The multi-billion dollar three-way deal of Novartis with GlaxoSmithKline (GSK) and Eli Lilly is likely to trigger merger control approvals from various anti-trust authorities, including a scrutiny by Competition Commission of India (CCI), industry officials and competition law experts said.

The multi-billion dollar three-way deal of Novartis with GlaxoSmithKline (GSK) and Eli Lilly is likely to trigger merger control approvals from various anti-trust authorities, including a scrutiny by Competition Commission of India (CCI), industry officials and competition law experts said.

The global deal entails some key business segments such as oncology, vaccines, over the counter products and animal health.

While all the companies have significant presence in most of these segments, including in India, it is likely that some of their interests might overlap after the deal, impacting competition in the market.

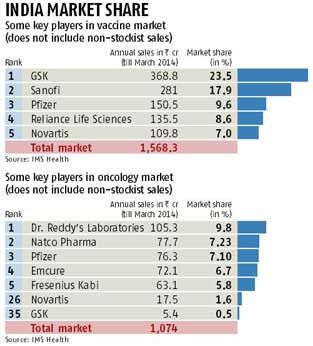

For instance, GSK, now the top entity in the domestic vaccine market with around 23.5 per cent share, would further consolidate its position in the segment, after acquiring vaccines from the Swiss drug major’s portfolio. This also assumes significance because the Indian pharmaceutical market is highly fragmented and an increase in the product portfolio would immediately reflect in market share.

According to a GSK spokesperson, the company would secure from Novartis brands like Bexsero, a new vaccine for the prevention of meningitis-B, and a meningitis ‘ABCWY’ combination vaccine being developed.

According to data recorded by IMS Health, a leading market research agency in the health care segment, GSK clocked annual sales in the vaccine segment of Rs 368.8 crore (Rs 3.68 billion) of the domestic market during the year ended March.

Novartis, generated Rs 110 crore ( Rs 1.10 billion) in the same period. However, this data reflect only sales through stockists; in oncology and vaccines, a lot of sales is generated through non-stockist routes.

Novartis, generated Rs 110 crore ( Rs 1.10 billion) in the same period. However, this data reflect only sales through stockists; in oncology and vaccines, a lot of sales is generated through non-stockist routes.

Similarly, Novartis, already strong in the oncology segment with products such as Glivec, is expected to gain a significant market share across regions by acquiring GSK’s cancer products.

In the domestic market, GSK Pharma, the Indian arm of GSK, sells four brands in the segment — Revolade, Tykerb, Votrient and Hycamtin. As part of the deal, these products will be sold or transferred to Novartis.

“Given the size of the businesses involved, these transactions will probably trigger merger control approvals from anti-trust authorities in various jurisdictions.

As there is bound to be some horizontal consolidation, it will be interesting to see how competition authorities deal with these transactions,” said Khaitan & Co partner Rajat Mukherjee.

On Tuesday, Novartis announced a major revamp of its businesses, swapping assets with GSK and selling its animal health arm to Eli Lilly, in a bid to simplify its business and increase its focus on high-margin cancer medicines.

As part of the proposed transaction, Novartis and GSK agreed to trade about $20 billion worth of assets. Novartis agreed to buy GSK’s oncology products business for $14.5 bn, while selling its vaccines business, excluding flu, to GSK for $7.1 bn. Besides, Novartis will pay up to $1.5 bn more if certain milestones are met.

It will also form a consumer health joint venture, in which GSK, with an equity interest of 63.5 per cent, will have majority control.

In India, the current regulations require a combination or a merger & acquisition to seek approval if the combined assets of the enterprises are worth more than Rs 1,500 crore (Rs 150 billion) or is more than Rs 4,500 crore (Rs 45 billion) in this country.

If either or both have assets or turnover outside India, too, there must be approval from CCI if the combined assets are more than $750 million, including at least Rs 750 crore ( Rs 7.50 billion) in India or there is turnover of more than $2,250 mn, including at least Rs 2,250 crore ( Rs 22.50 billion) in India.

Experts say despite it being a global deal, the transaction will have to undergo CCI scrutiny because of the scale of operations and impact on the domestic market. “The deal will have an impact on the interest of the Indian consumer,” said M M Sharma, head of competition law and policy at Vaish Associates.

© 2025

© 2025