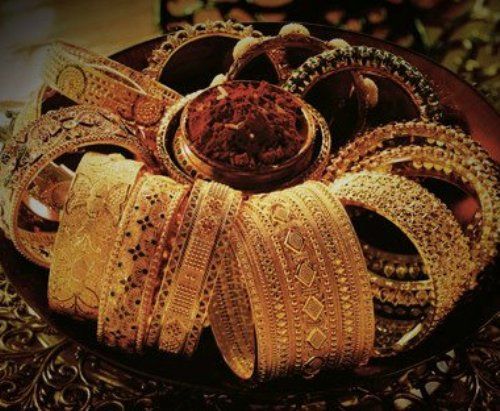

The total jewellery demand was up by 60 per cent at 182.9 tonnes as against 114.5 tonnes in the same period last year.

India's gold demand during July-September quarter this year shot up by 39 per cent to 225.1 tonnes against the overall third quarter demand in 2013 on rise in jewellery sales, says a World Gold Council report.

The overall third quarter demand in the country for 2013 stood at 161.6 tonnes, WGC Gold Demand Trends report showed.

Gold demand during the period in terms of value rose by 31 per cent to Rs 56,219.3 crore (Rs 562.19 billion) as compared to Rs 42,829.6 crore (Rs 428.29 billion) in the third quarter of 2013.

Similarly, the total jewellery demand was up by 60 per cent at 182.9 tonnes as against 114.5 tonnes in the same period last year.

The value of jewellery demand surged by 51 per cent to Rs 45,681.6 crore (Rs 456.81 billion) from Rs 30,346.5 crore (Rs 303.46 billion) in the third quarter of 2013.

"The rise in demand for gold jewellery during third quarter of 2014 reflects the unusual low base of third quarter of 2013 that was impacted by the introduction of a range of duty increases and restrictions.

"The third quarter can be viewed as normal for gold demand in spite of the unfulfilled expectations of a duty cut and policy relaxations from the new government," WGC managing director (India) Somasundaram PR told PTI in Mumbai.

He further said that demand around Diwali reflected the general optimism seen in the country.

"It is now beyond debate that import restrictions have had little impact on demand for gold and yet have strengthened the unauthorised supply channels and seems at odds with the overall sentiment that defines the new government's business approach," he added.

In the long-term, sources of demand -- jewellery, investment, central banks and technology - remain robust and diverse, Grubb added.

Central banks bought 93 tonne of gold in Q3 2014, (compared to 101.5 tonne in the same period last year) the 15th consecutive quarter that banks were net purchasers of gold.

In the entire year till the third quarter, central banks have bought 335 tonne of gold compared to 324 tonne in the same period last year.

This is due to continued diversification away from the US dollar and in the backdrop of ongoing geopolitical tensions.

People around the world buy gold for different reasons at different times, reinforcing the unique self balancing nature of the gold market.

"With recycling at a seven year low and mine supply looking increasingly likely to be constrained in the future, outlook for physical gold demand remains strong," Grubb said.

During the quarter, the total supply fell by 7 per cent year-on-year to 1,048 tonne from 1,128.6 in the corresponding quarter of last year.

Recycling of gold also continued to abate, declining 25 per cent to 250 tonne compared to 333.7 tonne in the same quarter last year, the report added.

© 2025

© 2025