India's manufacturing sector activities moderated in December but output remained in the growth territory, amid slower rise in sales and new orders, even as business sentiment was dampened by concerns surrounding supply-chain disruptions, COVID-19 and inflationary pressures, a monthly survey said on Monday.

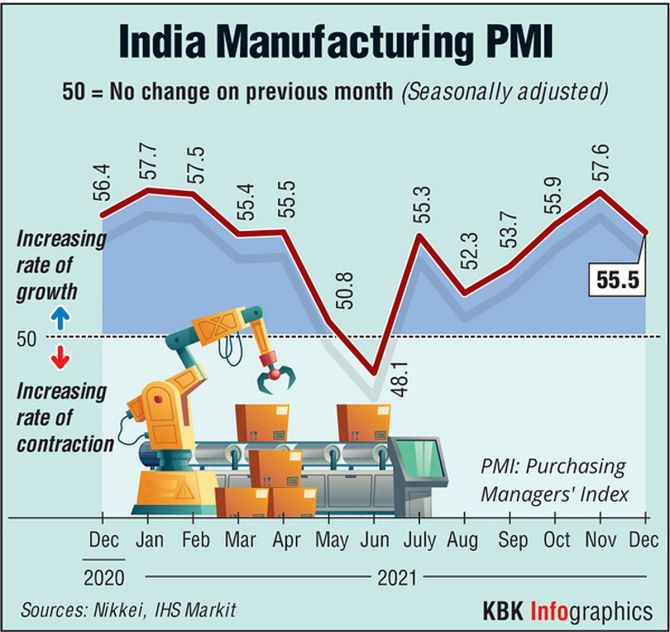

The seasonally adjusted IHS Markit India Manufacturing Purchasing Managers' Index (PMI) eased to 55.5 in December, from November's ten-month high of 57.6.

The December data pointed to a "substantial, albeit slower, rises in sales and output", the survey said, adding that the latest quarterly reading was at 56.3, its highest since the final quarter of fiscal year 2020/21.

The December PMI data pointed to an improvement in overall operating conditions for the sixth straight month. In PMI parlance, a print above 50 means expansion, while a score below 50 denotes contraction.

"The last PMI results of 2021 for the Indian manufacturing sector were encouraging, with the economic recovery continuing as firms were successful in securing new work from domestic and international sources," Pollyanna De Lima, Economics associate director at IHS Markit, said.

Lima, however, noted that "manufacturers were optimistic that output would continue to increase in 2022, but business sentiment was somewhat tamed by worries surrounding the path of the pandemic, inflationary pressures and lingering supply chain disruptions."

The survey noted that the upturn in new orders during December was sharp, despite being the slowest since September.

Similarly, production rose at a sharp pace that was nevertheless the weakest in three months.

Spending trends were mixed, with employment falling fractionally in response to a lack of pressure on capacity, but firms purchasing additional inputs amid restocking efforts.

Further, international demand for Indian goods continued to improve in December.

New export orders rose for the sixth month in succession, albeit only slightly, the survey said.

On the prices front, although input costs rose sharply, and at an above-trend pace, the rate of inflation eased to a three-month low.

"Despite easing in December, input cost inflation was still running at one of its highest rates in around seven-and-a-half years.

"The vast majority of firms nevertheless decided to keep their selling prices unchanged, in order to boost sales, with overall charges up only marginally in December," Lima said.

Concerns over elevated price pressures hampered business confidence in December, with firms also worried that the pandemic and supply-chain issues could dampen the recovery next year.

The overall degree of optimism remained below its long-run average, despite improving from November's 17-month low," the survey said.

Photograph: Rupak De Chowdhury/Reuters

© 2025

© 2025