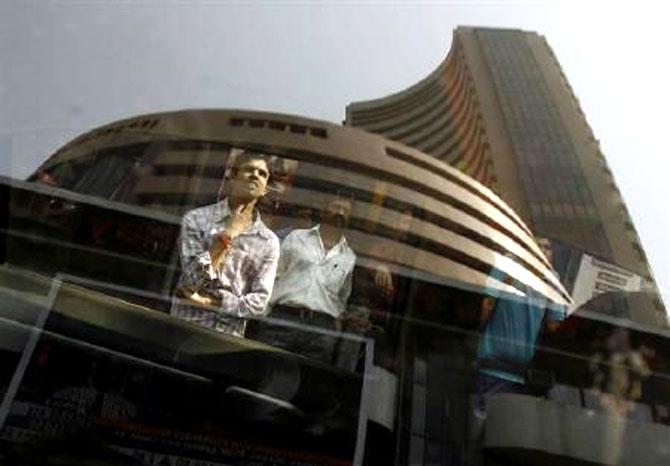

The Sensex on Wednesday bounced by over 244 points to close at 31,955 after metal, healthcare and FMCG stocks set the tone on the back of better-than-expected corporate earnings so far.

Foreign dollar inflows and positive global cues kept the risk appetite on.

The market opened positive on overnight earnings of FMCG major Hindustan Unilever coupled with a firming trend in Asia, tracking another record close at Wall Street.

The Sensex, after a gap up opening, advanced to hit a high of 31,978.89, before settling at 31,955.35, a gain of 244.36 points, or 0.77 per cent.

The gauge had retreated by 363.79 points in the previous session.

The 50-share NSE Nifty stayed in the positive zone and retook the 9,900-mark to hit a high of 9,905.05 as buying paced up towards the fag end. It settled higher by 72.45 points, or 0.74 per cent, at 9,899.60.

Bharti Airtel stole the show by climbing 3.21 per cent while Dr Reddy's surged 2.01 per cent.

"Pharma sector outperformed followed by a series of US FDA approvals, which offered bargaining opportunity to investors. Trump's failure to repeal Obamacare and a strengthening rupee will keep the outlook intact," said Vinod Nair, Head of Research, Geojit Financial Services.

Coal India, TCS, Sun Pharma and Kotak Bank also contributed to the upmove, rising by up to 2.66 per cent.

Shares of State-owned HPCL, Indian Oil Corporation, BPCL and ONGC buzzed with activity, largely on the back of merger talks, which recorded a rise of up to 4.14 per cent.

Hindustan Unilever, whose net profit grew 9%, succumbed to profit-booking at higher levels and finished in the red.

Tobacco stocks led by ITC were back in better shape on value buying, a day after a steep fall in the wake of higher cess.

ITC Ltd rebounded 2.42 per cent, helping the key indices recoup most of its lost ground from Tuesday. VST too recovered 1.22 per cent while Godfrey Phillips rose 0.71 per cent.

Foreign portfolio investors (FPIs) bought shares worth a net Rs 317.44 crore while domestic institutional investors (DIIs) net sold shares worth Rs 975.01 crore on Tuesday, as per provisional data.

Elsewhere, Asian markets were mostly higher as investors turned their focus to policy meetings by central banks in Japan and the EU.

Besides, Europe was trading in the green too.

BSE metal rose the most by 1.95 per cent followed by healthcare 1.78 per cent, realty 1.50 per cent and FMCG 1.49 per cent.

Mid-cap and small-cap indices firmed up 1.01 per cent and 0.99 per cent, respectively.

© 2025

© 2025