Analysts see the stock regain some of the lost ground over the next few weeks, but the overall market sentiment needs to improve for the counter to regain its lost glory.

Puneet Wadhwa reports.

This stock is one of the largest holdings (along with ONGC) of Christopher Wood, global head of equity strategy at Jefferies in his India long-only portfolio with a weight of 10 per cent.

And with a 6 per cent weight, the counter is also part of his Asia ex-Japan long-only thematic portfolio, next only to HDFC Bank that enjoys a similar weight in this portfolio.

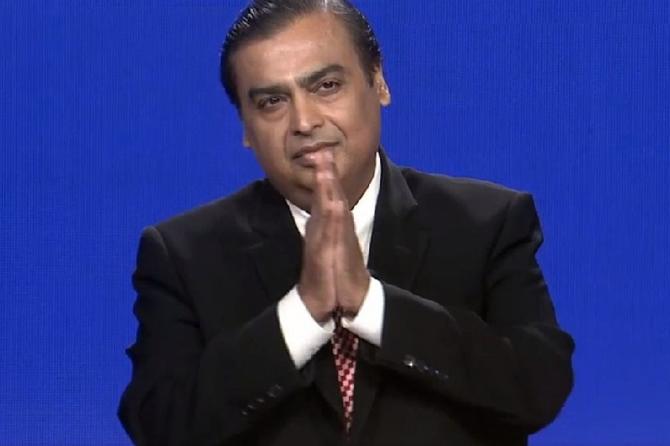

However, in the last few sessions, the stock of Mukesh Ambani–controlled Reliance Industries Limited (RIL), hit its 52-week low level of Rs 2269.75, and has been one of the worst performers among the Sensex pack thus far in calendar year 2023 (CY23).

Thus far in CY23, RIL has tanked nearly 11 per cent as compared to a fall of around 5 per cent in the S&P BSE Sensex.

The fall in the stock, according to Gaurang Shah, senior vice-president at Geojit Financial Services is mostly due to the overall dip in the market sentiment, which in turn has impacted large-caps, including RIL.

“The company is on a strong footing and the fall from the recent highs to the 52-week low level is due to the overall risk-off mode investors are in,” he explains.

Devarsh Vakil, deputy head of retail research at HDFC Securities, too, believes that there is nothing fundamentally wrong with the company.

“The fall in the stock could be driven by selling by foreign players in the backdrop of a risk-off sentiment as it is one of their core holdings.

"I am bullish on this counter and suggest investors use any dip to buy from a long-term perspective,” he said.

However, one possible reason for the fall in the stock, according to A K Prabhakar, head of research at IDBI Capital, is the rise in debt in the backdrop of RIL’s expansion plans at a time when the interest rates are rising.

According to a February 2023 Systematix Institutional Equities note, RIL’s capex may remain elevated over next few years, as it expects to invest $9 billion towards petchem expansion, $10 billion on new energy, Rs 880 billion on 5G spectrum, 5G roll out, and regular capex in all segments.

Overall, they forecast capex of Rs 1.4/Rs 1.3/Rs 1.4 trillion during FY23E/FY24E/FY25E, respectively.

“This may elevate RIL’s net debt to Rs 1.8 trillion by FY25E from Rs 1.4 trillion in FY23E.

"However, EBITDA/net debt would remain comfortable at 1x, with net debt to equity at 0.2x.

"Further, as RIL is committed to becoming a net carbon zero company by 2050, it may attract higher capex in future,” wrote Sudeep Anand and Prathmesh Kamath of Systematix in the note.

In a recent development, Competition Commission of India (CCI) has cleared RIL's Rs 2,850 crore acquisition of the Indian business of German retailer Metro AG.

This, analysts feel, will fortify the company's wholesale format and cement its position as the biggest player in India's retail industry.

In a separate move, Reliance Jio (RJio) took Bharti Airtel head-on with the proposed launch (starting March 22) of its postpaid plans starting from Rs 399.

These developments are positive for the company, analysts said, and could see the stock regain some of the lost ground over the next few weeks, but the overall market sentiment needs to improve for the counter to regain its lost glory.

Prabhakar, too, suggests that the stock can be bought on every decline and becomes a ‘screaming buy’ around the Rs 2,000 mark.

Historically, RIL has found support near its long-term mean levels of Rs 2,400 and has tested these levels only four times since 2017.

“We believe a sharp reversal is likely and the stock may move towards Rs 2,700 going ahead,” wrote analysts at ICICI Direct in a recent note.

© 2025

© 2025