Softening his stance on the Pradhan Mantri Jan Dhan Yojana, Reserve Bank of India Governor Raghuram Rajan on Tuesday said he is not worried about the quality of KYC for opening new accounts and welcomed the financial inclusion scheme.

"We welcome the Jan Dhan Yojana, it is part of RBI's plan to get universal access," he told a press conference called for announcing bi-monthly monetary policy.

"I am not as worried about the quality of KYC for small accounts. In fact, we have essentially allowed for KYC that can be upgraded over time and in fact we have been more liberal on KYC," Rajan added.

The RBI Governor had earlier cautioned the banks on the risks involved in just hunting for numbers, asking them not to compromise on core objectives of the programme.

"When we roll out the scheme, we have to make sure it does not go off the track.

“The target is universality, not just speed and numbers," Rajan had said while addressing bankers a fortnight ago.

However, on Tuesday Rajan said he wanted a proper inclusion of unbanked households into the banking system.

"What I am more concerned about is that we actually achieve proper inclusion by bringing in households that were not reached in past. . . “We are working with the government to try and make this dream a possibility," Rajan said.

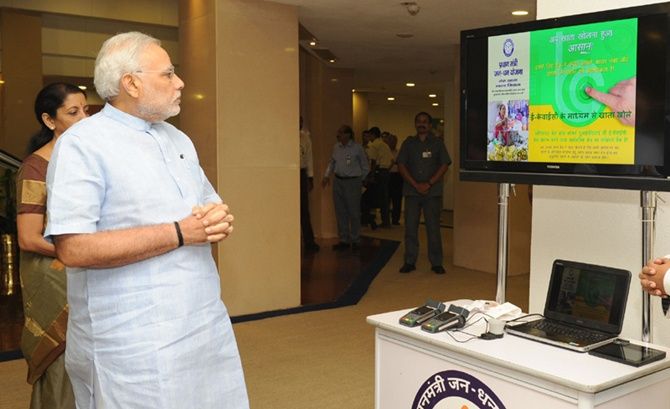

Jan Dhan Yojana was launched with great fanfare by Prime Minister Narendra Modi in August to bring 7.5 crore (75 million) more families into the banking network by January 26, 2015.

So far, over 5.1 crore (51 million) accounts have been opened and Rs 3,600 crore (Rs 36 billion) deposited in banks.

Under the financial inclusion scheme, each Jan Dhan account comes with Rs 5,000 overdraft facility, a Rs 100,000 accident cover, and a RuPay debit card.

A person who does not have officially valid documents or Aadhaar numbers can open Jan Dhan bank accounts by submitting two copies of signed photographs at a bank branch.

However, it said these accounts will be called small accounts and shall normally be valid for 12 months and shall be continued subject to showing of proof that he/she has applied for any of the officially valid document within 12 months of opening of such 'Small Account'.

These accounts have certain limitations such as balance at any point of time should not exceed Rs 50,000, total credit in one year should not exceed Rs 100,000, and total withdrawal should not exceed Rs 10,000 in a month.

Rajan said the Payments bank and Small banks for which RBI is in the process of finalising guidelines, will help in promoting financial inclusion.

The Jan Dhan accounts will be linked to the Direct Benefit Transfer scheme, he said, adding, ‘let us keep the broader aim in mind and work towards achieving universal access’.

.jpg)

© 2025

© 2025