This provision is a very smart rule against fraudster and would not affect any genuine business entities or Ease of Doing Business in any manner, said a source.

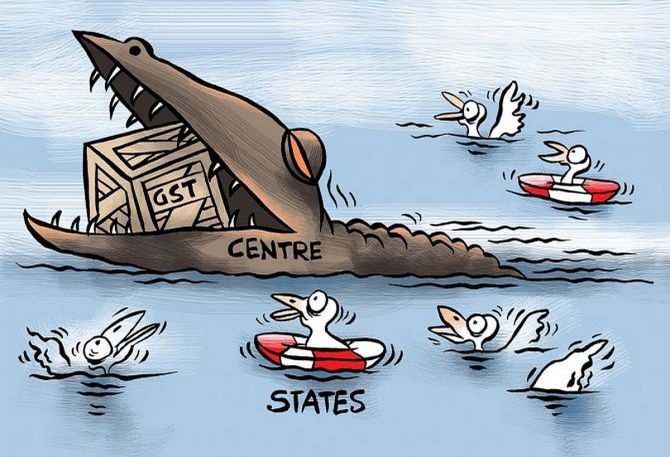

The finance ministry defended the recent move of asking companies above a threshold to pay at least one per cent tax liability through cash under the goods and services tax system, on the grounds that it will impact only risky or fly-by-night operators.

Earlier a section of traders cried foul over the new rule, saying it would apply to just 40,000-45,000 taxpayers, representing 0.37 per cent of the total GST base.

Last week, the Central Board of Indirect Taxes and Customs (CBIC) had inserted a rule under the Central GST Act that businesses with monthly turnover of over Rs 50 lakh will have to mandatorily pay at least one per cent of their GST liability in cash. The rule will become effective on January 1.

Reacting to the rule, trader body CAIT wrote to finance minister Nirmala Sitharaman to defer its implementation.

Finance ministry sources in the know of the matter explained that the new provision applies to those whose annual turnover is more than Rs 6 crore and large number of exemptions and exclusions have been provided.

For instance, they said this rule is not applicable in the cases where the registered person deposited more than Rs 1 lakh as income tax in each of the last two years.

Also, if registered person has received a refund of more than Rs 1 lakh in the preceding financial year on account of export or inverted tax structure, he does not come under the ambit of this rule.

Besides, this rule is not applicable to the government departments, public sector undertakings and local authorities.

Further, all small businesses including MSMEs and composition dealers have been excluded from the rule.

After all exclusions, the rule would apply to only 40,000-45,000 taxpayers, the sources said adding this would be around 0.37 per cent of the total GST tax base of 10.2 million.

Explaining the raison d’etre of introducing this rule, a highly placed source said that a legitimate business runs for profit and a minimum value addition is expected from them.

It is only where a lot of fake credit is used that no tax payment in cash is made.

Further, dummy companies which generate fake ITC or are used to be a layer in multi-layer fake credit flow pays no tax in cash.

“This provision is a very smart rule against fraudster and would not affect any genuine business entities or Ease of Doing Business in any manner,” he said.

Sources said that the new measures provided in the recent notification are very diligently and selectively designed after thorough discussions in the law committee of the GST Council over a month to pin-pointedly identify and control only fake invoices and ITC fraudsters.

The seriousness of this menace to GST ecosystem may even be understood by the fact that in the recent nationwide drive against GST fake invoice frauds that was launched in the second week of November and still going on, has resulted in the arrest of more than 175 fraudsters and more than 1800 cases are booked against 8000 fake entities in just 40-45 days, sources said.

© 2025

© 2025