| « Back to article | Print this article |

Reliance Industries chairman Mukesh Ambani's claim that Reliance Retail has become the largest food retailer in the country has left his competitors unimpressed.

Reliance Industries chairman Mukesh Ambani's claim that Reliance Retail has become the largest food retailer in the country has left his competitors unimpressed.

Reliance Retail, which started in 2006, runs over 1,000 stores across 86 cities.

Of this, over half (nearly 600) are supermarkets called Reliance Fresh which mainly sell food and grocery items.

The company also runs mini-hypermarkets and hypermarkets under the name Reliance Super and RelianceMart respectively. All the three formats are the in the value segment.

Other retailers in the food and grocery segment say Reliance may be the largest in terms of stores but not in revenues.

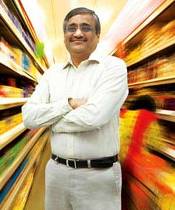

"You can check out the numbers to find out who is the largest. They might be large in terms of food and grocery store presence, but we are the largest in terms of revenues," says Kishore Biyani, chief executive of the Future Group.

According to Biyani, his revenues from food and grocery will be over Rs 3,200 crore (Rs 32 billion) in 2010-11 (the financial year for the group's flagship company Pantaloon, ends on June 30).

But that is only marginally more than the Rs 3,132-crore (Rs 31.32-billion) turnover of Reliance Retail.

A quick look at RIL's FY 2011 annual report reveals that Reliance Fresh has posted a turnover of Rs 2,513 crore (Rs 25.13 billion) during the last financial year, while Reliance Hypermart posted revenues of Rs 619 crore (Rs 6.19 billion).

While Reliance Retail's total loss was Rs 351 crore (Rs 3.51 billion) during the year, Reliance Fresh accounted for Rs 159.94 crore (Rs 1.59 billion) and Reliance Hypermart Rs 86.99 crore (Rs 869.9 million).

Comparative numbers for the Future Group's food and grocery business are not published.

According