Market's volatility expectations have shot up and option premiums are unprecedentedly high

Market's volatility expectations have shot up and option premiums are unprecedentedly high

The settlement comes at a time when the market is very nervous.

China has not settled down; the foreign institutional investors are selling in every emerging market including India; the rupee is under pressure.

The Nifty, the Sensex and other indices have slipped below their respective 200 Day Moving Averages (200-DMAs).

This signals a deeper correction and traders should be braced for a serious bear market.

Volumes have been quite high, which is a poor signal in a falling market. Declines outnumbered advances.

Domestic institutions are substantial net buyers for August.

But the FII selling has been so heavy that the indices have slid anyhow.

The last bottom was at the Nifty 7,667 on Tuesday and there was heavy selling on Wednesday between 7,900 and 7,950.

Volatility expectations have shot up, and option premiums are unprecedentedly high for this stage of settlement.

Options are also priced high for September.

The market broke down on Monday, August 24.

It closed on Friday, August 21, at 8,299 (with an intra-day low of 8,225) and it closed on Monday at 7,809 after opening at 8,055. The gap between 8,055 and 8,225 has not been filled, since the Nifty has hit resistance at 7,930.

The exponential 200-DMA is at 8,280, while the simple 200-DMA is at 8,450.

This has all the hallmarks of a long-trend bear market. All the signals are down.

It is impossible to set a time period for such a trend or calculate likely support zones yet. We would have confirmation of a big bear market if the next rebound doesn't cross back above the 200-DMA pair.

A pullback above 8,280 (the exponential 200-DMA) would be taken as a positive sign, while a pullback above 8,450 (the simple 200-DMA) would be interpreted to mean the big bull market was alive.

The rupee is under pressure.

It slid till 66.50 against the dollar and the subsequent pullback may have been due to profit booking.

The rupee is very likely to move lower if the FII selling continues.

A weaker rupee would mean some investment flows into information technology and pharmaceutical stocks.

The banking and finance sectors have seen heavy selling.

The Bank Nifty has lost more ground than the Nifty itself and, it has a great influence on the broader index.

The Bank Nifty has lost more ground than the Nifty itself and, it has a great influence on the broader index.

September is likely to continue to be a volatile month.

The 200-DMA for the Bank nifty is at 17,930-about 1,000 points above the index.

A long strangle of long 16,000p (238) and long 18,000c (220) costs 458 (about 1.4 per cent).

This would breakeven at 15,542, 18,458. It could gain handsomely if September is a volatile month.

A trader may also wish to wait for settlement and then take the strangle, since premiums should drop.

The Nifty's put-call ratios are very bearish, with PCR at 0.7 for three-month and 0.6 for the one-month data.

However, this is distorted by settlement considerations.

The Nifty’s call chain for September has peaks at 8,000c, 8,500c, and 9,000c.

The September put chain has open interest peaks at 7,000p, 7,500p, 7,600p, 7,800p and 8,000p.

Given very high premiums, a trader could consider selling options at say, 300 points from money, with the intention of buying back by Monday.

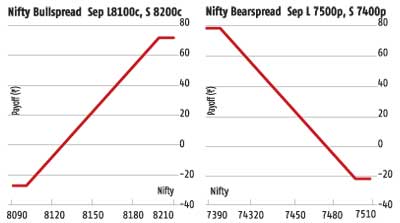

A bullspread of long August 8,100c (91), short 8,200c (63) costs 28 and pays 72.

A bearspread of long August 7,500p (101), short 7,400p (80) costs 21 and pays a maximum 79.

These are both about 300 points from money and could be combined for a long-short strangle with a 51 pay off for a cost of 49.

But it's better to take a pure long strangle in the Bank Nifty if you want a two way position.

© 2025

© 2025