A year before, silver prices were $21 an ounce, while gold was around $1,300.

A year before, silver prices were $21 an ounce, while gold was around $1,300.

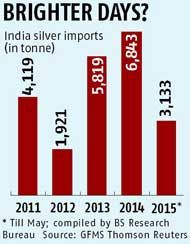

Demand for silver has seen a significant jump in India, reflected in rising import numbers.

On the first half of 2015, these have risen 35 per cent over the same period last year, to 3,824 tonnes.

Imports were at a record high in 2014, at 6,843 tonnes.

“With prices continuing to fall, demand from electronic goods manufacturers has helped imports continue to rise despite the very high level the previous year,” said Rajiv Popley, director, Popley Group.

A year before, silver prices were $21 an ounce, while gold was around $1,300.

Silver prices are 29 per cent down from a year before, while gold has fallen 16 per cent in global markets.

Silver, apart from tracking gold, also tracks base metals, as it has huge industrial use. With base metals also falling, silver prices are falling faster than gold.

Silver imports normally increase in the second half.

Demand rises from August for making jewellery and silverware for the festive season and supplying for exports before Christmas.

There are lesser facilities for making silver articles in the country and, hence, demand starts much ahead of the festivals.

The trend of falling silver prices is expected to continue. Nic Brown, head of commodities research, Natixis, said: “Industrial demand for silver is expected to remain solid over the coming year but in the absence of investment demand, that is unlikely to be enough to prevent prices from falling further.

"Our forecast for silver anticipate a steady decline to a low of around $13/oz by the end of 2016.” This means a further 10 per cent down from the current $14.7 an ounce.

A fundamental difference berween gold and silver is that a large proportion of the latter's global output is as a by-product.

Silver is largely produced from zinc, a reason why Hindustan Zinc is the largest producer of silver in India. Hindalco is another big producer.

Globally, investors in gold have long started unwinding their investments in gold exchange traded products.

The largest among these, SPDR, has seen its holding fall from 1,300 tonnes to 680 tonnes in two and a half years.

In the past year, the holding in ISHARES, largest ETF for silver investors, has had the holding rise marginally by 2.2 per cent to 10,228 tonnes.

In the past year, the holding in ISHARES, largest ETF for silver investors, has had the holding rise marginally by 2.2 per cent to 10,228 tonnes.

Considering the 52-week high, the silver holding is only down six per cent; from the peak in 2011, it is down 11.3 per cent.

While, the gold holding has almost halved from its peak of 1,353 tonnes seen at the end of 2012.

“Western investors that held gold in physically-backed exchange traded products have relinquished a substantial portion of their holdings over two and a half years,” says Brown.

“In contrast, holdings of silver in physically-backed ETPs remain close to their recent highs.

"There is, therefore, a risk that investor outflows could have a disproportionate impact upon silver prices if markets were to fall further.”

This selling, if and when it begins, could result in a sharper fall in silver prices as compared to gold.

Already in the past one year, the ratio of gold to silver prices has increased from 62 to 75, indicating silver has fallen faster. Silver tends to fall sharply in a bearish market.

Brown adds: “Silver prices typically exhibit a strong positive correlation versus gold prices.

"At the same time, silver prices typically move by more than gold prices (with a beta of around 1.4).

"Hence, during a secular bear market, one would expect the gold: silver price ratio to rise steadily.”

Image: Silver jewellery; Photograph: Reuters

© 2025

© 2025