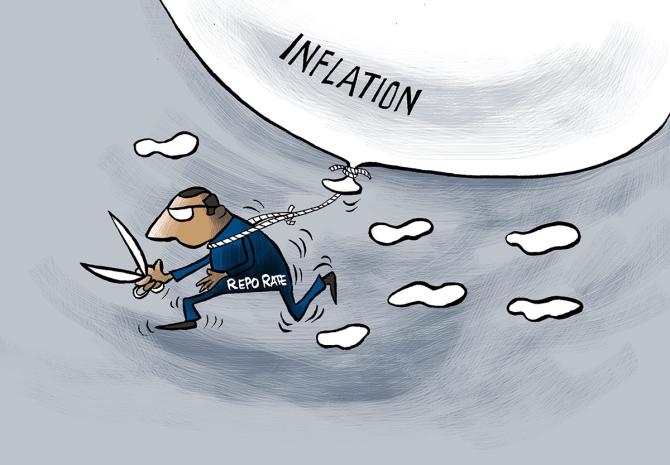

Most members of the Reserve Bank of India’s monetary policy committee (MPC) decided to stick to the course on bringing retail inflation to the target of 4 per cent while voting for maintaining status quo in the April review, except external member Jayanth Varma who voted for a 25 bps cut in the repo rate.

“I believe that the extant monetary policy setting is well positioned,” RBI governor Shaktikanta Das said in the minutes of the policy review, which came out on Friday.

“Monetary policy transmission is continuing and inflation expectations of households are also getting further anchored.

"At this stage, we should stay the course and remain vigilant.

"The gains in disinflation achieved over last two years have to be preserved and taken forward towards aligning the headline inflation to the 4 per cent target on a durable basis,” Das said while adding strong growth momentum provides the policy space to “unwaveringly” focus on price stability.

External member Shashanka Bhide also pointed that due to strong economic growth, it is necessary to maintain monetary policy focus on aligning the inflation trends with the target.

Deputy governor Michael Patra said headline inflation is expected to remain in the upper reaches of the tolerance band until favourable base effects come into play in the second quarter of 2024-25.

“Hence, conditions are not yet in place for any let-up in the restrictive stance of monetary policy.

"Downward pressure on inflation must be maintained until a better balance of risks becomes evident and the layers of uncertainty clouding the near-term clear away,” he said.

The six-member monetary policy maintained status quo on rate for the seventh consecutive policy in April.

The withdrawal of the accommodation stance of the policy also remained unchanged.

Varma voted for the change in stance to neutral.

He said a real interest rate of 1 to 1.5 per cent would be sufficient to glide inflation to the target of 4 per cent and that the current real policy rate of 2 per cent (based on projected inflation for 2024-25) is excessive.

“The fact that economic growth in 2024-25 is projected to slow by over half a percent relative to 2023-24 is a reminder that high interest rates entail a growth sacrifice.

"Monetary policy should try to reduce this sacrifice while ensuring that inflation (a) remains within the band and (b) glides towards the target,” he added.

External member Ashima Goyal said real interest rates are higher than the natural or neutral interest rate (NIR) compatible with keeping inflation at target and output at potential.

She said this is lesser worry at present due to high corporate profits with credit growth continuing to be robust.

“But there has to be a limit to squeezing core inflation to compensate for periodic headline shocks.

"Core sustaining below 4 per cent implies real policy rates are in the contraction zone,” she said.

Goyal said since there are uncertainties maintaining stability must have priority while justifying her decision for a status quo.

Internal member Rajiv Ranjan observed that it is too early to drop guard against inflation.

“Going ahead, while monetary policy seems to be on the right track, it is too early to ease guard against inflation.

"It is important that we gain more confidence on our macro numbers for 2024-25 and their nuances.”

The next review of the policy is scheduled between 5-7 June, after the general election results.

© 2025

© 2025