After missing two self-imposed deadlines, billionaire Mukesh Ambani's Reliance Industries Ltd on Friday announced recalibration of a proposed $15 billion deal to sell 20 per cent stake in its oil refinery and petrochemical business to Saudi Aramco, saying the two firms have agreed to re-evaluate the proposed investment in light of the Indian firm's new energy forays.

The stake sale talks, which were first officially revealed in August 2019, are being reset in light of Reliance making forays into new energy business in recent months by investing $10 billion in alternative energy over three years.

To pivot to green energy, it has already bought a German maker of photovoltaic solar wafers and signed a deal with a Danish company to manufacture hydrogen electrolysers in India.

Aramco's proposed investment was only limited to oil refining and petrochemicals business but Reliance now has a burgeoning green energy business as well which requires a reset.

"Due to the evolving nature of Reliance's business portfolio, Reliance and Saudi Aramco have mutually determined that it would be beneficial for both parties to re-evaluate the proposed investment in O2C business in light of the changed context," the Indian firm said in a statement.

Consequently, the application Reliance had made to the NCLT for segregating the oil-to-chemical (O2C) business to allow for the stake sale, is being withdrawn.

The company, however, refrained from giving any new timelines for concluding any possible deal.

"Over the past two years, both the teams made significant efforts in the process of due diligence, despite Covid restrictions.

"This has been possible due to the mutual respect and long-standing relationship between the two organisations," the statement said.

The company said it has recently unveiled its plans for the new energy and materials businesses by announcing the development of Dhirubhai Ambani Green Energy Giga Complex at Jamnagar, which will comprise four giga-factories for making solar photovoltaic modules, energy storage factories, electrolyser for green hydrogen and fuel cell factory.

"The deep engagement over the last two years has given both Reliance and Saudi Aramco a greater understanding of each other, providing a platform for broader areas of cooperation.

"Saudi Aramco and Reliance are deeply committed to creating a win-win partnership and will make future disclosures as appropriate," the statement said.

Reliance said it shall continue to be Saudi Aramco's preferred partner for investments in the private sector in India and will collaborate with Aramco and SABIC for investments in Saudi Arabia.

"Saudi Aramco and Reliance have a very deep, strong and mutually beneficial relationship that has been developed and nurtured by both companies over the last 25 years.

"Both companies are committed to collaborate and work towards strengthening the relationship further in the years ahead," it added.

Ambani had in August 2019 announced talks for the sale of 20 per cent stake in the O2C business, which comprises its twin oil refineries at Jamnagar in Gujarat and petrochemical assets, to the world's largest oil exporter.

Making the announcement at the company's annual general meeting that year, he had hoped to conclude the deal by March 2020. But this was delayed for reasons not disclosed by either company.

Talks were revived this year and the two are reportedly discussing a cash and share deal -- Aramco paying for the stake with its shares initially and then staggered cash payments over several years.

In June this year, Reliance appointed Saudi Aramco chairman and head of the Kingdom's cash-rich wealth fund PIF, Yasir Othman Al-Rumayyan as an independent director on its board.

The appointment was said to be a precursor to the deal. Ambani had in the company's annual shareholder meeting on June 24, 2021, stated that he expected the "partnership" with Aramco "to be formalised in an expeditious manner during this year."

This does not look likely and the deal is now being reset.

Besides refineries and petrochemical plants, the O2C business also comprises a 51 per cent stake in the fuel retailing business.

It, however, does not include the upstream oil and gas producing assets such as the KG-D6 block in the Bay of Bengal.

A stake in Reliance's O2C business would give Aramco an entry into one of the world's fastest-growing fuel markets.

It would also give a ready-made market for 5 lakh barrels per day of its Arabian crude and offer a potentially bigger downstream role in the future.

Reliance had in 2019 put $75 billion as the value of the O2C business after signing a non-binding letter of intent with Saudi Aramco.

Aramco has an equity stake in China's largest O2C project at Zhejiang with a long-term crude supply agreement and a plan to build a network of retail outlets.

It also has a fuel retailing joint venture with Sinopec operating 1,000 retail outlets.

An investment in Reliance's O2C subsidiary could give Aramco a similar footprint -- a stake in India's largest O2C project with a long-term crude supply agreement and participation in fuel retailing via the Reliance-BP joint venture.

Over the past years, the oil-to-telecom conglomerate has segregated businesses into separate verticals -- Jio Platforms houses the company's digital and telecom unit, retail is a separate unit and oil refining and petrochemical segments have been carved into the O2C vertical to attract strategic partnerships.

The firm had recently announced carving out the O2C business as a separate subsidiary to support strategic partnerships and new investors in order to accelerate its new energy and material plans.

Aramco buying 20 per cent stake in the O2C business would allow Reliance to build financial muscle, as it carves out a space for itself in highly competitive omni-channel retail.

With the stake, Aramco would have a share in one of the world's best refineries and largest integrated petrochemical complex.

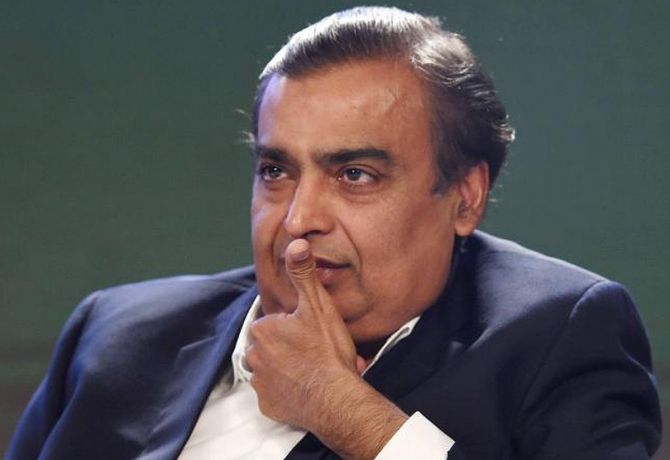

Photograph: PTI Photo

© 2025

© 2025