But equity markets in Pakistan and Bangladesh are tiny compared to the market capitalisation of the Indian equity market, reports Krishna Kant.

T stock markets of Pakistan and Bangladesh are pulling ahead of their Indian counterpart in returns.

T stock markets of Pakistan and Bangladesh are pulling ahead of their Indian counterpart in returns.

For the second year in a row, the BSE Sensex would underperform Karachi and Dhaka.

The Karachi Stock Exchange 100 (KSE 100) is up 44% during the current calendar year so far against 0.7% rise in the BSE Sensex.

The Dhaka Stock Exchange's (DSE) Broad index, at a 6.5% rise during the calendar year so far, is also ahead of the Sensex.

Last year, the KSE 100 was up 2.1%, outperforming the BSE Sensex, which had declined by 5% during the same period.

The DSE Broad index had marginally beaten the Sensex with a fall of 4.8% in 2015.

The Karachi stock market has also outperformed its Indian peer over the long term.

The KSE100 has appreciated at a compound annual growth rate (CAGR) of 33% in the last five years against 11.2% annualised returned earned by Indian equity investors during the period.

Pakistan's equity and bond valuation are lower compared to India.

For example, the KSE100 index is currently valued at trailing 12-month price-earnings multiple of 12.4 times against the BSE Sensex’s 19.7 times.

The KSE 100 offers dividend yield of 4.64%, nearly triple the 1.6% yield that Sensex offers its investors. The corresponding ratios are not available for DSE.

Similarly, the 10-year government bond in Pakistan at 8% yield is nearly 150 basis points higher than India.

With similar level of consumer inflation at around 4% in both countries, a prospective bond investor earns higher real return in Pakistan than in India.

Experts attribute this to continued inflow of foreign institutional investments (FIIs) in Pakistan unlike the sell-off in India.

Foreign investors have pumped in nearly $1.1 billion in Pakistan during the July-October 2016 period, nearly three times their investment ($344 million) during the corresponding period last year according to data from the State Bank of Pakistan, the country's central bank.

All this money went into Pakistan's bond market with foreign investors buying (on net basis) little over $1 billion worth of bonds during October 2016 itself.

In contrast, FIIs have been net sellers on the Karachi stock market to the tune of $40 million during the first four months of Pakistan's FY17, similar to their behaviour on Dalal Street.

In comparison, FIIs have been big sellers in Indian bonds and equity during the second half of the current calendar year.

For example, foreign investors withdrew $1 billion from the Indian bond market during October itself.

In all, FIIs have sold $7 billion worth of Indian bonds during the October-December quarter so far.

This has been the biggest sell-off by FIIs in any major bond market globally during the year so far.

During the same period, FIIs have withdrawn $3.6 billion from the Indian equity market pulling down India's benchmark equity index.

"The FII investment in the Pakistani bond market would have been recycled to their equity market by domestic investors. This is not feasible in India given a widespread sell-off by FIIs in both equity and bond markets," said G Chokkalingam, founder and chief executive officer, Equinomics Research & Advisory.

Base-effect could also be at work here.

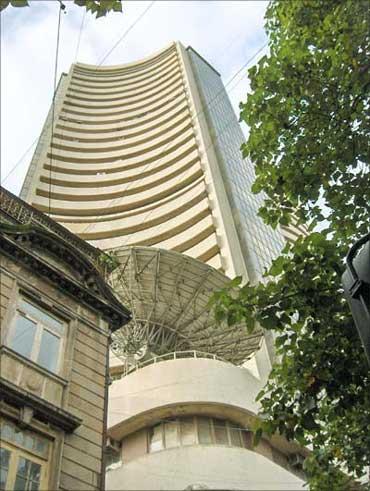

Equity markets in Pakistan and Bangladesh are tiny compared to the market capitalisation of the Indian equity market.

For example, the combined market capitalisation of all listed companies on the Karachi stock exchange is only $93.5 billion against Dalal Street's market capitalisation of $1.57 trillion. The corresponding figure for DSE is $42 billion.

In comparison, India's most valuable company Tata Consultancy Services is valued at around $67 billion at Thursday's closing stock price.

"Lower market capitalisation means that its takes much less FII investment to move the needle (benchmark indices) in Karachi and Dhaka than in Mumbai," said Chokkalingam.