Chandra Shekhar Ghosh, chairman and managing director of the upcoming bank, would do well to answer one simple question: 'After me, who?'

Chandra Shekhar Ghosh started Bandhan in 2001 with just two employees, one branch office and capital worth Rs 2 lakh.

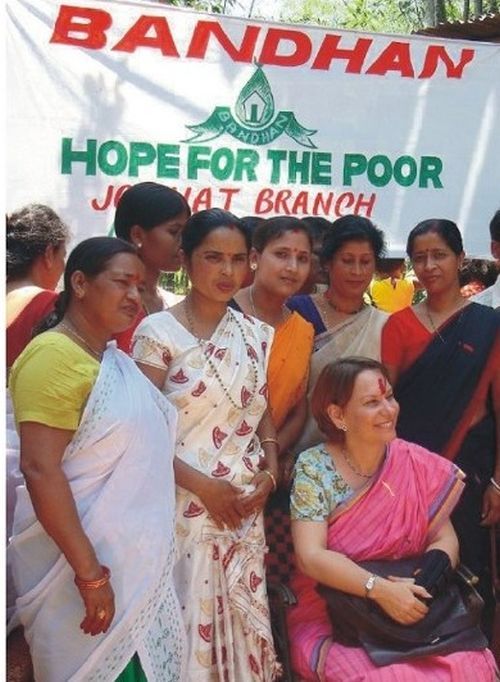

Thirteen years later, Ghosh's baby has grown really fast - it is present in 22 states, has over 2,000 branches catering to 5.9 million women borrowers and a loan book of Rs 6,500 crore.

Bandhan's crowning glory, of course, was in April this year when it became one of the youngest entities to be allowed to enter the banking space.

India's biggest microfinance institution has also shown how financial inclusion can be a profitable business - reasons why Ghosh evokes a deep sense of loyalty and even reverence among his colleagues.

All this is one man's dream and his execution. But as Ghosh - now in his mid-fifties - plans his next big-league moves on launching the bank, he would do well to answer one simple question: "After me, who?"

Let's face it. Do we know anyone in Bandhan beyond Ghosh, who is the chairman and managing director (CMD)?

The answer will be an obvious one: no.

Take a look at the list of the senior management team mentioned on the Bandhan website.

There are 26 names and at the very top are Ghosh, one "administrator", three "advisors" and the company secretary.

The rest of the team includes 10 assistant general managers, two deputy general managers and two general managers.

Frequent visitors to the eighth floor of Bandhan's headquarters say two cabins next to the CMD's office are ready to welcome the new executive directors.

Though nobody seems to know who these lucky gentlemen or ladies will be.

The moot point is simple: Ghosh has to act fast on a succession plan and prepare the second line of defence to avoid uncomfortable questions later on.

This is all the more important since Bandhan needs to go for public listing within three years of starting the bank.

So the process has to start now.

Many would argue that this is nothing typical of Bandhan - India Inc, in general, hasn't cared much about succession planning.

Research by Bain & Company found that only one in five board members in Indian companies were ever involved in talks about a CEO's succession and little effort was made at the board level to groom top leadership. Consider the case of Crisil, a subsidiary of Standard & Poor's.

It's almost two months now since Roopa Kudva stepped down as managing director and chief operating officer, but India's largest rating agency has still not named her successor.

Bandhan's supporters could also argue whether anyone knew much about others, except Deepak Parekh, in HDFC?

After all, Keki Mistry came into the limelight only recently. Ditto for HDFC Bank.

It was all about Aditya Puri till a few months back when Paresh Sukhtankar, now deputy CEO, started coming to the fore.

The argument against such logic will be that unlike Bandhan, which has been a complete one-man show, the HDFC group has been in the business long enough and is backed by a strong institutional framework, which has the bandwidth to take care of succession issues.

In any case, Ghosh could take lessons from the best professionally managed companies all over the world that always groom the CEO successors well in advance.

For example, when he was the GE supremo, Jack Welch identified his talent pipeline by individually meeting with potential successors and asking them - if we were in a plane and crashed, who do you think should lead the company?

This made them nominate other individuals from their peer group and was an effective way to gauge what the individuals felt about the senior leadership of the company.

Welch was trying to practise what human resources experts call a drop-dead succession plan. In other words, what happens if something unfortunate happens to the CEO?

Although a succession plan may be an uncomfortable topic, Ghosh surely knows this is a serious issue that must be discussed and planned in advance to avoid trauma to the organisation whenever a transition takes place at the top.

© 2025

© 2025