The valuations are reasonable, say observers, and the outlook for most of the fundamentals is looking up, for a variety of reasons.

The valuations are reasonable, say observers, and the outlook for most of the fundamentals is looking up, for a variety of reasons.

The coming auction of blocks will also result in better price discovery for the cash-rich firm.

The central government’s proposal to sell up to 10 per cent equity in Coal India through an Offer For Sale (OFS) on Friday is an opportunity for investors to buy a cash-rich monopoly in a higher margin business.

While only a fifth of the 632 million shares on offer (including the over-allotment option) are reserved for retail investors, the discount (typically provided by government in public sector offers) of five per cent for successful retail bids makes the offer attractive.

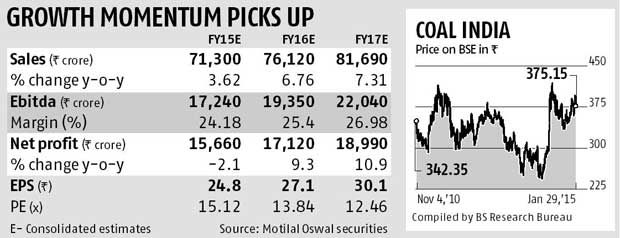

If the floor price of Rs 358 is taken as the one for allotment, retail investors would get the shares at Rs 340.10 or 12.5 times the company’s FY16 and 11.3 times the FY17 estimated earnings, a reasonable valuation.

As the stock fell 2.3 per cent on Thursday on news of the OFS to close at Rs 375.15, the floor price is at a discount of 4.6 per cent for the bigger investors and a steeper 9.3 per cent for retail investors.

Analysts at Nomura say at Rs 358, the valuations are not stretched (FY16 price to earnings ratio at 10.35 times the normalised earnings per share of Rs 34.6 and the FY16 normalised ratio of enterprise value to operating earnings at slightly more than 6.8 times).

A poll by Bloomberg since the start of 2015 has 11 of 19 analysts giving a ‘buy’ or ‘accumulate’ rating on the stock. The average one-year target price is Rs 392.

Even if the bids are slightly higher than the floor price, given the healthy demand, there is potential for gain.

Notably, after the OFS, the lingering overhang on Coal India’s stock will be over and focus will shift to the fundamentals. Namely, volume growth, e-auction volumes, fuel supply agreements, price increases, etc. The outlook for most of these is looking up or expected to improve.

For the first nine months of 2014-15, while production at 353.5 million tonnes (mt) was up 7.3 per cent year-on-year, it is also 97 per cent of the targeted production. Sales volumes have been lagging — at 354.6 mt, the offtake has grown only 3.8 per cent, about 94 per cent of the target.

In this backdrop, one might not see strong improvement in overall and e-auction volumes during the December quarter or in 2014-15.

In this backdrop, one might not see strong improvement in overall and e-auction volumes during the December quarter or in 2014-15.

Importantly, though, the government is showing commitment to remove bottlenecks. Hence, the medium to long-term prospects remain strong.

The offtake volumes have been impacted due to infrastructure bottlenecks and once the railway sidings and rake availability is in place, volume growth will improve.

On output, with environmental clearances, the existing and new mines can easily drive output, as Coal India has the largest reserves in the world (estimated at over 60 billion tonnes).

The government also has plans for pushing production to a billion tonnes by FY20. It is also targeting to build three trunk rail links by calendar year 2017, enabling smooth movement from mines to places of consumption.

Analysts at Nomura feel there is room to raise linkage coal prices, as blended realisation is 35-45 per cent below the gross calorific value-adjusted comparable CIF (cost, insurance and freight) prices.

The analysts also believe the coming block auctions will enable price discovery of CIL’s resources.

With production going up, the e-auction volumes, a concern in the recent past, will also improve.

As the company is under compulsion to supply coal to power plants on a priority, the e-auction volumes have come under pressure. These auctions garner higher prices and, hence, higher sales will boost revenue and profitability.

Lower diesel prices will also act positively on the margins. Further, the company is cash-rich and has healthy free cash flows (after capital expenditure), with a history of good dividend payouts. All these add to advantages for investors.

© 2025

© 2025