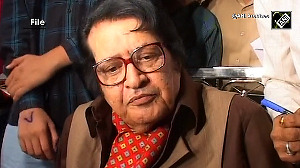

Vittaldas Leeladhar, 57, chairman and managing director of Union Bank of India, is set to be appointed as a deputy governor of the Reserve Bank of India.

Finance Minister P Chidambaram has already cleared the file and the Prime Minister's Office is expected to put its seal of approval any day.

"One can expect the government notification on Leeladhar's appointment soon," said a source in the know of the development.

Leeladhar will be the RBI's third deputy governor. The other two are Rakesh Mohan and KJ Udeshi.

The other contenders for the third deputy governor's post were S S Kohli, CMD of Punjab National Bank, PS Shenoy, CMD of Bank of Baroda and Dalbir Singh, CMD of Central Bank of India.

The RBI also recommended the name of its senior most executive director Shyamla Gopinath for the deputy governor's post in case the government wanted to appoint a fourth deputy governor.

Sources said Leeladhar will join soon and Gopinath could be considered at a later date.

By tradition, the deputy governors fall in three categories. If they are economists, they usually oversee monetary policy, economic research and exchange rate management.

Internal candidates normally supervise administration, currency management, rural and export credit while commercial bankers are put in charge of banking regulations and supervision.

Vepa Kamesam, a commercial banker turned deputy governor, retired last year. In a deviation from tradition, he was put in charge of administration, currency management, rural and export credit, etc. After his retirement, Rakesh Mohan (an economist) and Udeshi (an RBI insider) have been sharing Kamesam's portfolio.

Low profile and non-controversial, Leeladhar has quietly transformed a relatively small bank into the country's sixth largest public sector bank.

Union Bank's balance sheet has been growing by over 20 per cent every year since he took the bank's top job. During his tenure, the bank made its initial public offering.

© 2025

© 2025