'The effect will be seen two-three quarters down the line.'

Shreepad S Aute and Abhijit Lele report.

In a sign that borrowers might have to wait longer to enjoy the full benefit of 25 basis points cut by the Reserve Bank of India, the country's largest lender State Bank of India cut interest rates on home loans up to Rs 30 lakh by only 5 basis points.

Analysts say a sharper rate cut is not possible thanks to a slower growth of deposits.

'SBI has the highest market share of the home loans market and it is only appropriate that we empower the large lower and middle class segment by transmitting the rate cut announced by the RBI,' said SBI Chairman Rajnish Kumar.

SBI did not cut rates in other segments neither did it lower deposit rates.

In order to garner more deposits -- the key source of funding loan books -- banks are unlikely to cut deposit rates.

This will also restrain lending rates from going down, which are currently mapped on the marginal cost of funds-based lending rate (MCLR), which mainly comprises deposit rates for banks.

"Banks may not reduce deposit rates despite the rate cut due to high credit-deposit ratio. The interest rate on bank deposits and the tax rates are unattractive as compared to other investment avenues such as small savings, mutual funds and equities, which has impacted growth of bank deposits," said Madan Sabnavis, chief economist, CARE Ratings.

This will also confine softening of lending rates, he added.

The liquidity crunch at the non-banking financial companies (NBFCs), including housing finance firms, has paved the way for the banking sector to propel their loan book base.

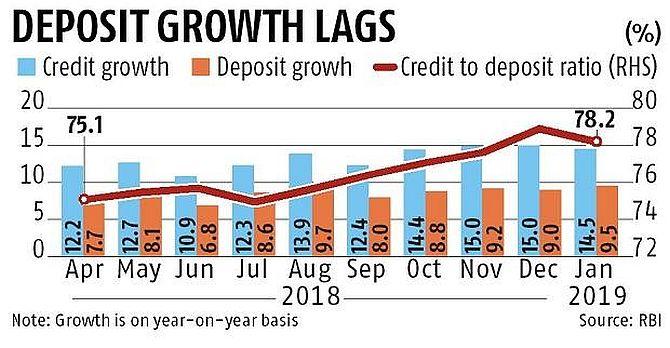

However, bank deposits are growing at a comparatively slower pace.

Even the RBI's data shows that after the Infrastructure Leasing & Financial Services saga in September, banking credit has been continuously rising by 14% to 15% from October 2018 onwards.

This pushed credit to deposit ratio of banks to the highest level of 79% in December last year.

The credit-to-deposit ratio helps assess a bank's liquidity by comparing total advances to total deposits as on a particular day -- a high number suggests banks may need to improve the denominator or deposits.

The situation is unlikely to change immediately.

CRISIL estimates a 13% to 14% average growth in India's banking advances between FY19 and FY20, significantly faster than the 8% seen in FY18, which would force a change in the deposit mobilisation plans of banks over the medium term.

In fact, some private banks have recently raised deposit rates.

The RBI and the government have introduced measures to improve liquidity by the reduction in statutory liquidity ratio, reduction in risk-weight on loans to the NBFCs, direct fund infusion in PSU banks and open market operations.

However, these will bring limited respite, and deposits remain the main source of funds.

According to CRISIL, of the total expected fund requirement of Rs 25 trillion, 80% would need to be raised through bank deposits.

Sabnavis also believes that the government's announcement of no TDS for up to Rs 40,000 interest on deposits from Rs 10,000 will not support deposit growth much as customers will have to pay tax at the time of tax filing.

However, the top management at some banks see transfer of partial benefits to customers.

SBI's Kumar said banks may look at revising home loan rates.

"But it would be tough to change deposit rates for now," he said.

"The effect will be seen two-three quarters down the line," Karnam Sekar, managing director and chief executive, Dena Bank, said. "Banks may not pass on full quantum (25 basis points), but rates (lending and deposits) will come down by about 10 to 15 points."

"There may not be change in rates till March 31."

© 2025

© 2025