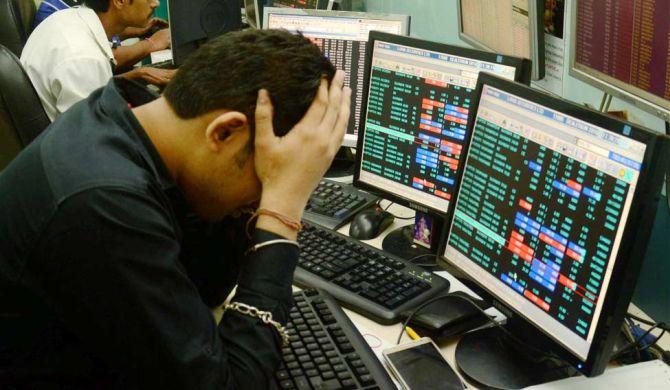

Equity benchmark index Sensex buckled under selling pressure for the second straight session to close below the 65k mark on Friday, as investors offloaded IT, teck and metal stocks amid a bearish global trend.

Besides, fresh foreign fund outflows also hit investor sentiments, traders said.

In a volatile trade, the 30-share BSE Sensex declined 202.36 points or 0.31 per cent to settle at 64,948.66.

During the day, it fell by 396.3 points or 0.60 per cent to 64,754.72.

The NSE Nifty dipped 55.10 points or 0.28 per cent to end at 19,310.15.

On a weekly basis, the BSE gauge fell 373.99 points or 0.57 per cent, and the Nifty declined 118.15 points or 0.60 per cent.

"It turned out to be a roller coaster ride on Friday as Nifty oscillated on both sides and ended lower.

"Meanwhile, majority of sectors felt the heat, wherein IT and realty were among the top losers.

"The broader indices too traded in sync and lost nearly half a per cent each.

"Fresh weakness in the US markets is largely weighing on the sentiment, however, the pace of decline is still capped," said Ajit Mishra, SVP - Technical Research, Religare Broking Ltd.

Tata Consultancy Services was the biggest laggard in the Sensex list, falling 2.14 per cent, followed by Tech Mahindra, Mahindra & Mahindra, Infosys, Power Grid, Wipro, Bajaj Finserv and Bajaj Finance.

In contrast, Reliance Industries, Maruti, Nestle, Axis Bank, Hindustan Unilever and Tata Motors were among the gainers.

In the broader market, the BSE midcap gauge declined 0.41 per cent, and smallcap index dipped 0.23 per cent.

"A sharp fall in tech-heavy Nasdaq triggered a sell-off in domestic IT stocks, while other sectors too came under selling pressure due to weak global cues," Amol Athawale, vice president - technical research, Kotak Securities Ltd, said.

Among the indices, IT fell by 1.46 per cent, teck declined by 1.26 per cent, metal (0.88 per cent), realty (0.73 per cent), telecommunication (0.62 per cent) and consumer durables (0.57 per cent).

Power, FMCG and utilities were the gainers.

"World equity markets, including India, are under the grip of a sharp rise in US bond yields, which has led to currency depreciation in China and other emerging markets.

"This has prompted investors to park their funds in safe haven dollar securities by exiting risky equity assets.

"The consolidation phase in local markets could continue for some more time as worries over further interest rate hikes in the US and other key economies coupled with higher inflation and slowing growth in China would curb appetite for equity as an asset class in the near term," Athawale said.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong ended in the negative territory.

Global oil benchmark Brent crude declined 0.46 per cent to $83.73 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,510.86 crore on Thursday after a day's breather, according to exchange data.

The BSE benchmark had declined 388.40 points or 0.59 per cent to settle at 65,151.02 on Thursday.

The Nifty slipped 99.75 points or 0.51 per cent to end at 19,365.25.

"With US Fed Chair Powell's speech and more macro data lined up globally next week, we expect domestic as well as global markets to remain under pressure.

"Also, RBI would release its meeting minutes on Thursday.

"However, action is likely to continue in the broader market along with sectorial rotation.

"Index heavyweight Reliance would be in focus as Jio Financial Services is set to be listed on Monday," Siddhartha Khemka, head - retail research, Motilal Oswal Financial Services Ltd, said.

© 2025

© 2025