Kotak Bank was the top laggard in the Sensex pack, shedding over 2 per cent, followed by ITC, PowerGrid, M&M, HDFC, Asian Paints and NTPC.

On the other hand, Maruti rallied over 4 per cent. Bharti Airtel, Axis Bank, IndusInd Bank and Bajaj Finance were also among the gainers.

Equity benchmarks closed lower after a see-saw session on Wednesday as border tensions with China and spiking coronavirus cases kept investors on the back foot.

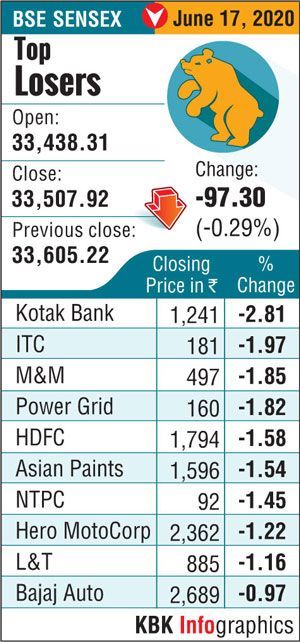

After gyrating 600.70 points during the day, the 30-share BSE Sensex closed 97.30 points, or 0.29 per cent, lower at 33,507.92.

Similarly, the broader NSE Nifty settled 32.85 points, or 0.33 per cent, down at 9,881.15.

Kotak Bank was the top laggard in the Sensex pack, shedding 2.81 per cent, followed by ITC, M&M, PowerGrid, HDFC, Asian Paints and NTPC.

Kotak Bank was the top laggard in the Sensex pack, shedding 2.81 per cent, followed by ITC, M&M, PowerGrid, HDFC, Asian Paints and NTPC.

On the other hand, Maruti rallied over 4 per cent. Bharti Airtel, Axis Bank, IndusInd Bank and Bajaj Finance also finished in the green.

According to traders, border tensions with China, spike in COVID-19 cases and unabated foreign fund outflows weighed on investor sentiment.

As many as 20 Indian Army personnel were killed in a clash with Chinese troops in Ladakh on Monday night, the biggest military confrontation in five decades that has significantly escalated the already volatile border standoff between the two countries.

There were around 35 casualties on the Chinese side, sources said, citing US intelligence reports.

Adding to investors' woes, India witnessed its highest single-day spike of 2,003 COVID-19 deaths, pushing the toll to 11,903, while cases rose to 3,54,065 with 10,974 new infections.

The number of cases around the world linked to the coronavirus has crossed 81.62 lakh and the death toll has topped 4.41 lakh.

Meanwhile, foreign institutional investors sold equities worth a net Rs 1,478.52 crore on Tuesday, provisional exchange data showed.

"After another day of indecisive trades, brought by the threat of escalation in border dispute with China, Indian benchmark indices ended slightly negative.

“The losses were mainly due to financial stocks.

"The major sectoral gainer was the auto sector, led by gains in Maruti.

“FIIs have also been net sellers in equity this week which have impacted the markets," said Vinod Nair, head of research at Geojit Financial Services.

BSE power, utilities, metal, finance, bankex, capital goods and FMCG indices shed up to 1.05 per cent, while telecom, auto, teck, consumer durables and realty rose up to 2.35 per cent.

Broader BSE mid-cap and small-cap indices outperformed the benchmarks, spurting up to 0.71 per cent.

Global equities were largely in the positive territory as investors focused on economic recovery, even as some regions reported fresh coronavirus cases.

Bourses in Shanghai, Hong Kong and Seoul ended higher, while Tokyo settled in the red.

International oil benchmark Brent crude futures slipped 0.83 per cent to $40.62 per barrel.

On the currency front, the rupee settled 4 paise higher at 76.16 against the US dollar.

© 2025

© 2025