Includes those dealing in high-value property and petrol pump owners

After receiving a lukewarm response to the Pradhan Mantri Garib Kalyan Yojana (PMGKY), the income tax (I-T) department has zeroed in on 60,000 persons who deposited “excessive” cash after the note ban. These include those dealing in high-value property and petrol pump owners.

Of the 60,000 persons, 1,300 are “high risk” ones who, along with the remaining, would be probed for possible black money generation as part of Operation Clean Money II (OCM) launched on Friday, the Central Board of Direct Taxes (CBDT) stated.

More than 6,000 of high-value property purchases and 6,600 cases of outward remittances will be investigated in detail as part of the OCM.

The government had allowed people to deposit demonetised notes in banks between November 9 and December 30.

Businesses reporting sales as the source of cash deposits, which are excessive compared to their past profile, will be probed. These may include petrol pumps and other essential services such as hospitals.

However, the CBDT said it might take more than a year to examine all the accounts. “But with the help of technology and continuous enforcement action, all the liable accounts will be brought to tax,” the board added.

Those to be examined include government and public sector undertaking employees who made “large cash deposits”, people who have undertaken high-value purchases, those who “layered” or laundered funds by using shell companies, and those who did not respond to the taxman’s queries under the first phase of the operation.

An official said the initial communication to these 60,000 people would be sent online and taxmen would later undertake search and survey actions and also seek physical documents from assessees.

The operation has identified persons on the basis of identifying huge cash deposits using advanced data analytics, including the integration of data sources, relationship clustering and fund tracking.

The I-T department had earlier launched the OCM on January 31 on the basis of deposits made in banks between November 9 and December 30. As many as 1.79 million people were identified to have entered into cash transactions that did not appear to be in line with their tax profile. They were requested for online responses to such transactions.

Of these, 946,000 people have responded. In cases where cash deposits have been declared under the PMGKY, the verifications will be closed. Online queries were raised in 35,000 cases and online verification was completed in more than 7,800 cases. All the remaining cases will be investigated now.

The PMGKY could elicit declarations worth only Rs 4,600 crore (Rs 46 billion). Of this, Rs 2,300 crore (Rs 23 billion) will be collected as tax, Rs 1,150 crore (Rs 11.5 billion) will be parked for four years and the remaining Rs 1,150 crore will be given back to the assessees.

The CBDT said taxmen also undertook “extensive enforcement action” after demonetisation and detected undisclosed income to the tune of Rs 9,334 crore (Rs 93.34 billion) between November 9 and February 28.

“More than 2,362 search, seizure and survey actions have been conducted by the department...leading to seizure of valuables worth more than Rs 818 crore (Rs 8.18 billion), which include cash of Rs 622 crore (Rs 6.22 billion), and detection of undisclosed income of more than Rs 9,334 crore (Rs 93.34 billion),” it said.

Over 400 cases had been referred by the tax department to the Enforcement Directorate and the CBI, it said, adding surveys had been conducted in more than 3,400 cases by assessment units.

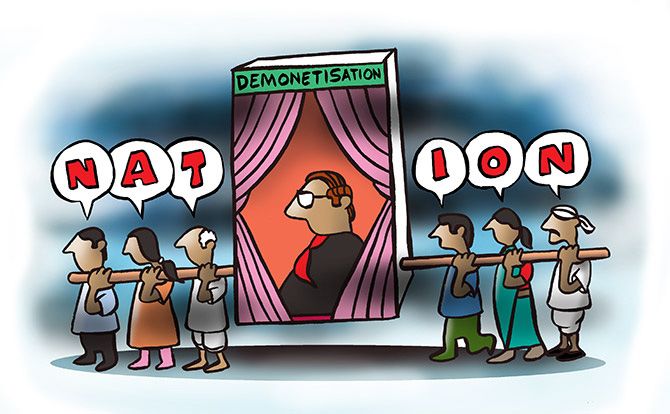

Demonetisation of currency notes of Rs 1,000 and Rs 500 was announced by Prime Minister Narendra Modi on November 8 last year.

The CBDT said the demonetisation exercise was aimed at the “elimination of black money that casts a long shadow of the parallel economy on our real economy” and the latest operation was one of the major steps aimed to achieve this goal and also widen the tax base.

It said the impact of government action against black money holders was already visible in the increase of 21.7 per cent in tax returns filed in 2016-17, 14 per cent rise in tax collection, and the 18 per cent, 25 per cent and 22 per cent growth in personal income tax, regular assessment tax and self-assessment tax, respectively.

Illustration: Uttam Ghosh/Rediff.com

© 2025

© 2025