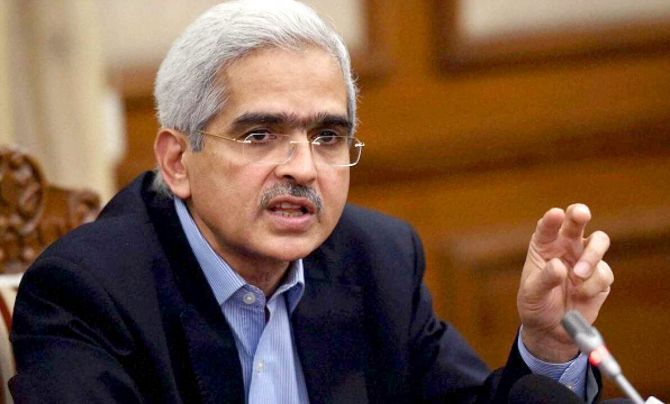

Reserve Bank of India (RBI) Governor Shaktikanta Das had stumped the market in the previous two policies — in August and in October — first with action and then with words.

In August, it was the introduction of an incremental cash reserve ratio (I-CRR) to take out excess liquidity, which took the markets by surprise.

In October, there was no action. Rather, what is known as “open mouth operation”, Das’ comment that the central bank might conduct open market operations (OMOs) by selling bonds tempered the euphoria in the bond markets after JP Morgan’s inclusion of India in its Emerging Market Bond Index.

No such OMOs were conducted by the central bank since the October policy.

“The RBI had surprised the markets in its October policy by indicating the possibility of OMO (via auction) as a liquidity-absorbing tool.

"Since then, the RBI hasn’t conducted any OMO sales via auction and the pace of screen-based OMO sales has slowed.

"Indeed, since November 2, there have been no OMO screen-based sales,” said Gaura Sen Gupta, economist with IDFC First Bank.

Rahul Bajoria, managing director and head of emerging markets, Asia (ex-China), economics, Barclays, said: “The chances of incremental tightening of liquidity appear relatively low because the cost of liquidity and short-end rates are fairly high, and I don’t think the RBI’s intention is to slow the economy.

"But it may want to modulate economic growth to prevent any overheating risks.

"Even the action on managing risk weights is to control the quality of credit disbursement and not necessarily to reduce credit growth materially.”

“In the midst of falling core inflation, steps to reduce economic momentum are difficult to envisage,” Bajoria added.

Is there another surprise up Das’ sleeve?

The RBI has maintained a hawkish tone in the previous two policy reviews, and those steps were to further reinforce the point that it was not dropping its guard on inflation anytime soon.

India’s headline retail inflation rate — the main yardstick for the RBI’s policy making — fell to 4.87 per cent in October.

However, the consumer price index (CPI) rate could hit the upper tolerance limit of 6 per cent in November and December.

“We estimate that the CPI inflation rate rose above the RBI’s tolerance limit of 6 per cent in November, driven higher by elevated prices of vegetables and pulses.

"Still, likely stable core inflation and robust growth momentum suggest no rate moves in either direction at the MPC (Monetary Policy Committee) meeting later this week,” wrote economists at Barclays Bank.

Indeed there is an agreement among market participants that the central bank will maintain the status quo once again.

According to Madhavi Arora, lead economist at Emkay Global, a benign global narrative, a tighter system liquidity, and easing core inflation despite stronger growth will be the backdrop of the upcoming MPC meeting.

This reduces the need to conduct OMO sales.

Banking-system liquidity moved to surplus in the first few days of December — after a month — due to government spending though it could become tighter later.

“The policy focus then reverts to the domestic narrative, wherein the resurgence of food inflation and slow policy transmission will be the key.

"We expect the RBI to softly prod banks to nudge up SA [savings accounts] rates while ruling out any explicit policy directive to re-regulate such rates,” Arora said.

After increasing the policy rates by 250 basis points between May 2022 and February 2023, the six-member rate-setting policy maintained the status quo in the previous four review meetings.

There is a consensus that the RBI will maintain the status quo for the fifth time and most market participants say the stance — withdrawal of accommodation — will be maintained.

“We are expecting the status quo from the policy on the rates and stance.

"With a raft of recent surprise measures, we are not anticipating any major changes in this meeting,” said Aditi Nayar, chief economist, ICRA.

© 2025

© 2025