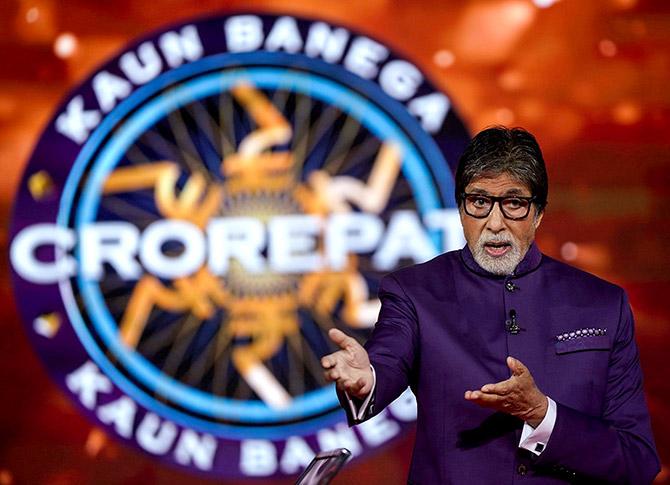

As many as 97,689 people had more than Rs 1 crore gross income in 2018-19 AY against 81,344 in the previous year, shows official direct tax data.

There were 16,345 more crorepatis in the 2018-19 assessment year (AY) in the country compared to the previous year, showed official direct tax data.

However, their proportion to total tax filers remained stagnant at 0.17 per cent in both the years, revealed the time series data released by the Central Board of Direct Taxes.

As many as 97,689 people had more than Rs 1 crore gross income in 2018-19 AY against 81,344 in the previous year. But then, total return filers also rose to 55.3 million in AY19 from 46.6 million in AY18.

However, income inequality remained stark as over 99 per cent of the return filers earned up to Rs 10 lakh.

Around 13.9 per cent of the return filers earned up to Rs 2.5 lakh, which is a threshold for income tax.

There may be more people who come under the threshold since taxes take taxable income for consideration after various deductions.

More than 60 per cent of those filing taxes earn gross income up to Rs 5 lakh in AY19.

If this number remains the same for AY21, tax payers may also not be filing any taxes due to rebates given in the Budget.

Since that rebate is for taxable income up to Rs 5 lakh, those earning up to Rs 10 lakh may not draw any tax if they do proper tax planning. There were 89 per cent of the return filers earning up to Rs 10 lakh in AY19.

There was 10 per cent surcharge on those earning more than Rs 50 lakh and up to Rs 1 crore in AY19. In this category, there were 209,345 return filers, constituting 0.4 per cent of the total. Also, there were 0.17 per cent of those filing returns in AY19 who paid 15 per cent surcharge. This levy was imposed on those earning more than Rs 1 crore that year.

© 2025

© 2025