Aiming to replicate the Silicon Valley story in the country, IT-BPO industry body Nasscom has asked the government to set up a technology entrepreneurship mission in India to handle needs of start-ups like financing, infrastructure, ease of business, among others.

Aiming to replicate the Silicon Valley story in the country, IT-BPO industry body Nasscom has asked the government to set up a technology entrepreneurship mission in India to handle needs of start-ups like financing, infrastructure, ease of business, among others.

According to the industry body, which represents the over $118 billion Indian IT-BPO industry, the country has showed promising prospects for developing technologies and solutions and many large multinationals are reporting that 70 per cent of their emerging markets solutions are coming from India.

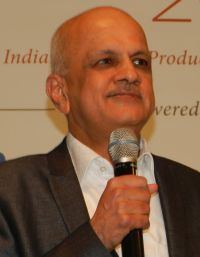

"Over the last 2-3 years, it (start-ups scene) has really widened. All the key elements of this ecosystem are there in terms of venture capital, private equity, angel investors, mentors," Nasscom President R Chandrashekhar said in a statement.

Even the presence of large companies, which actually encourage this ecosystem by way of incubators, accelerators and looking at them as possible partners or possible targets of acquisition, are also here, he added.

"Most of the large multinationals are reporting that 70 per cent of their emerging markets solutions are coming from India.

So, I think all in all this is gaining huge amount momentum and traction as well as recognition in different parts of the world," Chandrashekhar said.

Stressing on the need of a Technology Entrepreneurship Mission, the former Telecom Secretary said there a several issues that need to be addressed to sustain and enhance the start-up eco-system in India.

"I think we still need to do many things to build up this ecosystem and actually in a sense, replicate the Silicon Valley story in India and make sure that this ecosystem is actually able to nurture, grow and deliver breakthrough innovative products, services and solutions," he said.

Nasscom has identified 4-5 different areas and is taking these recommendations to the government.

Many states have actually funded and partnered with bodies like Nasscom to set up incubation centres and provide infrastructure support, which lowers the cost of entry, he added.

"There is also the need to ease the flow of capital into this ecosystem because the normal banking and financial set up don't work.

This industry is not an asset based industry, it is basically based on the value of an idea and on value of technology," Chandrashekhar added.

He said these issues are not recognised by the domestic financing system, which is more focused on assets and collaterals.

Another element is to leverage the domestic market to encourage the growth of such firms as a lot of them also look at the domestic market. The innovation and products and services are also based on domestic market needs, he added.

© 2025

© 2025