Mutual funds aspirants have the option of snapping up smaller AMCs or applying for a new licence.

Subrata Panda and Samie Modak report.

The Securities and Exchange Board of India's decision to relax the profitability criteria for sponsors could pave the way for digital disruption in the Rs 30 trillion mutual fund industry.

Market players say the move will entice technology-oriented firms to set up assets management companies (AMCs), which could create a paradigm shift by popularising concepts such as quant funds, robo advisory, and smart exchange-traded funds (ETFs.)

The Sebi board on December 16 said entities without a 3-year profitability track record can act as MF sponsors, provided they bring double the net worth at Rs 100 crore (Rs 1 billion).

The move followed lobbying by start-ups which don't necessarily have such a track record.

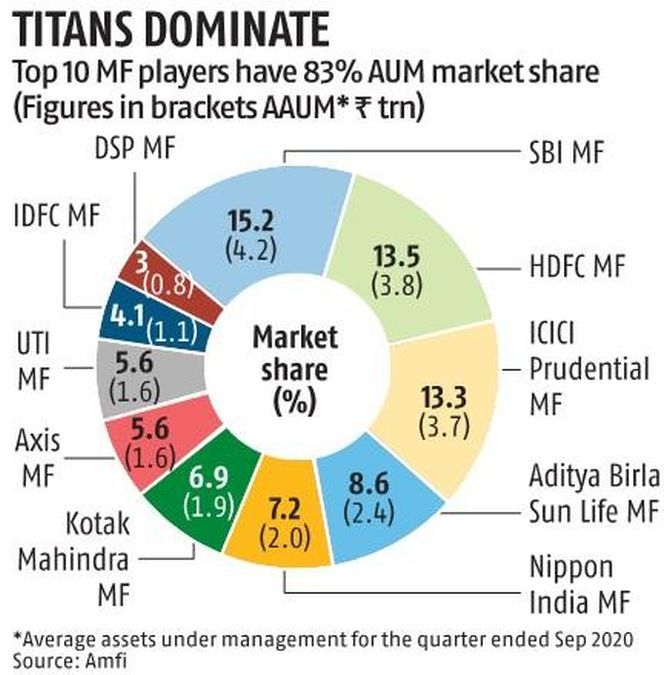

At present, the domestic industry has 45 players with combined assets under management (AUM) of around Rs 30 trillion.

However, nearly 83 per cent of assets are managed by the top 10 players, while the bottom 25 players have less than 2.5 per cent market share and combined asset size of Rs 68,000 crore.

Mutual funds aspirants have the option of snapping up smaller AMCs or applying for a new licence.

Experts say, given the regulatory framework, there isn't much difference between the two and more players may opt for the latter.

"Sebi's move will benefit VC-funded firms that aren't profitable yet. There aren't too many smaller players left to be acquired. Also, there isn't much time arbitrage in taking the inorganic route. The time taken in acquiring new licence is similar to that of acquiring an existing one. Also acquiring means taking on technical debts as well," said Nithin Kamath, CEO of Zerodha, a discount broking firm.

Zerodha has applied for an MF licence and is awaiting regulatory approval.

"Newer players entering the space will have a tech-first approach. Also, they will be more ETF-oriented," Kamath added.

Under the ETF approach, the asset manager selects stocks based on some pre-set parameters without the need for a fund manager.

"The whole idea of a fintech AMC will be completely different. They will be low on cost and high on reach. Also, most players will operate in the passive investment space," said Dhirendra Kumar, CEO of Value Research.

Kumar said in the coming years we might see an increase in the number of AMCs as more players will take the organic route.

"Fintechs are funded by risk capital and that allows them to take bigger or tougher bets than traditional players. Also, the fact that they do not have legacy, they can prepare the business model from scratch," said Vivek Belgavi, partner fintech leader, PwC.

Fintech giants such as Paytm and PhonePe refused to comment on Sebi's new guidelines.

Most popular digital payments platforms already act as MF distributors.

Belgavi said for some players it would make more sense to remain distributors or advisors rather than become product manufacturers.

MobiKwik, which already acts as an investment advisor, said it is keen to set up an AMC.

"We are keen on this opportunity, which would make us vertically integrated in the wealth management business. The relaxation on net worth is a welcome move that will pave the way for fintechs to launch AMCs, especially the well-capitalised ones already into MF advisory services," said Upasana Taku, COO and co-founder, MobiKwik.

© 2025

© 2025