A staunch defender of demonetisation, it would be interesting to see how he handles the government’s increasing demand for more cash from the RBI, and letting some weak banks get out of prompt corrective action.

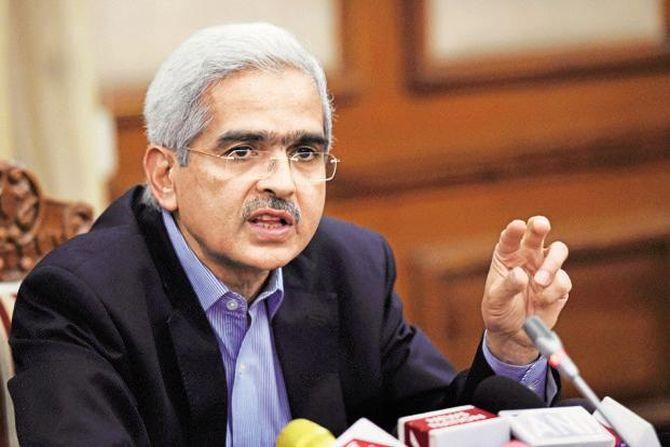

Shaktikanta Das, the Reserve Bank of India’s (RBI’s) 25th governor, will have to deal with issues that need to be sorted out immediately in order to create a bridge between the government and the central bank.

A staunch defender of demonetisation, it would be interesting to see how he handles the government’s increasing demand for more cash from the RBI, and letting some weak banks get out of prompt corrective action (PCA).

Also, the government favours a special liquidity line for the non-banking financial sector, which the RBI has resisted so far.

The government wants the RBI to soften the strict one-day default norm, especially in the case of power sector loans.

There is also demand that the RBI soften its hawkish stance and let rates fall to give a fillip to growth, especially now that the central bank itself expects the inflation rate to fall below its target rate of 4 per cent or stay in the vicinity of 4 per cent in the next one year.

And then, analysts would be closely watching the fight for the RBI’s autonomy.

The RBI’s history is replete with government administrators joining the central bank and turning fierce advocates of its autonomy.

In recent memory, Bimal Jalan, Y V Reddy, and D Subbarao were in government before becoming RBI governor and held the RBI’s ground against all onslaughts.

Das is expected to take that legacy forward.

Economists say the RBI governor need not be an economist, especially because one deputy governor is always an economist.

In Das’ case, the economist in charge of monetary policy department will be Viral Acharya.

The governor is part of the six-member Monetary Policy Committee (MPC), with three external members being noted economists, to decide on the policy rate.

In this context, the immediate challenges before Das are the following:

PCA framework

The PCA framework is not new, but under Urjit Patel, it became stricter.

Now 12 banks, 11 government-owned and one private, are going through PCA, under which a bank is not allowed to lend or take deposits like before.

The government wants the RBI to loosen some of the criteria so that some banks can come out of it and resume lending like earlier.

In the November 19 board meet, it was decided that the RBI’s Board for Financial Supervision (BFS) will take a call on the matter.

Economic capital framework (ECF)

The framework will examine how the RBI’s reserves will be treated and how much the RBI can transfer to the government every year in addition to the dividend it pays.

In the November 19 board meet, it was clear that the past reserves of the central bank would not be touched.

According to the government, most central banks keep 13-14 per cent of their assets as reserves, but in the case of the RBI, it is 27 per cent.

Therefore, the implicit demand was to have a reserve transfer of Rs 3-4 trillion.

There was a lengthy discussion about it, but RBI officials prevailed.

In the December 14 board meeting, Das will have to carry forward RBI’s agenda if the topic comes up again.

Special liquidity line for NBFCs

RBI officials, including most recently its Deputy Governor Viral Acharya, have clarified that even as the central bank is the lender of last resort, it would prefer to provide system-wide liquidity rather than focusing on a single company.

Non-bank financial companies (NBFCs) provide roughly one-fourth of the loans in the economy and tightness in liquidity in the segment translates into a credit squeeze.

The government wants to avoid that, and will prod the new governor to institute a mechanism to ensure that the NBFC sector receives adequate liquidity.

One-day default norms

The RBI’s February 12 circular has rattled the corporate sector and it has made a pitch before the government to ease the rules.

The government wanted the RBI to go slow on at least the power sector, but it steadfastly refused to do so.

The central bank did not even send its representative to the Cabinet Committee on Power Sector loans.

It will be interesting to see if the RBI under Das softens the one-day default norm, which says banks can start recovery if a company delays servicing its loans after 90 days.

Softer rates

Though the new governor will not have much say in this because the MPC decides the rates, Das, being governor, can persuade the MPC members to vote in favour of a cut, which the government wants.

At least, the policy stance can be changed back to “neutral” from “calibrated tightening” to signal to the markets that the central bank is ready for cuts at a time when the inflation rate is expected to fall below 3 per cent whereas growth fell to 7.1 per cent in the September quarter from 8.2 per cent in June.

Photograph: PTI Photo

© 2025

© 2025