budgets gave it little room.

Beijing's budget deficit since China became a middle-income country has been an average of 1.3 per cent of GDP; New Delhi's fiscal hole has been three times as deep.

Some of the reckless borrowing by local Chinese governments since the global financial crisis may eventually end up on Beijing's balance sheet.

As a result, China's real public debt levels may turn out to be much higher than the 19 percent of economic output suggested by official data.

But while sovereign debt could become a headache for China in the future, in India it's a challenge today.

The stock of government debt is about 54 per cent of GDP, and two important tax reforms that could begin to address the shortfall are already several years late.

Click NEXT to read more…

India has also squandered its initial advantage of superior institutions. For middle-income countries, IMF researchers find that strong rule of law lowers the probability of a sudden, multi-year slowdown in the tempo of growth.

The quality of legal institutions and their impact on the economy are hard to measure. But based on the rule of law index compiled by the Vancouver, Canada-based Fraser Institute, India has slipped since 2002, allowing China to overtake it.

China shed its low-income status with a demographic advantage: there were almost twice as many people of working age in China in the early 1990s as there were children and the elderly.

India became a middle-income society with fewer workers to provide for young and old dependents. But now India's more onerous dependency burden is beginning to lighten.

That suggests it can rejoin the growth marathon, provided it does not leave institutions to chance, infrastructure to the private sector and fiscal consolidation to future generations.

On present evidence, however, India is going to miss the growth acceleration that made the Chinese economy surge ahead 10 years ago.

The writer is the Asia economics columnist at Reuters Breakingviews in Singapore. These views are his own