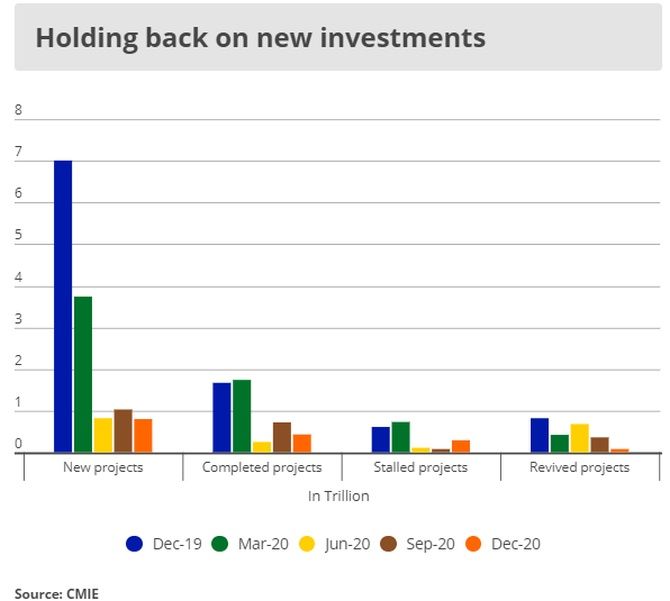

While there were Rs 7.01 trillion worth of new assets in December 2019, this fell 88.6 per cent to Rs 80,000 crore for the three months ending December 2020, shows data from project tracker Centre for Monitoring Indian Economy (CMIE), reports Sachin P Mampatta.

New projects involving setting up of factories, buildings and other assets fell to their lowest levels since the Coronavirus (Covid-19) pandemic began.

While there were Rs 7.01 trillion worth of new assets in December 2019, this fell 88.6 per cent to Rs 80,000 crore for the three months ending December 2020, shows data from project tracker Centre for Monitoring Indian Economy (CMIE).

Money spent on creating new assets like manufacturing plants is called capital expenditure and can be a key driver of economic growth.

Companies typically invest in setting up additional manufacturing or production capacity when they anticipate that their existing capacity will not be able to keep up with demand. The spread of the Covid-19 pandemic hit demand sharply, shows official data.

Capacity utilisation fell to less than 50 per cent according to the Reserve Bank of India in its Order Books, Inventories and Capacity Utilisation Survey (OBICUS) for Q1FY21 released in October. The data is released with a lag.

“At the aggregate level, capacity utilisation (CU) fell sharply from 69.9 per cent in Q4FY20 to 47.3 per cent in Q1FY21, as domestic economic activity was impacted severely by the lockdown imposed during the quarter to contain the spread of the Covid-19 pandemic. Seasonally adjusted CU also declined to 48.2 per cent in Q1FY21 from 68.2 per cent in the previous quarter,” it said.

Companies have less incentive to invest in new assets when the existing ones aren't being fully utilised.

Completed projects are down 74.3 per cent to Rs 43,000 crore. Stalled projects are down 52.5 per cent to Rs 29,000 crore.

Revived projects fell 90.2 per cent to Rs 8,000 crore.

There could be a selective revival in certain parts, according to a Edelweiss Securities Economy report.

“We foresee the capex landscape (marred for past 10 years) perking up in select pockets amidst global reflation.

"Among key categories–government capex, corporate tradeable (manufacturing), corporate non-tradeable (services), housing and others–we expect good traction in manufacturing capex (tail-lifted by exports) and pockets of real estate (upper income, metros) helped by lower rates,” said authors Kapil Gupta, Prateek Parekh and Padmavati Udecha.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025