The rupee is expected to trade in the 66-68 range against the US dollar in the next 12-18 months, with the Reserve Bank of India likely to manage the exchange rate proactively to stem excessive volatility from time to time, says Deutsche Bank.

The rupee is expected to trade in the 66-68 range against the US dollar in the next 12-18 months, with the Reserve Bank of India likely to manage the exchange rate proactively to stem excessive volatility from time to time, says Deutsche Bank.

"Indeed, the RBI has enough FX (forex) reserves in its coffer, $353 billion or about 9-10 months’ of import cover, to intervene decisively in the FX market, if need arises," said the bank in its Asia Economic Monthly report.

US interest rate normalisation policy, geopolitical uncertainty and risks of further yuan devaluation will likely keep global FX markets volatile next year, it said.

There is, however, one risk to rupee, though this is true for other EM currencies as well.

If China devalues its currency meaningfully next year, then there is a risk for rupee to depreciate to 68-70 against the dollar, it said.

"However, such a range shift in rupee would happen only with the explicit support of RBI, which in order to restore exchange rate competitiveness will likely not stand in the way of a sharper depreciation of the rupee,” said the bank.

It also highlighted the next fiscal year challenge.

"If growth momentum fails to pick up in Fiscal Year 2017, then it would become difficult for the authorities to continue with fiscal consolidation," said the bank.

At this point, there is hardly any traction on income tax collection, disinvestment continues to disappoint, and on the spending side it is not clear if the authorities can build on the savings generated from fuel subsidy reduction and cut subsidies on food and fertiliser.

"If the authorities are forced to cut back on capital spending to maintain budget consolidation, then growth will suffer," it warned.

"Fiscal weakness could therefore either translate into a wider deficit or poor growth," it added.

The ongoing drag on the financial sector could persist longer than expected, said Deutsche Bank.

The banking system, with 11 per cent of assets under stress, could see further NPLs due to weak growth, exports and earnings.

The private sector’s external debt burden, $189 billion, is considerable as well; as dollar funding costs rise and liquidity tightens around US Fed policy normalisation, debt service may become onerous for many Indian corporates, getting in the way of investment recovery, it said.

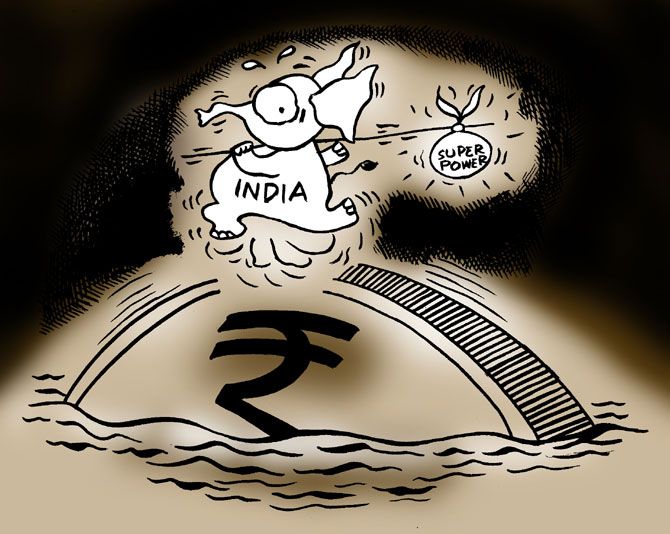

Illustration by Uttam Ghosh/Rediff.com

© 2025

© 2025