Reserve Bank of India Governor D Subbarao on Tuesday said the central bank needed more powers before it could firm up the final guidelines on new bank licences.

Reserve Bank of India Governor D Subbarao on Tuesday said the central bank needed more powers before it could firm up the final guidelines on new bank licences.

He added the finance ministry was considering how RBI could be given these powers without amending the Banking Regulation Act.

Subbarao said an amendment to the Act was pending.

The amendment would give RBI the powers and dispensation necessary to deal with companies that entered the banking sector.

RBI needed powers to supersede the board, to authorise the acquisition of shares beyond five per cent, as well as powers for consolidated supervision, Subbarao said, adding, "All those things are necessary."

At his meeting with RBI officials early this month, Finance Minister P Chidambaram had asked whether the banking regulator could be given these powers without an amendment to the banking Act.

"He (the finance minister) had asked us whether it could be done without amending the Banking Regulation Act. We could not offer an informed response because we believe we need those powers to move forward," Subbarao said, after announcing the review of monetary policy for the second quarter.

He added the central bank was yet to receive any formal communication from the government on whether it could be empowered without an amendment to the Act.

During his visit to Mumbai, the finance minister had discussed the issue with RBI officials.

"We have discussed this with RBI and it has agreed to take the process forward.

Meanwhile, I have assured RBI we will do our best to get the amendment Bill passed in the winter session of Parliament," Chidambaram had said.

In August 2011, RBI had issued draft guidelines on new bank licences.

A year later, it released the highlights of comments and feedback received on the draft norms.

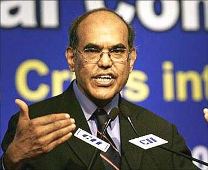

Image: D Subbarao

© 2025

© 2025