With multiple infrastructure projects failing to get off the ground in various parts of the country, the commercial vehicle sector, one of the biggest allied industries dependent on growth in infrastructure, is bound to face some heat in the coming quarters, say market experts.

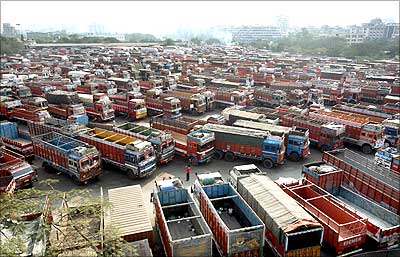

With multiple infrastructure projects failing to get off the ground in various parts of the country, the commercial vehicle sector, one of the biggest allied industries dependent on growth in infrastructure, is bound to face some heat in the coming quarters, say market experts.Medium and heavy commercial vehicles such as trucks that are extensively used in areas like construction of public and private utilities, mining and quarrying among several other sectors rely on growth in these sectors.

However, as per the latest guidance given out by engineering and infrastructure firms like Larsen & Toubro, Hindustan Construction Company and IVRCL a significant double-digit drop is expected in fresh orders for projects in the ensuing year.

The medium and heavy trucks segment posted a scorching growth of 47 per cent in April-December selling little more than 1.88 lakh units in the domestic market as per Society of Indian Automobile Manufacturers data.

However, much of this growth was a result of a sudden spurt in the economic activity that regenerated CV demand from the lows of 2009-10.

Various public and private sector companies have delayed finalising their orders due to unavailability of land or clearances, lack on adequate funding or perhaps due to a cut in capital expenditure following lower demand. As per reports, Rs. 50,000 crore (Rs. 500 billion) worth of projects are held back. All these will serve an impact on the CV sector.

Managing Director (India operations), Tata Motors, P M Telang said: "There can be problems which can surface in the coming months but we will like to have a cautiously optimistic view for it as the long-term demand remains strong."

President, SIAM, Pawan Goenka said: "We have always been wrong in our prediction, I mean if you look at the sales they are doing very well.

"Though there are some concerns of a slowdown undoubtedly more in the segments that depend on commercial vehicle purchase, we have not seen any serious slowdown in the last 3-4 months. Therefore concern is there but hopefully things

An official from Chennai-based Ashok Leyland, India's second-largest truck and bus maker stated that with the economy showing definite signs of heating up and bank lending for infrastructure projects also getting uncertain, India is heading towards a trough.

"The industry operates in a cyclical pattern. We saw a boom in spending on various projects and now many projects are facing hurdles. These will definitely have a ripple effect on CV purchases," he said.

Ashok Leyland sales of MHCVs dipped by 11 per cent last month to 5,154 units as compared to the same month last year.

In addition to lowered spending on infrastructure projects, other deterring factors such as rising interest rates, high inflation and peaking vehicle prices due to high raw material prices could also impact volumes.

Managing Director, Shriram Transport Finance Company, R Sridhar said: "There will be an impact on demand if key sectors like infrastructure gets affected. We are also in a scenario where inflation in going up and interest rates are hardening. We will see a deep correction in sales if projects do not take off."

Banks lend to non-banking finance companies like STFC, which in turn lend it to CV consumers at a higher rate. Due to a recent upward revision in lending rates by banks on auto loans for CVs have also become expensive.

"Interest rates have moved up by 50 basis points recently and are likely to go up and another 50 basis points in the next few months," said Sridhar. STFC is the largest NBFC lender to the CV sector in the country.

"CV industry has a strong correlation with GDP. CV growth is 1.5 times the growth in GDP. Growth is, however, moderating in each sector. The industrial growth, which was at 3.4 per cent, was significantly lower than expected. The kind of surge in demand we had seen last year will certainly be missing this year," said V G Ramakrishnan, Senior Director, Automotive Practice, Frost & Sullivan.

© 2025

© 2025