A new management at one of India's oldest paint companies looks to revive the dormant paints brand as it readies for a stiff fight with rivals.

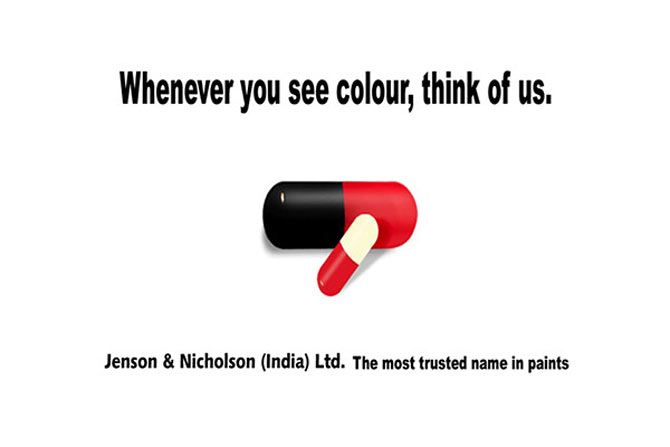

For readers of a certain vintage, the tag line 'Whenever you see colour, think of us' still has instant recall.

Even though the name of the brand may have itself faded from memory.

Now the brand behind the ad, Jenson & Nicholson, is making a comeback under a joint venture with the South-based Sheenlac Paints.

But the challenges that the second oldest paints brand in the country faces, as it dons the greasepaint for its second life, are many: a whole new generation of consumers that are not familiar with the label, new technology and an aggressive pack of competitors such as Asian Paints, Nerolac and Berger.

The brand has a tough fight ahead as established giants like Asian Paints or Berger have moved far ahead in terms of technology, service infrastructure and even marketing methods.

J&N however believes that it can bank upon a strong brand recall among the older generation and some residual brand equity among the paints dealers.

According to Sridhar K, CEO of J&N Paints, a joint venture between Jenson and Nicholson India (J&N’s mother company) and Sheenlac Paints, the key problem is availability and once this can be addressed, the brand can regain its former glory.

Set up in 1922, J&N was once considered a leader and innovator in the highly competitive decorative paints landscape in India. The J&N campaign in the mid-1990s made the brand a familiar name across the country, but the company failed to cash in on that.

Financial trouble dogged its production facilities and soon supplies began drying up and dealers turned to more reliable brands to service their customers. J&N paints soon disappeared from the shop shelves.

Sheenlac Paints will be bringing the product back into the market soon and is banking upon the residual brand equity of J&N. It says that it will ensure a smooth and continuous supply of products in the coming months.

“The dealers hold J&N in high regard and can associate with the brand. The only problem is supply which will be addressed,” Sridhar said.

Under the terms of the agreement, J&N’s mother company has transferred the managerial rights of its Sikandrabad (near New Delhi) factory to the JV while Sheenlac has done the same with its three plants in Chennai. The joint capacity for these four units stands at one lakh kilolitres per annum, which, according to Sridhar, is enough for reintroducing the brand in the initial stage.

Following an asset light model, Sridhar is not keen to open new plants but will outsource it to other manufacturers once demand starts building up in the consumer market. Thereafter, it will reach out to the 2,000-strong original dealer base of J&N where this brand will have higher brand equity as compared to the new age dealers.

It is for this brand recall value that the advertising tagline will be retained during the relaunch.

This is exactly the way to go forward, according to Ramesh Thomas, president of Equitor, a management consultancy firm. “The brand needs to be targeted towards those aged above 35 years as they are aware of the brand and thus will have a higher recall value,” he said.

Sridhar is not looking at a pan-India presence to start with. Instead J&N will be reintroduced in its eastern and northern strongholds first followed by the South and later, based on the response, the west.

The brand has plenty of challenges to contend with. First and foremost, according to industry officials as well as brand expert Sandeep Goyal, is the positioning.

“The brand is over 30 years old and the generation which was its primary consumer has moved on. The J&N brand as such has recessed in memory,” says Goyal.

As per Goyal and an industry official, the J&N brand, although held in high regard, is ‘a thing of the past’ and the newer generation, accustomed to the names like Asian Paints, Berger, Nerolac will view the brand as a newcomer. The other challenge is matching the value added services offered by competitors.

“In its heyday, J&N was known for market innovation. In fact they were the ones who pioneered the concept of recommending colour shades based on the interiors of a house. J&N was positioned not just as a paints manufacturer but a colour consultant,” Thomas adds.

An industry official added that it is this kind of value addition which dealers would expect from J&N now that it is trying to stage a comeback.

J&N is relying on its history of innovations to stake its claim on the future. It says that it was the first company to roll out plastic emulsion paints under the brand Robbialac way back in 1955 and the first to enter the organised powder coatings market in 1986. In 1996, it introduced InstaColor in-shop tinting system which offered consumers a choice of over 5,000 shades to choose from and which gave rise to the famous ad line.

However, some time in the early 2000s, the company hit a roadblock. It closed down two units at Naihati, West Bengal and Panvel, Maharashtra with subdued production in the Sikandrabad unit. Lower production impacted the supply chain and over the years eroded the brand’s value.

As J&N steps back into the limelight, it will have to tread carefully, making sure that the brand does not slip on its promises yet again. It will also have to get up to speed with customer expectations on service and technology. All that it can be sure about, as it gets back in the game, is that rivals will be keeping a close watch.

© 2025

© 2025